A country controller provides support for Canada, including:

▪tax codes include components to handle Canadian State, GST, HST and PST taxes, automatically splitting tax between GST and state taxes

▪linking general ledger accounts to specific tax components

▪tax can be based on Ship# State rather than Cust# State

▪default tax codes can be set in cardfiles

▪Canadian province/territory support in cardfiles

▪American date formats throughout Jim2 and reports

▪support for Letter size reports

▪reports (invoice, quotes, purchase orders, etc.) to handle Canadian reporting requirements.

Each province/territory in Canada has a different tax rate, which is typically made up of a national GST and an additional province/territory tax. The province/territory tax is only applicable if the goods are being sold to the end user (eg. retail), is not a service and the tax is based on where the goods are shipped to – not the actual customer.

The Tax checkboxes take on a slightly different meaning when using Jim2 in Canada:

▪unticked indicates a wholesale sale

▪ticked indicates a retail sale.

In all cases, tax is calculated tax free up (ie. ex tax).

Sell prices are ex tax, and in Jim2 are typically set as G, or buy and sell at a rate of 0%. When adding stock to a job/quote, etc. the G code is replaced with the appropriate wholesale/retail tax code, based on the province/territory the goods are being shipped to.

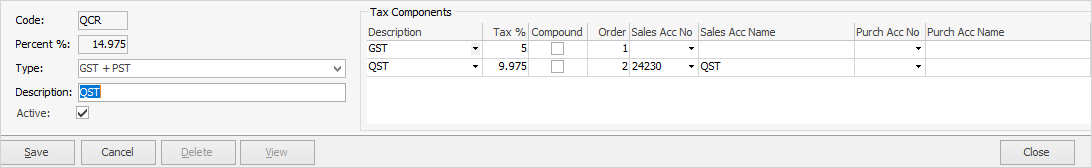

Jim2 has the ability to split a tax code into separate tax components. For example, the retail tax code for Québec is QCR and is a combined GST+PST tax rate of 14.975% split into two tax components as follows:

As the province/territory tax for Québec needs to be reported separately, it is linked to its own general ledger account, rather than the normal GST Collected linked account.

Typically, the tax code is driven via the Ship# province/territory, however this can be overridden on individual cardfiles by setting the TF/TP tax codes on both the Customer and Vendor tab.

Jim2 fully supports any date format. An option in the Jim.ini file can tell Jim2 to use the workstation’s date format, and this will be used throughout Jim2 on that workstation.

Regional Settings also include a default paper size setting. This defaults to A4, however can be set to Letter for use in Canada.

Canada makes heavy use of cheques, and the cheque reports include additions to satisfy Canadian banking system requirements (including 34/100, rather than 34 cents) and making clear the date and currency being used.

Further information