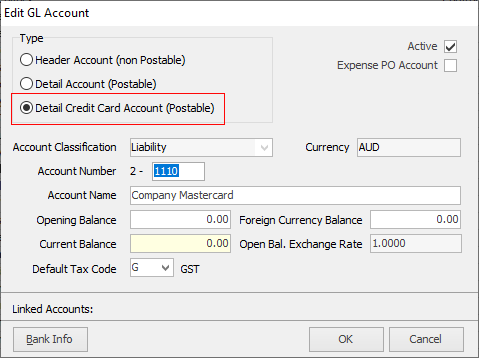

The general ledger will have liability accounts set up to track the liability accruing on any company credit cards that staff use.

|

Note: Many cards are debit cards (not credit cards), meaning transactions are immediate, and reduce the running balance on one of the existing asset accounts – transactions appear on the normal bank account statement. |

With the credit card set up as a Detail Credit Card Account, the debits and credits to the card can be reconciled when a statement arrives, the same as a normal cheque-style account. Each time a payment is made to a vendor using the company credit card, it effectively acts like a cheque.

Because it is a credit card, liability is being accumulated. The general ledger will show the running total of what has been charged to the card. When funds are transferred from another account to clear the monthly balance on the card, the liability will reduce. Because the general ledger shows the running total, it is easy to track the available funds on the credit card.

To transfer money from a bank account to a credit card, there are two methods to choose from:

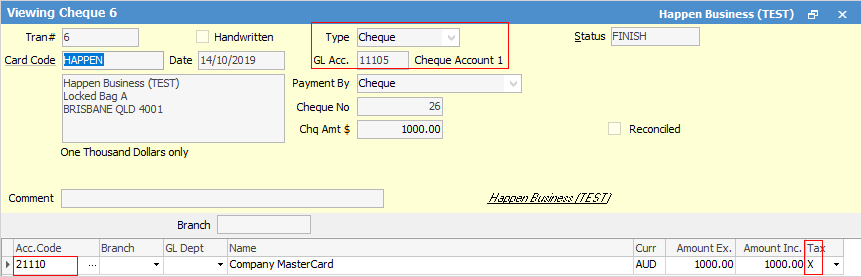

On the ribbon, go to Accounts > Cheque Book.

Select Type Cheque. Choose the cheque account general ledger account. Enter the amount, then in the Acc.Code field select the credit card account, and use Tax Code X – the tax has already been recorded via the credit card charge.

|

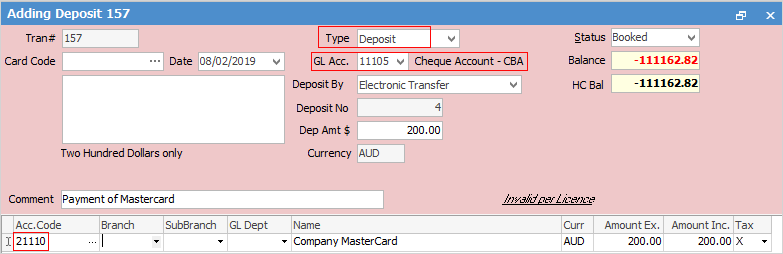

On the ribbon, go to Accounts > Deposits.

Select Type Deposit and the bank general ledger account. Enter the amount, then in the Acc.Code field in the grid below select the credit card account, and use Tax Code X – the tax has already been recorded via the credit card charge.

|

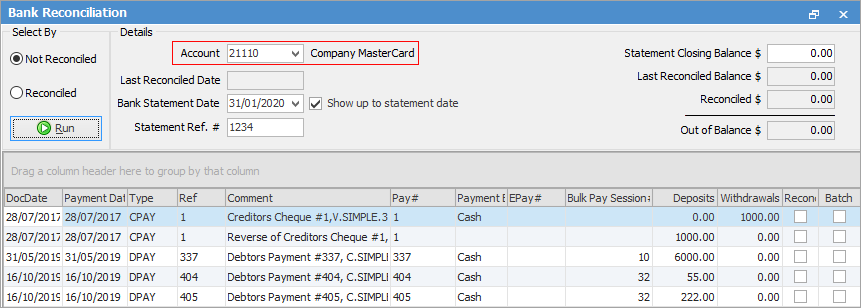

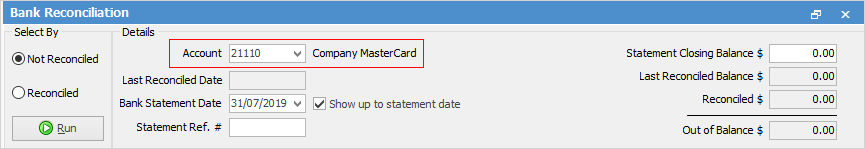

Reconciling a credit card account is as easy as reconciling a normal cheque account. On the ribbon, go to Accounts > Bank Reconciliation and use the drop down on the Account field to select which credit card account is to be reconciled.

Match transactions to the vendor payments made and add the bank charges, etc.

|

Remember, a cheque/direct deposit needs to be written to the credit card account to clear the balance – use exactly the amount the Credit Card Centre has used. |

If paying a vendor using the credit card, and the transaction does not appear on the statement (ie. it is still in the reconciliation list), check with the vendor as to what date they actually ran the transaction (in case it missed the cut off on the statement period), or if they have run the transaction at all. If they haven’t charged the card, and for some reason want an alternate payment type, reverse the payment that has been recorded in Jim2.

|

To reverse a payment it cannot be reconciled. |

The upshot of all the above is: record a payment to the vendor around the time it happened, rather than leave vendor payments till the statement comes in. Although it is not important as to where the liability lies (in the creditors balance or credit card balance) in dollar terms, it’s good to keep regular track of what funds are available on the credit card.

Hyperlinked fields

Some fields provide hyperlink access to view associated information. Hovering the cursor over the wording to the left of the field will display the label name in blue if it is hyperlinked. Click the label and select the option to View. Card Code – will open the cardfile of the code entered here.

Further information

Apply a Credit Card Charge Using Stock