No formal end of month procedure is required in Jim2, however it is good practice to run through a checklist at the end of each month to ensure that nothing has been overlooked. This process can be followed weekly, if preferred, as it is integral to maintaining an accurate Jim2 database

The following is suggested:

Sales and purchasing

▪Run a Job List of all open jobs. Review jobs to ensure all that should be invoiced have been. This especially applies to jobs on Finish or Ready status. Review and confirm that all jobs on Booked are real, and cancel any that are no longer required. Instruct staff members to add comments to explain why they are not finished.

▪Run a list of returns from customer that are not on Finish. Review any that are in the list. Confirm they are valid and set to Finish, if possible. Instruct staff members to add comments to explain why they are not finished.

▪Run a purchase order list and review all purchase orders on Received. Task someone to chase the supplier for the invoice so that creditors will be correct.

▪Run a list of Returns to Vendor that are not on Finish. Review any that are in the list. Confirm that they are valid and set to Finish, if possible. Chase the supplier for the credit notes so that creditors will be correct.

▪Run a list of stock adjustments that are on Booked. Check why they are not finished or cancelled. Instruct staff members to add comments in the Notes section of the stock adjustment header to explain why they are not finished.

▪Run a list of stock transfers that are on Booked or Transfer. Check why they are not finished, and finish or cancel.

▪Review and resolve any stock sold in advance.

▪Run a list of quotes not yet accepted. Review and follow up, or update as appropriate.

Accounts

▪Ensure all debtor and creditor payments have been entered, as well as payroll general journals and other non-debtor/creditor entries.

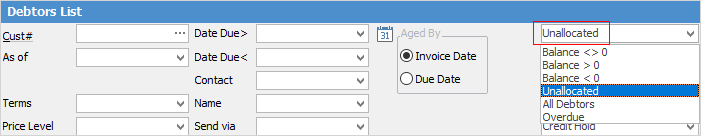

▪Ensure that all payments in debtors and creditors have been applied to invoices where relevant. This is especially important if Cash GST is the method being used, as this is how cash GST in Jim2 is calculated. Check this by running the debtors and creditors lists by Unallocated to identify accounts with unapplied credits.

▪Check bank deposits and review any unbanked entries, making corrections if necessary.

▪Review any cheque book entries on Booked.

▪Review any unders/overs amounts, and resolve as necessary.

▪Reconcile all bank, petty cash and credit card accounts to ensure nothing has been overlooked, and any errors are picked up and corrected.

▪Send out debtor statements once all invoicing is completed and debtor payments have been entered.

▪Only print copies of all management/financial reports once the above tasks have been completed.

▪Lock the month once all the creditor transactions and bank reconciliations are completed. It can be unlocked if corrections are necessary prior to reconciling the GST session and lodging the BAS.

|

Stock valuation reports (Management > Reports > Stock Reports) are live reports and cannot be backdated, however the Stock Value by GL Group As Of Estimate can be backdated. |

For more information, please contact the support team at Happen Business, on 02 9570 4696, or email support@happen.biz