To provide gift certificates/cards/vouchers that can be used as currency by customers, this is effectively creating a new payment type (just like cheques or cash). When selling the gift certificate in the first place real currency that can be banked will be received. When customers use the gift certificate to pay for goods, record the gift certificate value as part of the $ received.

Gift certificates and GST

When selling a gift certificate, it is important to know when to report the GST for the gift certificate on the BAS.

When selling a gift certificate which can be redeemed for a choice of goods or services up to that value, report the GST for that gift certificate when the gift certificate is redeemed, not when the gift certificate is sold. If only part of the gift certificate is redeemed, only report the GST on that part.

However, if the gift certificate is for a specific product or service, report the GST when the certificate is sold.

As gift certificates are not real currency that can be sent to the bank, create a separate bank account (detailed credit card liability account) that banks certificates into in a separate banking session to ensure there is no duplicate income recorded.

As gift certificates are redeemed (by customers) and banked, the liability will reduce. The dollar value in the Gift Certificate Header account (which is the difference between the Gift Certificate Sold and Gift Certificates Redeemed liability accounts) will indicate the value of certificates still in circulation.

On the ribbon, go to Accounts > General Ledger:

At the 1 – Asset tab under SOH

▪Add a 1- SOH account called Gift Certificates

At the 2- Liability tab under Current Liabilities:

▪Add a new 2- HEADER account called Gift Certificates

▪Under the header account add a new 2- Detail account called Gift Certificates Sold

▪Under the above account add a new 2- Detail Credit Card Account (Postable) called Gift Certificates Redeemed.

At the 5- COGS tab under COGS:

▪Add a new 5- COGS account for Gift Certificates

Close the General Ledger.

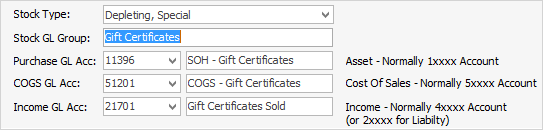

On the ribbon, go to Tools > Setups > Stock GL Groups

Non-Serialised – Add a new Stock GL Group called Gift Certificate with a Type – Non-Depleting, COGS GL Acc – the new 5XXXX account as above, Income GL Acc – the new 2XXXX Gift Certificate Sold account as above

Serialised – Add a new Stock GL Group called Gift Certificate with a Type – Depleting, Special. Select Serial# on purchase.

Select the SOH GL Acc – the new 1XXXX account as above, COGS GL Acc – the new 5XXXX account as above, Income GL Acc – the new 2XXXX Gift Certificates Sold account, as above. Save and Close.

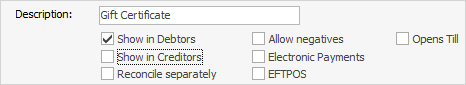

On the ribbon, go to Tools > Setups > Banking > Payment Type. Add a new payment type called Gift Certificate. Tick Show in Debtors, but do not tick Show in Creditors, Reconcile Separately, Electronic Payments or Allow Negatives. Save.

Stock GL group setup for gift certificates

Non-Serialised

Create non depleting stock that belongs to a Stock GL Group that will help move the liability around correctly. The Stock GL Group will move the sale value of the gift certificate to the 2XXXX Gift Certificates Sold liability account automatically.

Serialised

Create a depleting Serial on purchase order stock that belongs to a Stock GL Group that will still move the liability around correctly. Purchase the certificates using the company card code as the vendor at $0 to record the serial number, ready to sell. The Stock GL Group will show a $0 value in Assets (stock on hand for Gift Certificates) and move the sale value of the gift certificate to the 2XXXX Gift Certificates Sold liability account automatically.

