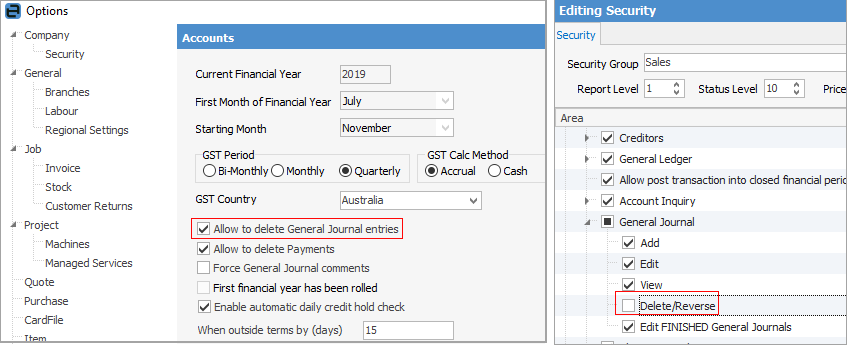

The ability to delete a general journal must be configured in Tools > Options > Accounts and is also controlled by the user's security settings.

|

Deleting/reversing a general journal in Jim2 should always be performed with caution. |

Delete a general journal

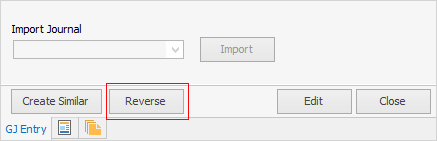

1.Open the general journal for deletion and remain in View mode.

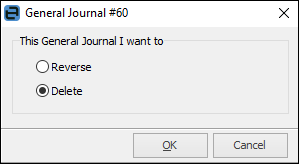

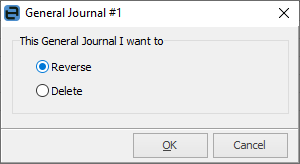

2.Click Reverse to initiate the reversal.

3.Click Delete.

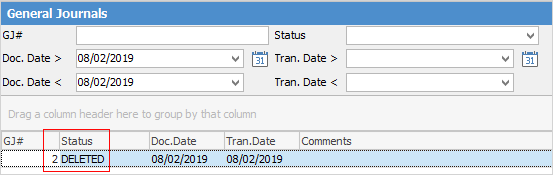

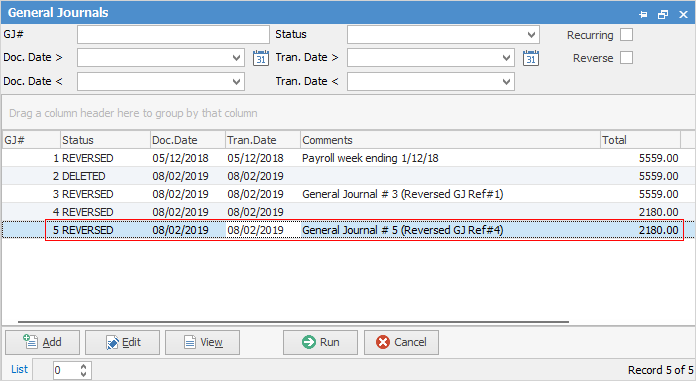

4.Clicking OK will delete the general journal from the general ledger transaction journal, however the transaction history will remain. All deleted transactions have a status of Deleted and are still available to view, however they are shown as deleted when viewed in a list.

Reverse a general journal

1.Open the general journal for reversal and remain in View mode.

2.Click Reverse to initiate the reversal.

3.Click the Reverse option.

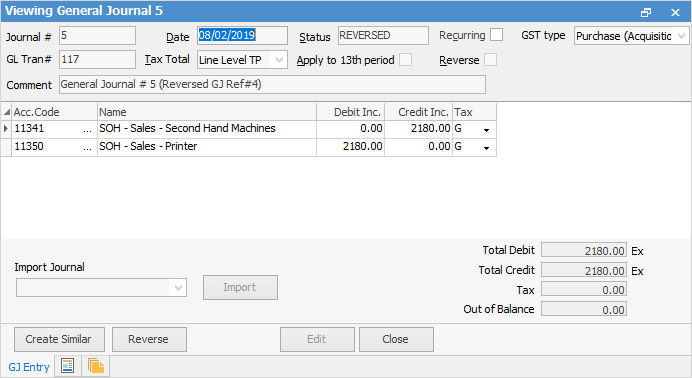

4.A reversing general journal will automatically be created by Jim2. Check and confirm the date of the reversal, then save the reversing general journal.

The general journal will still be available to view, and both the original general journal and the reversing general journal will show a status of Reversed when viewed in a list.

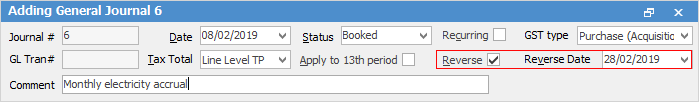

Reverse checkbox and Reverse Date

The Reverse checkbox acts only as an identifier to mark the general journal for a future reversal. That is, create a list of general journals that have been marked to be Reversed. Reversals must be performed manually.

Once the Reverse box has been ticked, the Reverse Date field appears, for nominating a date for this general journal to be reversed. Completing the actual general journal reversal must be performed manually.

|

▪A reversed general journal cannot be reversed. Another general journal needs to be added to reverse it instead. ▪If adding general journals that will need to be reversed at a later date, at the time of adding the general journal tick Reverse and set the reversing date to minimise date errors. ▪If reversing a general journal and the period of that general journal is closed, a message will appear offering to place the reversing transactions into the 13th Period. |

How to