On the previous page we showed you how to create an adjustment for situations where the amount to be adjusted is a debit. However, if the amount is a credit, eg. -0.01, it becomes a two-step process to clear this.

Follow these simple steps.

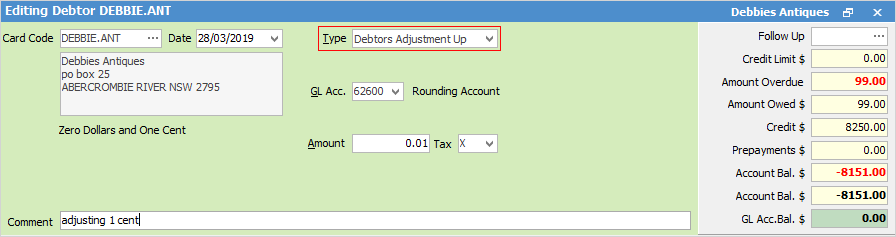

1.First, you need to add a debtors adjustment up to offset the credit.

|

You will see some letters underlined in the field names within the header, eg. Type. Using Alt+ the underlined letter will jump you to the field beside that heading. |

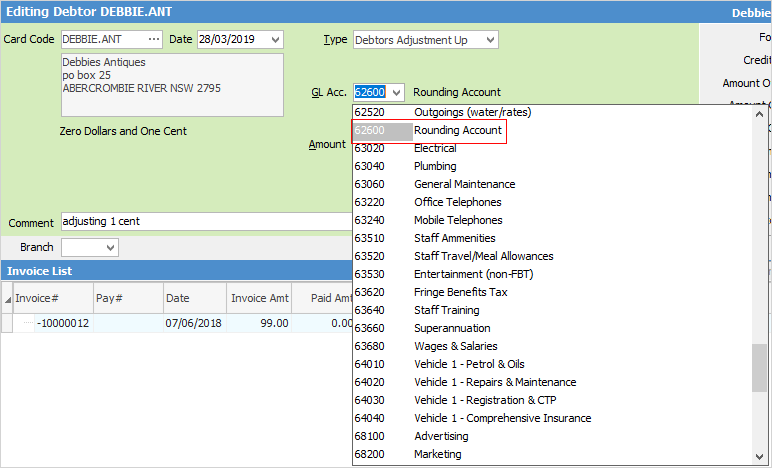

2.Next, select the 6-xxxx Rounding Account and use tax code X, as you are simply writing off a small rounding credit balance, with no GST reporting required.

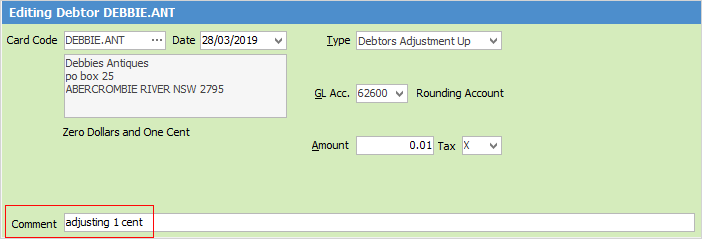

3.Enter a comment and click Save.

4.As a result of the above procedure, you will have created an invoice for one cent ($ 0.01), to which you can now apply a credit.

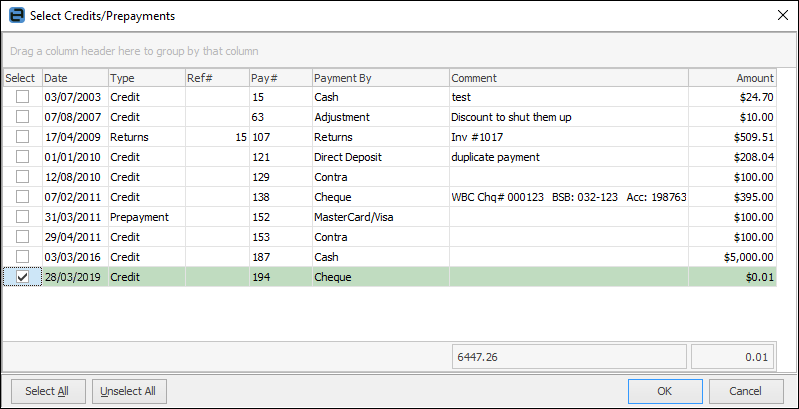

5.The last step is to add a Payment By – Credit to apply the one cent ($ 0.01) credit to the one cent invoice (the Select Credits/Prepayment screen will open). Select the credit and then click Save.

By following the above steps your debtor account will now be clean.

Further information:

Debtors Adjustments Up and Down