Please check the current GST and tax ruling with your accountant before you record a superannuation salary sacrifice transaction in Jim2. Please note that tax code X must be used for all superannuation accounts.

Option 1:

▪Use your current 6-XXXX Superannuation Expense and 2-XXXX Superannuation Liability accounts to record the Salary Sacrifice amounts.

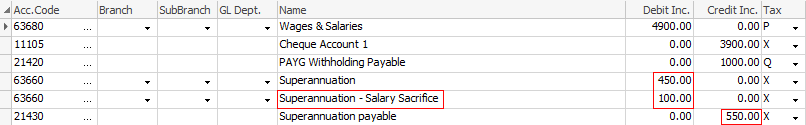

▪Add to Payroll General Journal as shown below.

–DR 6-XXXX Superannuation Expense Account $XX using Tax code X.

–CR 2-XXXX Superannuation Liability Account $XX using Tax code X.

|

You can enter the combined liability or add another line to record the Salary Sacrifice amount separately |

Option 2:

▪Add specific Superannuation Salary Sacrifice Expense and Liability Accounts.

a)Expense Account - 6-XXXX Superannuation – Salary Sacrifice.

b)Liability Account - 2-XXXX Superannuation – Salary Sacrifice.

•Add to Payroll General Journal, include two extra lines:

c)DR Expense Account – 6-XXXX Superannuation – Salary Sacrifice $XX (Tax code X).

d)CR Liability Account – 2-XXXX Superannuation – Salary Sacrifice $XX (Tax code X).

|

When you pay the superannuation fund, using the cheque book, you should include the Salary Sacrifice amount and enter as a separate line on the cheque entry. |