1.On the ribbon, go to Accounts > Debtors, then clicking Run at the bottom of the screen.

2.Locate and open the debtor. Click Edit.

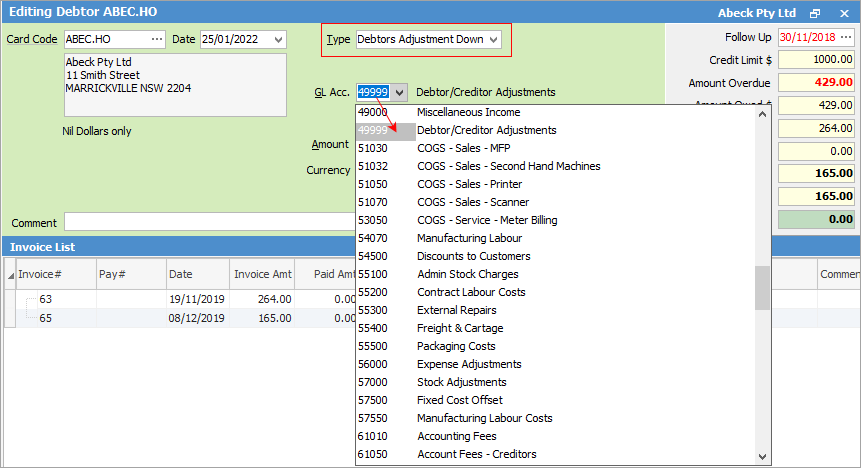

3.Select the Type – Debtors Adjustment Up.

4.Use the dropdown list to select the general ledger account to be affected by this entry.

This adjustment will have the following results: create a credit on the Debtor account which can then be applied to an outstanding invoice.

5.Enter amount and tax code.

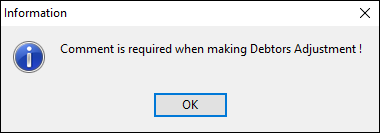

6.Enter a comment before saving a debtors adjustment up or down, as this is a required field.

7.Click Save, and a message to confirm will appear.

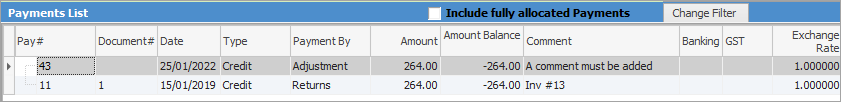

The adjustment down entry will now be created.

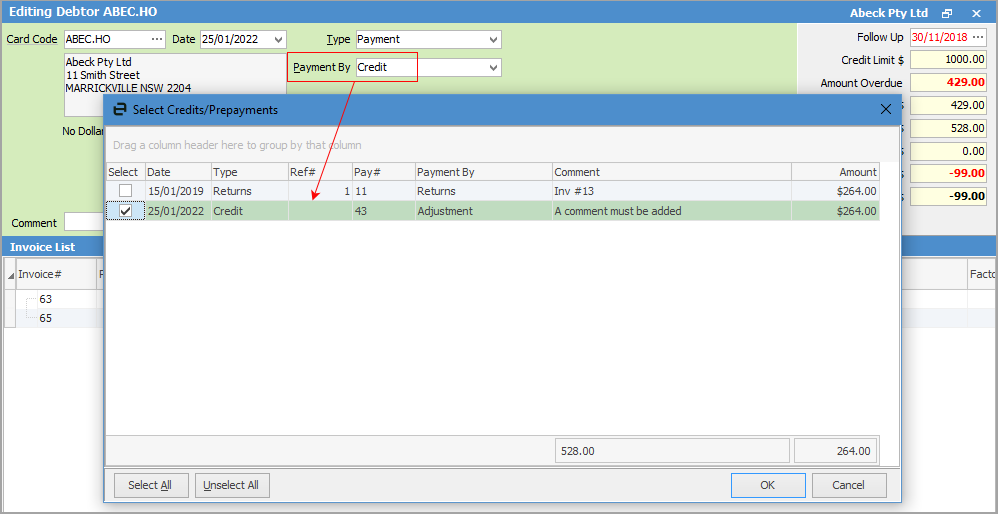

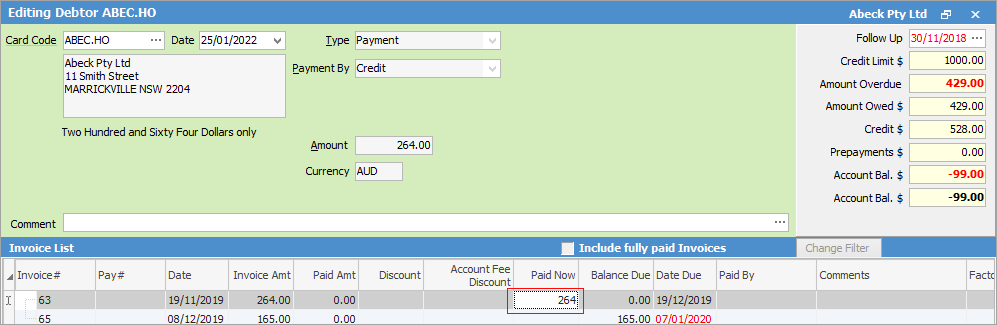

To allocate the adjustment to an invoice, edit the debtor and select Payment By – Credit. A window will pop up, where you can select the adjustment.

Click in the Paid Now field of the relevant invoice, then click Save.

|

To reverse (or cancel) a debtors adjustment, add a further adjustment opposite to the first one, ie. if an adjustment down was performed, do an adjustment up. |

How to