Please check the current GST and tax ruling with the company's accountant before recording a superannuation salary sacrifice transaction in Jim2. Please note that tax code X must be used for all superannuation accounts.

|

Note: To record salary sacrifice, you will need to reduce the employee's wage by the amount of the salary sacrifice. |

Option 1

▪Use the current 6-XXXX Superannuation Expense and 2-XXXX Superannuation Liability accounts to record the Salary Sacrifice amounts.

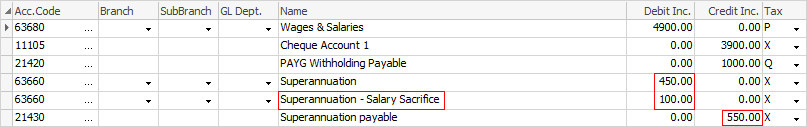

▪Add to Payroll general journal as shown below.

–Debit 6-XXXX Superannuation Expense Account $XX using tax code X.

–Credit 2-XXXX Superannuation Liability Account $XX using tax code X.

|

Enter the combined liability, or add another line to record the salary sacrifice amount separately. |

Option 2

▪Add specific Superannuation Salary Sacrifice Expense and Liability Accounts.

a)Expense Account – 6-XXXX Superannuation – Salary Sacrifice.

b)Liability Account – 2-XXXX Superannuation – Salary Sacrifice.

•Add to Payroll general journal, include two extra lines:

c)Debit Expense Account – 6-XXXX Superannuation – Salary Sacrifice $XX (Tax code X).

d)Credit Liability Account – 2-XXXX Superannuation – Salary Sacrifice $XX (Tax code X).

|

When paying the superannuation fund using the cheque book, include the salary sacrifice amount and enter as a separate line on the cheque entry. |