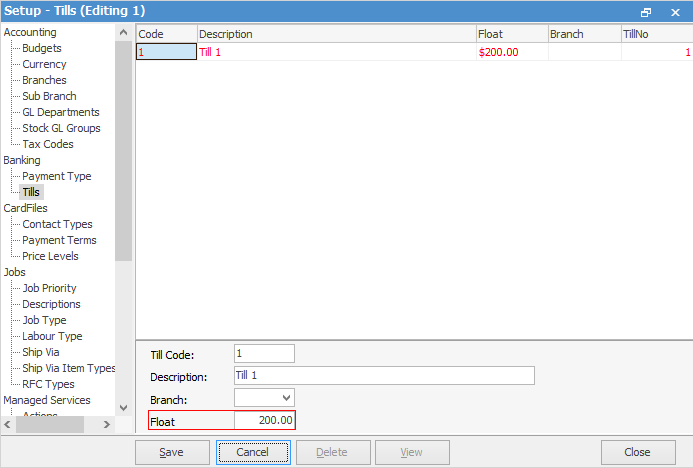

When a workstation is set to Retail mode and reports directly to a Till, it is preferred that a daily Till reconciliation is performed to ensure staff are accountable for till takings, and to correct any unders or overs prior to the banking session being performed. To make reconciliation easier, a till float can be nominated in the setup for each Till:

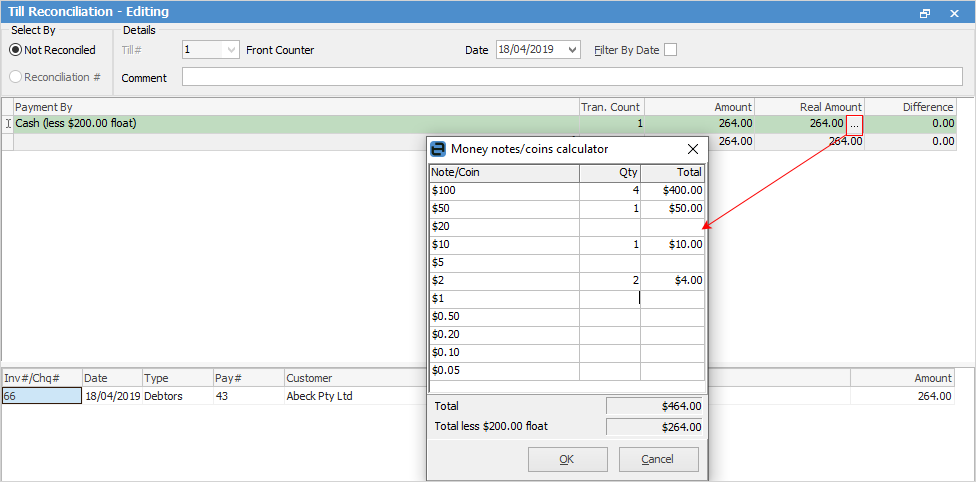

With the float accounted for as part of the Till cash total, staff need only count and record the exact denominations in the cash calculator, including the float. Automatic calculations of unders/overs will be made via the cash calculator. To activate the cash calculator, click the ellipsis [...] in the Real Amount column for Cash (less $xx float) of the Till Reconciliation screen.

In the example below, there has been one cash transaction recorded at this Till totalling $264. The staff member has activated the cash calculator and entered the quantity of each denomination of notes and coins, including those of the float.

If a refund from the Till uses part of the float because there is not enough cash in the Till, there will be a negative amount in Unbanked Funds. To correct this, move the amount from the 6-XXXX Rounding account to the bank account so it offsets the amount. Add a general journal, GST Type = Sale and add required date and comment, then debit the bank account and credit the rounding account using Tax Code X on both lines. Finish and Save.

This will clear the amount from the rounding account and provide a deposit to offset against the withdrawal in the bank reconcilaition.

Further information