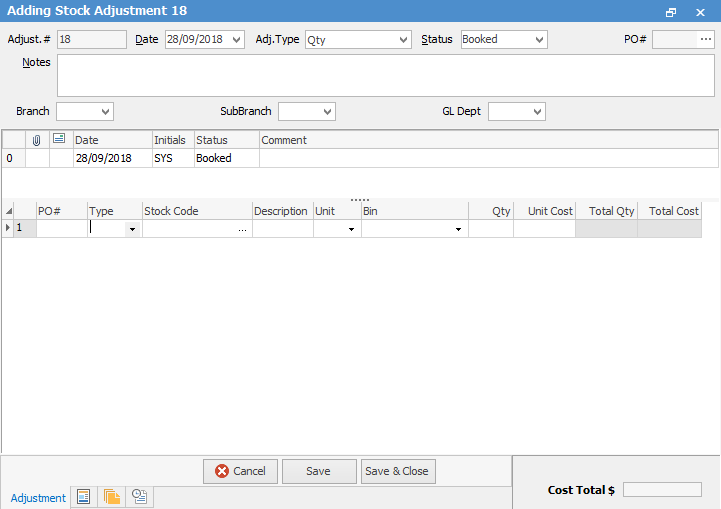

There are times within the course of business when you need to adjust your stock quantities and/or the cost of your goods for various reasons.

Within Jim2 you have the function of adjusting stock levels either up or down, and also to adjust the cost of goods for a stock on a certain PO.

Stock adjustments up or down should only be done if there is a discrepancy with real stock levels. You are only moving stock quantity – not creating credits/debits to vendors. For example, if Jim2 shows a quantity of 6 on hand, but the reality is that there are only 5, you would do a stock adjustment to correct this.

Stock adjustments create GL journals that affect stock on hand and cost of goods, so be very clear that the stock levels aren’t incorrect because a purchase order or RTV hasn’t been closed off, or that there is stock on open jobs or loaned out, on display etc. Stock adjustments affect profitability – so be careful. It’s okay to use stock adjustments for instances where serial numbers have been incorrectly entered, but it must be identical quantity up and down, and no $ value differences.

Stock adjustments (COGS) should be used when you want to write down the value of stock on hand, or write off damaged stock. Be very clear here – you are devaluing or writing off stock value and profitability for good.

Unlike purchases or invoices, stock adjustments can’t be unprinted. If you made a mistake or want to reverse an adjustment, just add another adjustment – exactly the opposite of the first one.

|

Before you add a stock adjustment, take a minute and check that this is really required – if you are adjusting a stock quantity up because a purchase order wasn't entered, or quantity down because a return to vendor wasn't entered, do not use the Stock Adjustment function, as this will not reflect correctly in your general ledger. Instead, create a purchase order or a return to vendor. |

|

You will see some letters underlined in the field names within the header, eg. Status. Using Alt+ the underlined letter will jump you to the field beside that heading. |

Write off Stock that is Being Credited by Your Supplier

Add your stock adjustment down, and write off the stock.

This will:

•Credit stock on hand 1-xxx

•Debit stock adjustment 5-xxxx

The full value of the stock will now be sitting in the stock adjustment account as a write down (cost to you).

Now add a creditor's adjustment down:

•Debit Trade Creditors (creating the credit in the creditor's account)

•Credit stock adjustment 5-XXXX

This will reduce the written down cost against the stock adjustment GL account.

The end result will be, the stock on hand will be reduced, and any cost written off will be shown in the stock adjustment GL account, and a credit in the creditor's account to take up as required.

Further information: