The following explains the steps to set up stock to apply a credit charge.

Add a stock GL group

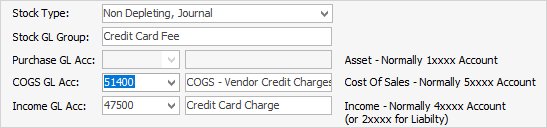

On the ribbon, go to Tools > Setups > Accounting > Stock GL Groups and click Add. Enter the following details:

▪Stock Type – Non Depleting, Journal.

▪Stock GL Group – Credit Card Fee.

▪Choices of GL accounts could be:

–Income, eg. 4-XXXX Credit Card Charge, or

–Expense eg 6-XXXX Credit Card Fees

–COGS, eg. 5-XXXX Vendor Credit Charges.

|

It is best to check with the company accountant, as a new general ledger account may need to be added. |

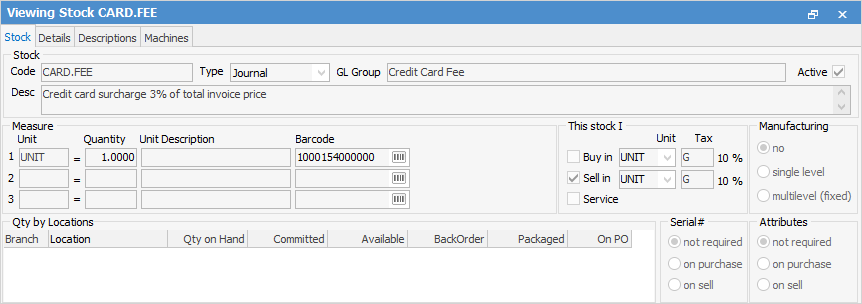

Add a stock record

▪Stock Code – CARD.FEE

▪Type – Journal.

▪GL Group – Credit Card Fee.

▪Enter a description in the Desc field.

▪Tick This Stock I Sell in and enter G in Tax.

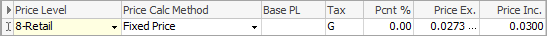

▪On the Pricing tab (in the footer):

–select a Price Level

–select Price Calc Method – Fixed Price

–Price Inc = 0.0300 (example only).

|

This setup is for 3% of the total invoice price including GST. The value for other % rates will need to be calculated. There is a slight rounding issue that may become apparent on large invoices and there is no way around this except to override the Price Ex or Price Inc as appropriate. |

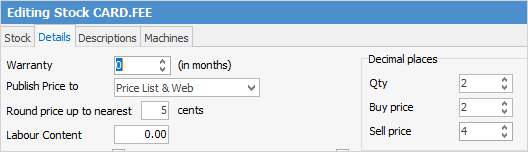

▪On the Details tab (in the header), change the decimal places to:

–Qty = 2

–Sell price = 4.

Add a job and complete the sale

▪Check the total sale value.

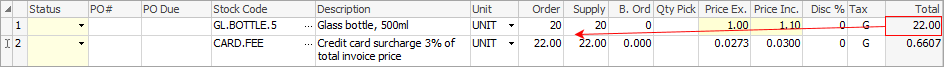

▪Add the CARD.FEE stock, then change the Order Qty and Supply to equal the original job Total amount.

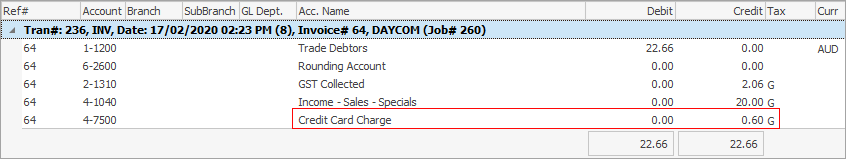

▪In this example, the total sale before adding the CARD.FEE was $22.00, therefore 66 cents ex GST is added to the total after adding an order quantity of 22.00.

▪Invoice the job.

▪The 0.60 cents net excluding GST has gone to the appropriate card fee account and 6 cents has been added to the GST Collected account.

Further information

Credit Card Surcharge Management