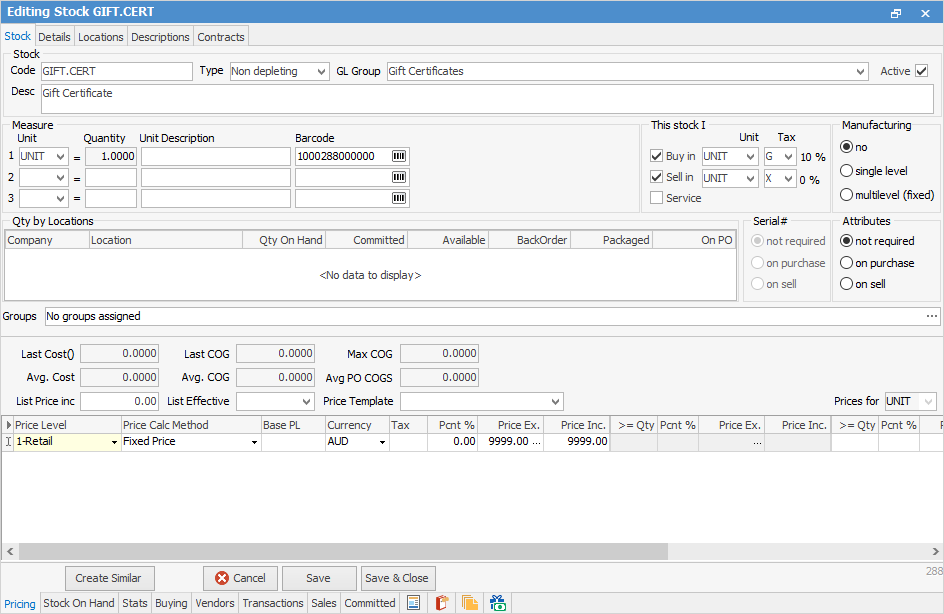

On the ribbon, go to Stock > Add Stock

Code – GIFT.CERT.S

Type – Non depleting (for non-serialised) or Depleting (for serialised)

GL Group – Gift Certificate

Description – Gift Certificate

For the option This Stock I Sell in – change the Tax Code to X

Serial number – Not Required (non-serialised) or – On Purchase (for serialised)

Price Level – 1

Price Calc Method – Fixed Price

Tax Paid $9999, or something else that will prompt staff to change the sell value to equal that of the certificate.

Showing non depleting stock

Save and Close.

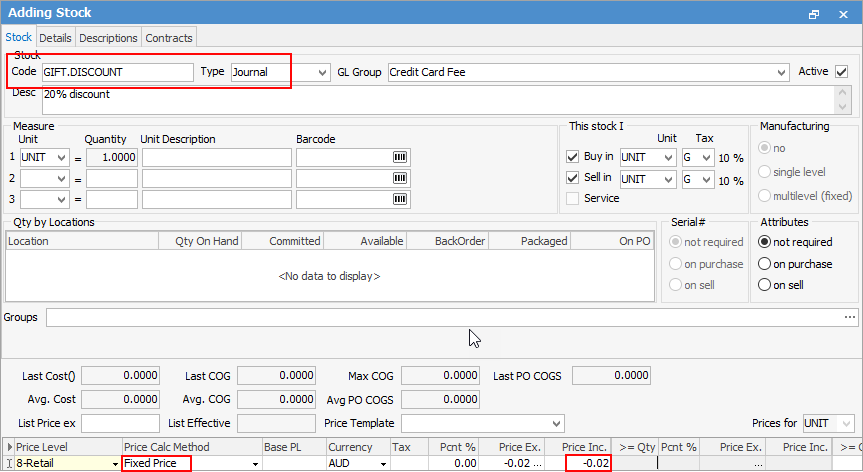

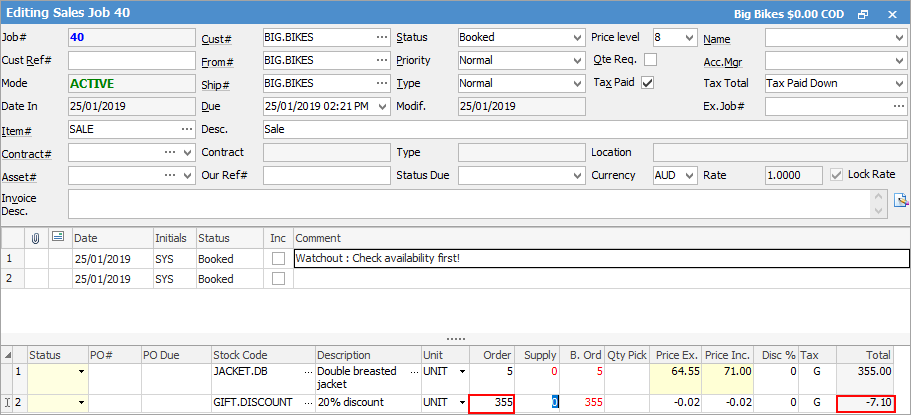

Discounts

If you wish to provide a discount (say 20%) when a customer claims a gift voucher, create a journal stock with a Fixed Price Calc of, say, 0.2 (this equates to 20%).

When you create the job, enter all stock to get the total value, then drop in the gift discount stock code and make the order Qty the total value of the job. This will take 20% off the total amount:

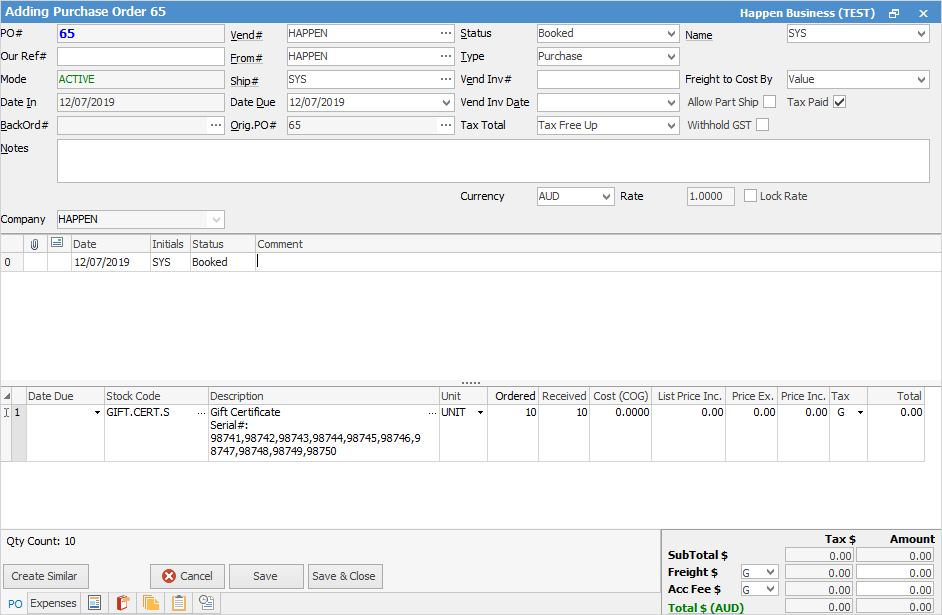

Add Purchase For Serialised Gift Certificates

On the ribbon, go to Purchases > Add Purchase

Vendor – the company

Stock code – GIFT.CERTIFICATE

Ordered – the number of certificates in the booklet

Received – the number of certificates in the booklet

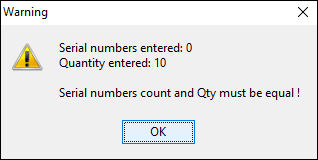

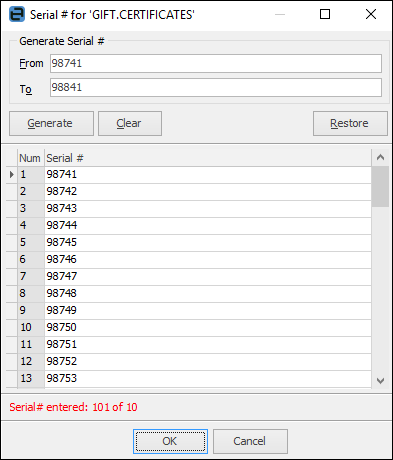

The serial# entry grid will appear.

