If you want to sell a company asset, eg. a motor vehicle, you may need to provide a tax invoice to the purchaser. Since the purchase of an asset is usually recorded on an Expense PO to a 1-XXXX Asset at Cost general ledger account, you will need to create a stock record, and move the asset value in your general ledger, in order to sell the asset and account for the value.

|

To ensure that the value of the asset you are selling is recorded correctly at the time of the sale, we advise you to discuss the sale of the asset with your accountant before you process the sale in Jim2. You can then enter any adjustments required, such as for depreciation, prior to following these steps. |

|

You will see some letters underlined in the field names within the header, eg. Status. Using Alt+ the underlined letter will jump you to the field beside that heading. |

You should complete the following steps:

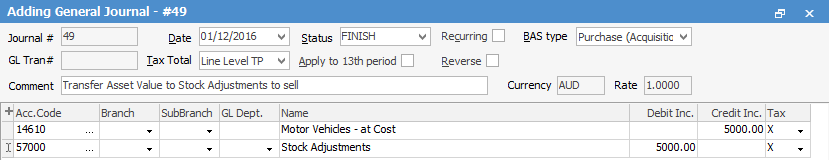

1.Move the ex GST value of the asset from the 1-XXXX Asset account to the 5-XXXX Stock Adjustment account by adding a general journal, BAS Type – Purchase, using tax code X on all lines on the journal.

2.Add a new stock record with Type – Depleting and select a relevant stock GL group (you may need to add a new one).

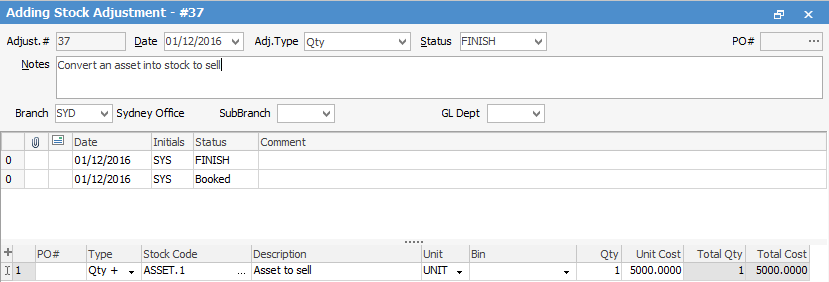

3.Add a Stock Adjustment Qty+ to increase the stock on hand count for the new product at the correct ex GST asset value. This transaction will also move the value from the 5-XXXX Stock Adjustment account to the correct 1-XXXX Stock on Hand account.

4.Add a job and sell the stock as normal.

Further information:

Move Stock from Depleting to Asset