Required Additions

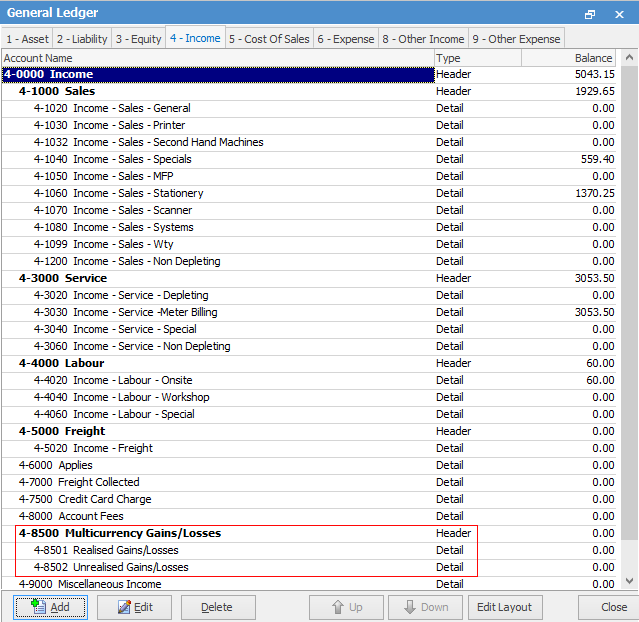

You will need to add two new general ledger accounts to accommodate journals for unrealised gains/losses and realised gains/losses.

Typically, these new GL accounts would be set up as Income accounts, for example:

4-8500 |

Multicurrency Gains/Losses |

Header |

4-8501 |

Realised Gains/Losses |

Control |

4-8502 |

Unrealised Gains/Losses |

Control |

The Default Tax Code should typically be X, as transactions to these accounts are done behind the scenes within Jim2.

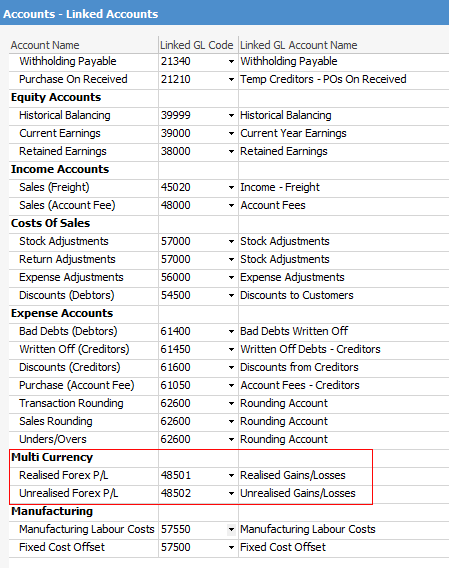

Tools > Options > Accounts > Linked Accounts

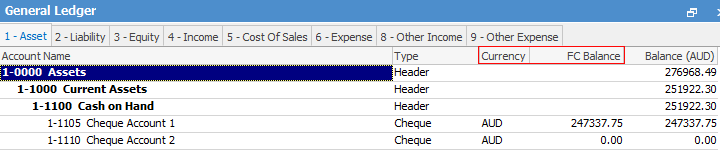

Once these accounts are set up and Multicurrency has been turned on in Options, the view of the general ledger includes two additional columns:

▪Currency

▪FC Balance

These are for showing the nominated currency and calculated foreign currency balance of detailed cheque and credit card accounts. The Account Balance column will always show its current balance in the GL in AUD.

The AUD value of these accounts can be revalued using the Multicurrency Revaluation Session.

|

You can only use the home currency, ie. AU$, in general journals as the general ledger is only in home currency. |

Further information: