When banking into a home currency bank account, any currency can be banked but only one currency at a time. For example, if you wished to bank both USD and AUD into an AUD bank account, you would need to do two separate Banking Sessions.

When banking into a Multicurrency bank account, you can only bank amounts that are in the same currency. For example, if you have selected a USD bank account, you can only bank USD amounts (the banking session will filter this automatically).

When banking Multicurrency amounts into a home currency bank account, the amount in Amount (foreign currency amount) and the equivalent amount in Amount AUD will be displayed as well as the AUD banked amount. The AUD bank amount will typically be the same as the Amount (AUD), but can be edited to allow exact matching of the bank statement.

If the Amount (AUD) and the Bank Amount (AUD) figures are different, a XBNK realisation journal will be created upon completing the banking session.

|

Realisation within a banking session is intended for matching bank statements. The majority of realisation should occur in debtors/creditors when applying payments to invoices/purchases. |

If the banking session only includes home currency amounts, it will only display home currency related columns.

The groupings are debtors, creditors, cheque book and unders/overs.

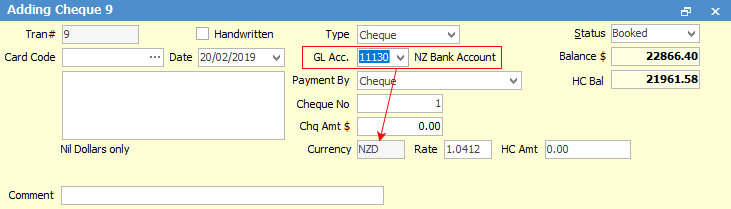

Entries via the Jim2 Chequebook (add a cheque or deposit) are made against detailed cheque or credit card accounts, with the proceeds of a cheque/deposit total being apportioned among your choice of GL accounts. Cheques and deposits are double-sided transactions. Example: credit cheque account $X, debit GL account/s $X.

|

You will see some letters underlined in the field names within the header, eg. Status. Using Alt+ the underlined letter will jump you to the field beside that heading. |

The specific currency for each cheque/credit card account is selected in the general ledger account.

The actual cheque details (the amount and how it is apportioned against GL accounts) must be the same currency – that is, you cannot allocate USD1000 as AUD900 and EUR€100.

|

If you write a cheque/deposit from a home currency bank account to any of your foreign currency bank accounts, additional fields appear on the cheque/deposit form. These allow you to edit the default foreign currency exchange rate on this transaction on the fly. |

Further information: