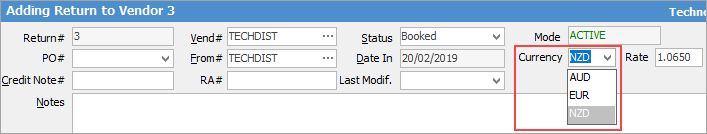

Return to Vendor transactions are always conducted at the specific currency of the original purchase order.

|

A very specific exception has been included for use in Multi-Currency. Existing Jim2 databases upgrading to Multi-Currency will have recorded all purchase transactions, including opening balance purchase orders, in AUD. |

Because the need may exist to return historic purchases in a foreign currency to a vendor, Jim2 allows producing a return to vendor against any AUD purchase using a foreign currency.

|

Some letters in the field names within the header are underlined, eg. Vend#. Using Alt+ the underlined letter will jump to the field beside that heading. |

The price and rate (defaulted from the original purchase order) on a return to vendor can be edited to suit.

If a foreign currency exchange rate change has occurred between the original purchase rate and the return to vendor rate, Jim2 will calculate the gain/loss and automatically post it to the Realised Gains/Losses account on applying the credit. Any difference in stock value will be credited to the linked stock adjustments account.

|

Finishing a return to vendor creates a creditor credit. Because this is a payment transaction, the gain or loss is realised. Applying the RTV credit to an outstanding creditor invoice is not affected by currency fluctuation or revaluation. |

Further information