Creditors adjustments up and down assist in moving amounts (or transferring) from one creditor to another.

Creditors adjustments should only be performed to resolve discrepancies of small values with creditors only. Do not use creditors adjustments if there is any stock involved. Money values are only being moved – stock on hand levels are not being adjusted. Therefore, use a creditors adjustment to move a payment from one supplier to another (even if the purchase order has been finished), as no stock will be affected.

If the balance outstanding is to increase, use a creditors adjustment up. Increasing will effectively create an amount that needs to be paid.

If the balance outstanding is to decrease, use a creditors adjustment down. Decreasing will create a credit that can be applied to reduce a current balance.

Creditors adjustments, whether up or down, do not represent COGS of stock value and need to be allocated to an expense or income account in the general ledger. Jim2 will prompt to allocate the adjustment to a general ledger account and create a journal for balancing the transaction.

Amounts can be added to the creditor's record without having to purchase from the vendor. This is useful when bank fees need to be added for a dishonoured cheque, etc.

|

This is the best way to handle a payment that has bounced due to entering an incorrect bank account. The creditors adjustment up will put the value back into the creditor's account and post it back to the bank account. This will debit the bank account for the reversal using tax code X. Once the type of creditors adjustment has been selected, the cursor will be placed at the GL Account field to select the required general ledger account. Enter the amount into the Amount field – if this transaction includes tax, enter the amount as tax inclusive, then choose the appropriate tax code. A comment is required when entering creditors adjustments. |

To reverse (or cancel) a creditors adjustment, add a further adjustment opposite to the first one, ie. if an adjustment up was performed, do an adjustment down.

1.Open the Creditors list.

2.Locate and open the creditor. Click Edit.

3.Select the type of creditors adjustment: up or down.

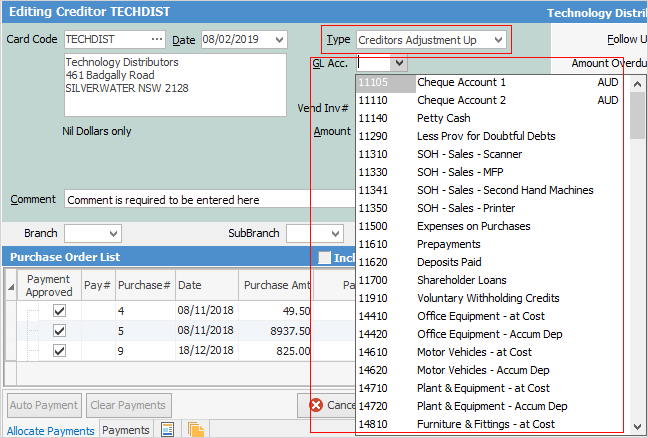

4.Use the drop down list to select the general ledger account to be affected by this entry.

|

The Trade Creditors Control Account must not be used. This general ledger account is for the other side of the creditors transaction, eg. the expense account. Creditors will offset the account selected here. |

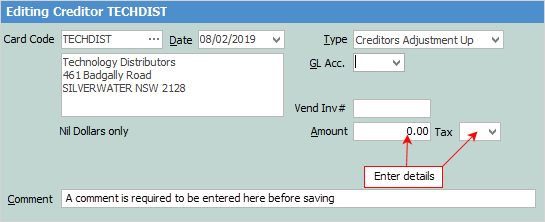

5.Enter a vendor's invoice number for reference.

|

The Vend# appears only on creditor adjustments up – not down. Use the Comment field in the creditor adjustment down to record this information in an adjustment up. A comment must be entered. |

6.Enter the amount of the adjustment and select a relevant tax code.

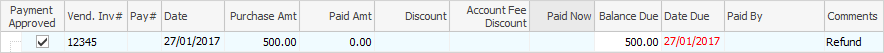

This adjustment will increase the creditor's balance, increase the general ledger account and increase the tax account – this adjustment can be paid the same way as a purchase.

|

Some letters in the field names within the header are underlined, eg. Date. Using Alt+ the underlined letter will jump to the field beside that heading. |

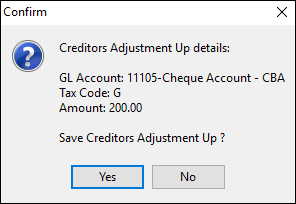

7.Click Save.

9.The adjustment up entry will be created.

How to