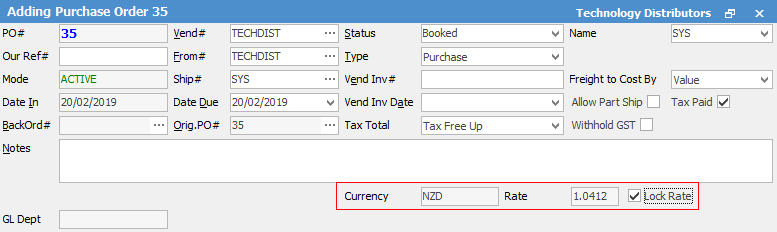

The purchase order has the following additional fields to accommodate purchasing in foreign currency:

▪Currency – select the currency for this purchase.

▪Rate – the current exchange rate set for the selected currency will shown by default.

▪Lock Rate – by locking a specific exchange rate on a document, it will be excluded from any subsequent revaluations.

|

Some letters in the field names within the header are underlined, eg. Vend#. Using Alt+ the underlined letter will jump to the field beside that heading. |

|

When adding a purchase order, the default currency is AUD. When selecting the vendor, their cardfile default currency (as set on the Vendor tab on their cardfile) will show that vendor's currency. |

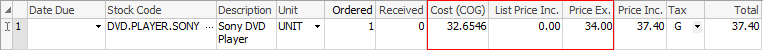

The purchase order stock grid shows:

Price Ex. and Price Inc. in the selected currency.

Cost (COG) in equivalent home currency (AUD), based on purchase order exchange rate. This is a handy reference. It is this home currency value that will be moved to the Stock On Hand general ledger account (dictated by each stock's Stock GL Group) when the purchase order is finished.

|

A warning will pop to screen if a user attempts to change the currency of the purchase order after it has been saved.

|

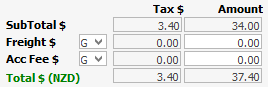

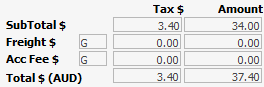

The purchase order footer has a function to display the purchase order totals:

In View mode, switch between the selected foreign currency total and the equivalent total in home currency. To switch between totals, select the word Total. |

NZD

AUD |

|

|

Tax Codes Be aware of the tax codes in use on foreign purchases. Although default tax codes can be changed at object level, using cardfile and stock record defaults will reduce errors. Where a vendor typically invoices without GST, and the customs agent bills bulk GST on arrival, purchase from the vendor at tax code X (exclude from GST calculation) and issue an expense order for the customs agent at tax code Y or Z (for the bulk GST component).

Tools > Options > Purchases > Purchase Defaults for Tax Code on Tax Free should be set to X.

Vendors who typically supply without GST should have their cardfile vendor default for tax paid unticked (will default tax code X into the stock grid on a purchase order).

Stock that is typically purchased without GST can have their stock record default for On Purchase Tax Code set to X. |

Purchase Order Reports

Purchase order and expense order reports support the currency symbols defined for each currency.

Further information