When importing, GST on imports may be deferred, instead of paying the GST to a customs agent on each shipment. The deferred GST figure will be embedded in the monthly ECI BAS by the ATO. This deferred GST amount should be entered into Jim2 before running the GST session as follows:

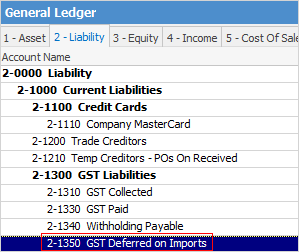

▪add a new account to the GST Liabilities area of the general ledger, eg. 2-1350 GST Deferred on Imports (if it is not already set up) with a default tax code of X

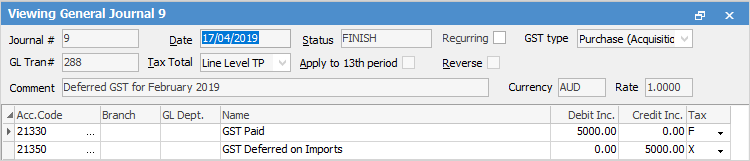

▪add a general journal – BAS Type – Purchase (Acquisition). A figure of $5,000.00 is used in this example, and the general ledger account numbers may also be different in the general ledger. Debit 2-1330 GST Paid $5,000.00 tax code F and credit 2-1350 GST Deferred on Imports $5,000.00 Tax Code X

The deferred GST has now been recorded and, using Tax Code F, Jim2 will gross up that amount to record total purchases including GST to $55,00.00. This was the deemed value of the goods at the time they cleared customs – including the GST charged.

|

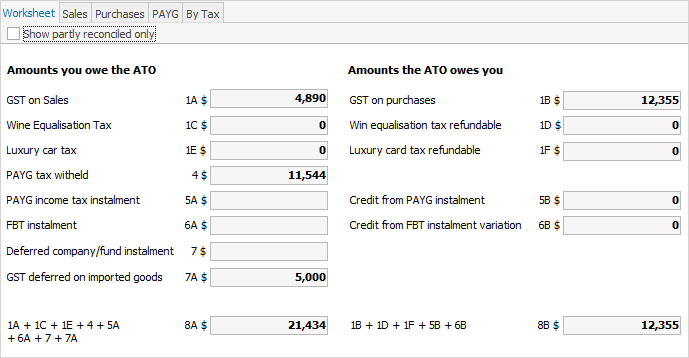

Note: The worksheet tab will show the grossed up amount in G11, however the By Tax tab will only show the tax amount. |

The deferred GST figure will flow through to 7A in GST Sessions in Jim2, and is included in the G11 figure for total non-capital purchases.

When paying the ATO, the payment should be entered as follows:

Credit 1-1110 Bank Account |

Tax Code X |

Total amount of payment |

Debit 2-1310 GST Collected |

Tax Code X |

Total GST Collected on Sales |

Credit 2-1330 GST Paid |

Tax Code X |

Total GST Paid on Purchases |

Debit 2-1350 GST Deferred |

Tax Code X |

Total GST Deferred on Imports |

Debit 2-1410 PAYG Payable |

Tax Code X |

Total PAYG Withheld from wages |

How to

Change GST Reporting from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Aust Database