It is recommended to use the Generate function to create the serial numbers in sequence as per the booklet numbering.

Price = $0

|

Some letters in the field names within the header are underlined, eg. Vend#. Using Alt+ the underlined letter will jump to the field beside that heading. |

Finish the purchase order. Save and Close.

Selling the gift certificates

Serialised or not, it is now a matter of selling the certificates to people in exchange for real money that can be banked. In a normal job, sell the gift certificate for whatever amount is required. Bank the money paid in the normal way.

|

In the general ledger, selling a gift certificate does not increase sales income. It in fact becomes a liability awaiting the customer to come in and buy some real stock. |

Customers using the gift certificates

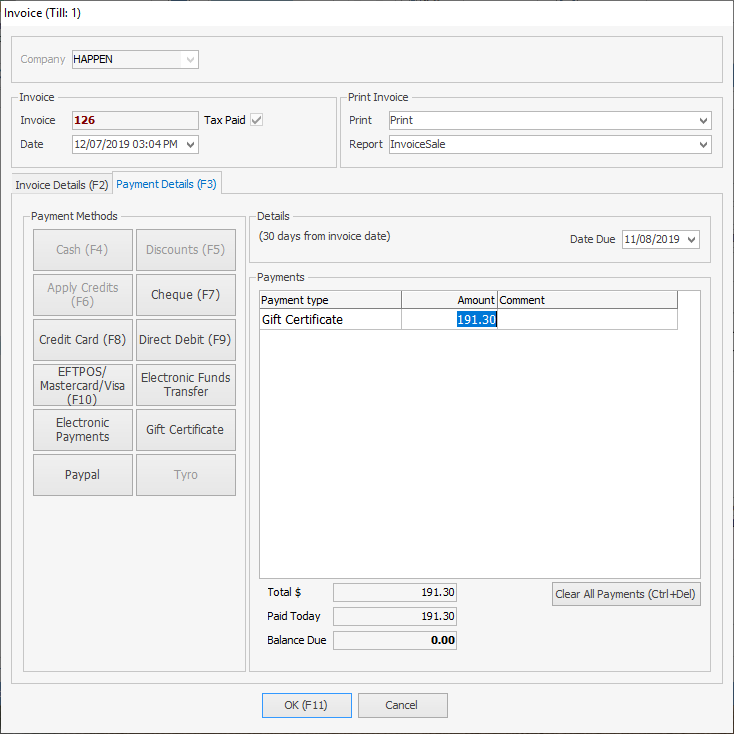

When the customer finally decides to use the certificate, sell them stock on a sales job in the normal way. When it comes time to process payment, use Payment Type – Gift Certificate. Multiple payments can be received from a customer against a sale (ie. $50 certificate + $20 cash + $30 Mastercard). If the certificate amount is greater than the overall sale value, either provide the customer the difference as a cash refund or debtor credit to use later.

Banking the gift certificates

As customers use the gift certificates, they will appear in Unbanked Funds.

|

It is very important that these are banked into the Gift Certificate Redeemed (credit card liability) account.

Why is this so? Each time a gift certificate is sold, an equal $ value liability is created in that Gift Certificates Sold Liability account. When banking the certificate into the Gift Certificates Redeemed account, the liability reduces. |

Certificates in circulation prior to go-live

For serialised pre-sold gift certificates:

▪Add an Opening Balance purchase order for certificates currently in pre-Jim2 circulation: purchase value @ $0 but record serial number.

▪Sell the customers the correct serialised certificate for $X (on a job – creates the liability).

▪Wait for them to redeem it on a job and bank into Gift Cert Bank Account (wipes $X liability the sale created.)

For non-serialised pre-sold gift certificates:

▪Sell the customer a certificate for $X (on a job – creates the liability).

▪Wait for them to redeem it on a job and bank into Gift Cert Bank Account (wipes $X liability the sale created).