1.On the ribbon, go to Accounts > Creditors, then clicking Run at the bottom of the screen.

2.Locate and open the creditor. Click Edit.

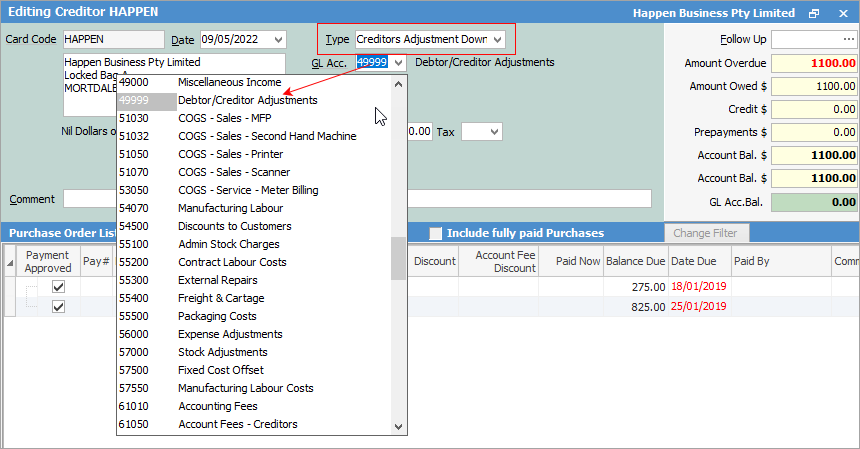

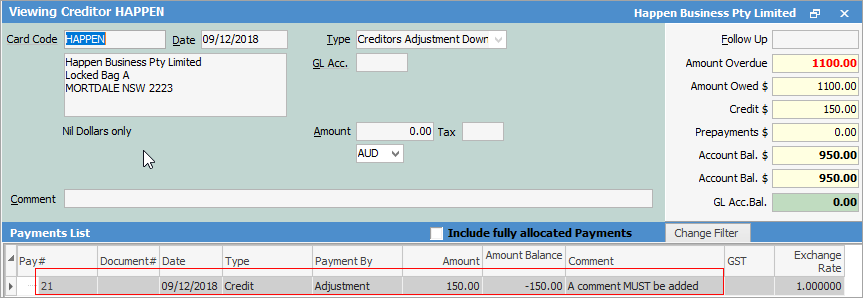

3.Select the Type – Creditors Adjustment Down.

4.Use the dropdown list to select the general ledger account to be affected by this entry.

This adjustment will have the following results: create a credit on the creditor account which can then be applied to an outstanding payment.

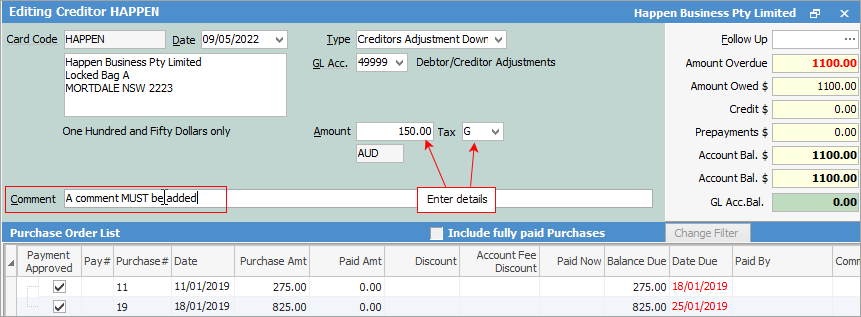

5.Enter amount and tax code.

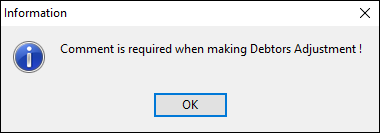

6.Enter a comment before saving a debtors adjustment up or down, as this is a required field.

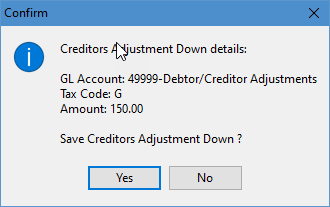

7.Click Save, and a message to confirm will appear.

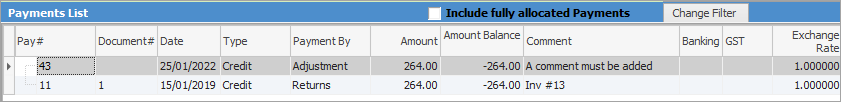

The adjustment down entry will now be created.

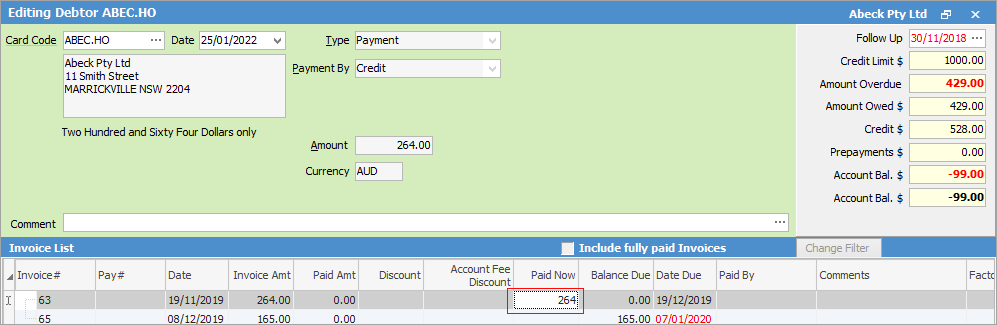

To allocate the adjustment to an invoice, edit the debtor and select Payment By – Credit. A window will pop up, where you can select the adjustment.

Click in the Paid Now field of the relevant invoice, then click Save.

|

To reverse (or cancel) a creditors adjustment, add a further adjustment opposite to the first one, ie. if an adjustment down was performed, do an adjustment up. |

How to