1.On the ribbon, go to Accounts > Debtors, then clicking Run at the bottom of the screen.

2.Locate and open the debtor. Click Edit.

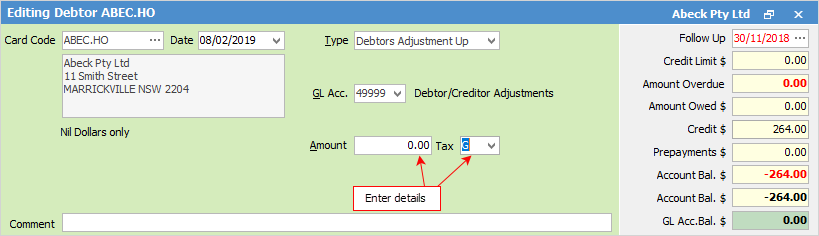

3.Select the Type – Debtors Adjustment Up.

4.Use the dropdown list to select the general ledger account to be affected by this entry.

This adjustment will have the following results: increase the debtor's balance, increase the selected general ledger account and increase the tax account. This adjustment can be paid the same way as an invoice.

|

Do not use the Trade Debtors Control Account. This general ledger account selection is for the other side of the debtors transaction, eg. the expense account. Debtors will automatically offset the account selected here. Enter the adjustment amount and relevant tax code. |

5.Enter amount and tax code.

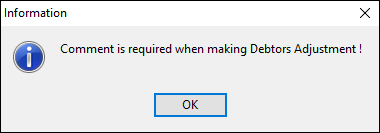

6.Enter a comment before saving a debtors adjustment up or down, as this is a required field.

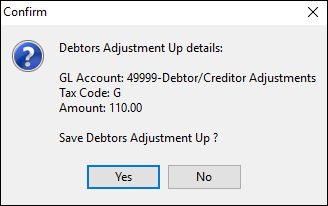

7.Click Save, and a message to confirm will appear.

The adjustment up entry will now be created.

|

To reverse (or cancel) a debtors adjustment, add a further adjustment opposite to the first one, ie. if an adjustment up was performed, do an adjustment down. |

How to