The GST Calculation Worksheet report is linked to each GST session completed within the financial year. For example, if you completed 4 GST sessions in the financial year, you will need to provide the accountant with 4 Reports.

You can use the Excel icon to produce reports directly to Excel. Permission for use of this is based on report permissions since it accesses the report for the information.

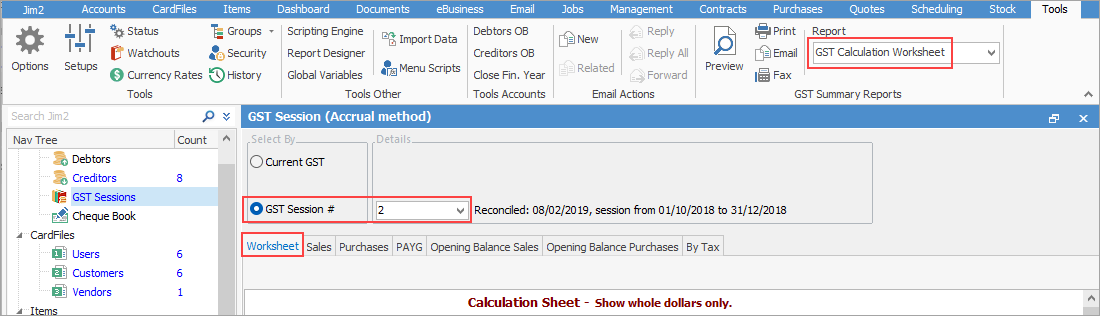

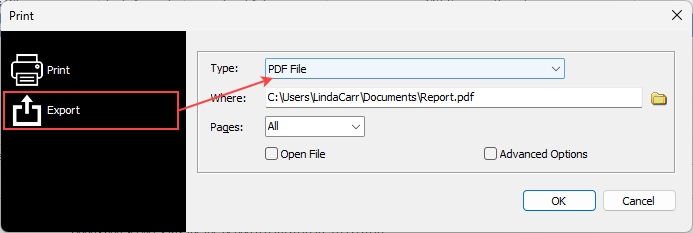

When Excel is selected, it will open spreadsheet windows and populate it with raw data from the selected report. Each report pipeline with be represented in a separate sheet, eg. Job, JobComments, JobStock etc. This will produce a much more comprehensive report in spreadsheet format for all these reports. 1.Open the relevant GST Session. 2.Go to the Worksheet tab. 3.In the Report section, select the GST Calculation Worksheet report. 4.Click Print, then select Export to save the PDF to your local computer.

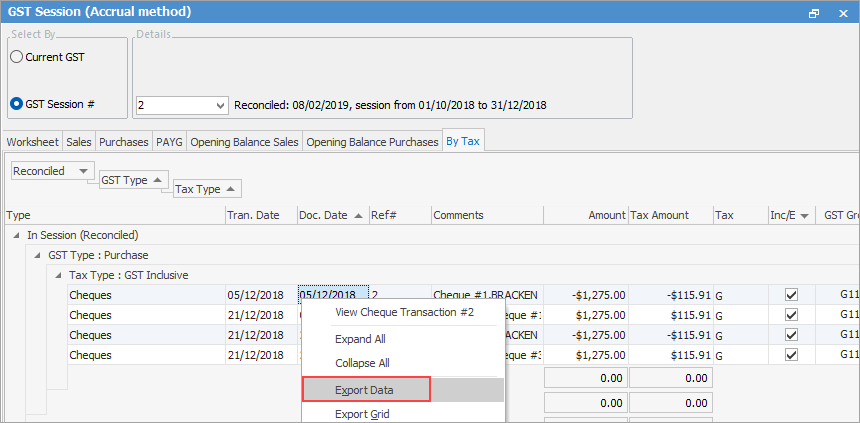

5.The By Tax tab for each GST session shows the transactions that make up the totals in the Worksheet. Right click in the grid of the By Tax tab and select Export Data as this should be included with each GST Calculation Worksheet report.

Repeat the above process for each period required for the full financial year.

|

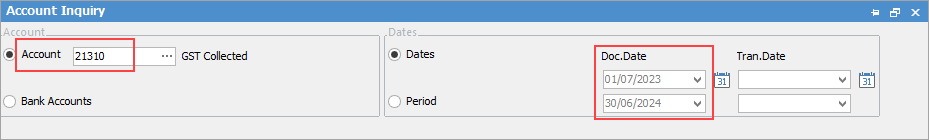

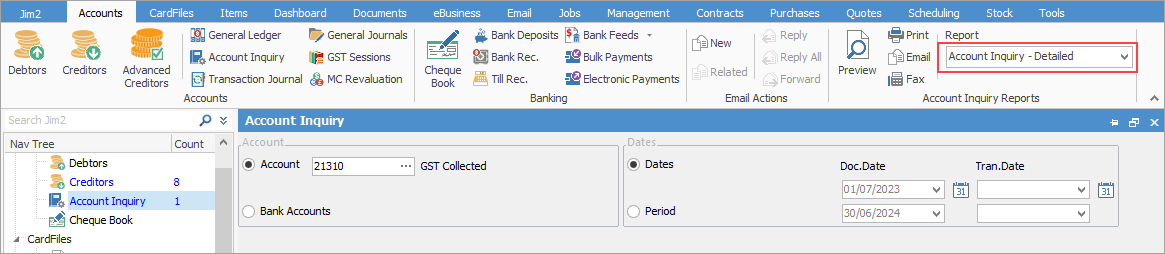

You can also provide the accountant with an Account Inquiry report for the GST Collected GL account and the GST Paid GL account. 1.Go Accounts > Account Inquiry on the ribbon. 2.In the Account field, select the GST Collected GL account. 3.In the Doc.Date fields, select the relevant financial year, then click Run at the bottom.  4.Right click in the grid and select Export Data. This will save the data into an excel spreadsheet. 5.The other option is to select the Account Inquiry - Detailed report in the Report section. You can send the export or the PDF version of the Report depending on preference.  6.Repeat the above steps for the GST Paid GL Account. |

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports