From time to time you may receive a rebate from a supplier, either as a credit against your vendor account to apply to outstanding invoices, or as a payment into your bank account.

You must first decide how you want to account for the rebate – either as a credit against a 5-XXXX Cost of Goods account in your general ledger, or as income reported against a 4-XXXX Income GL account. This decision will also affect how the rebates are reported in GST sessions (your BAS).

Recording Vendor Rebates as Income Reported Against a GL Account

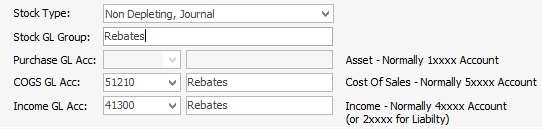

On the ribbon go to Tools > Setups > Accounting > Stock GL Group and add a stock GL group, type non depleting, journal, and select the Rebate GL account in both fields, then click Save.

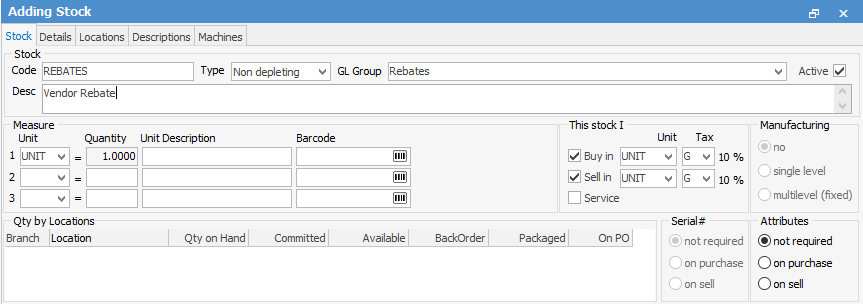

Add a stock record for Vendor Rebates, ensuring you select type Non Depleting.

Add a job and invoice your supplier for the rebate. Enter the payment as normal.

|

You may want to discuss this with your accountant, or refer to your previous system to see how you previously recorded vendor rebates. |

Recording Vendor Rebates as a Credit to COGS

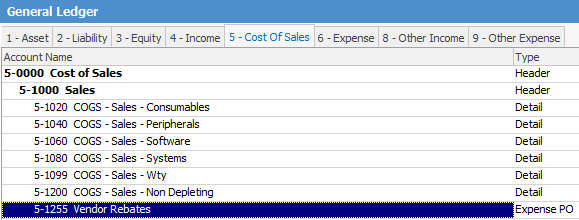

If you want vendor rebates reported as a credit in the 5-XXXX COGS area of the general ledger to reduce your overall cost of sales, simply add a negative expense PO to the vendor, and select the required 5-XXXX account (Purchases > Add Purchase > Type – Expense and make negative by putting a minus sign (-) before the amount).

|

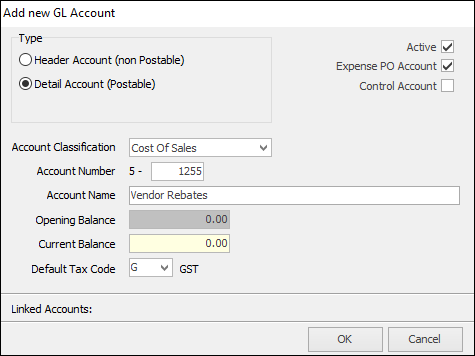

You need to add a new GL account, eg. 5-XXX Vendor Rebates, make it an expense PO account, and set a default tax code of G.

|

Recording Vendor Rebates as Income

If you want vendor rebates reported as income against a 4-XXXX Income GL account, then you must invoice the supplier for the rebate so it reports as a sale, and therefore income. You must add a journal stock pointing to an income account (you may need to add a new income account and journal type stock GL group for this purpose).

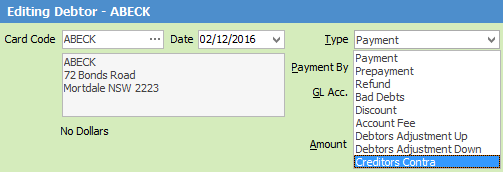

Edit the card file, and make the vendor a customer as well as a vendor. Add a job, and invoice them for the value of the rebate. Then edit the debtor account, and add a Creditors Contra to pay the invoice, and move the value to the creditor account where it will appear as a credit to apply to invoices.

|

You will see some letters underlined in the field names within the header, eg. Type. Using Alt+ the underlined letter will jump you to the field beside that heading. |