Term |

Explanation |

|---|---|

13th Period |

In normal accounting practices there are 12 reporting periods in a financial year. Each of these periods is represented by a calendar month. The 13th period isn't an actual period of time – it is merely a place-holder period that contains year end adjustments so they don't affect a particular reporting period. |

Account |

A section in a ledger devoted to a single aspect of a business (eg. bank account, wages account, office expenses account). |

Amortisation |

The depreciation of an intangible asset (eg. loan, mortgage) over a fixed period of time. For example, if a loan of $12,000 is amortised over one year with no interest, the monthly repayments (amortisation) would be $1000 a month. |

Arrears |

Bills which should have been paid. For example, if the last three months' rent has not been paid, this means the rent is three months in arrears. |

Assets |

Assets represent what a business owns, or is due. Equipment, vehicles, buildings, debtors, money in the bank, cash are all examples of the assets of a business. Typical breakdown includes fixed assets and current assets. ▪Fixed refers to assets that cannot be easily liquidated, such as equipment, buildings, plant, vehicles, etc. ▪Current refers to cash, money in the bank, debtors, etc. |

At Cost |

The At Cost price usually refers to the price originally paid for something, as opposed to the price it is being sold for. |

Audit |

The process of checking every entry in a set of books to make sure they agree with the original paperwork, eg. checking journal entries against the original purchase and sales invoices. |

Audit Trail |

A list of transactions in the order they occurred. |

Bad Debts Account |

An account to record the value of unrecoverable customer debts. |

Balance Sheet |

A Balance Sheet is a snapshot of all the assets, liabilities and equity (ie. what a company owns and owes) at a single point in time. |

Burn Rate |

The rate at which a company spends its money. For example, if a company had cash reserves of $120m and it was currently spending $10m a month, at the current burn rate the company will run out of cash in one year. |

Capital |

An amount of money put into the business (often by way of a loan), as opposed to money earned by the business. |

Central Billing |

This is a procurement technique where independent companies purchase inventory from a wholesaler rather than individual suppliers, allowing them to leverage collective buying power. |

Cash Flow |

The flow of money in and out of the business over a period of time. |

Chart of Accounts |

A list of all the accounts held in the general ledger. |

Closing the Financial Year |

A term used to describe the journal entries necessary to close the sales and expense accounts of a business at year end by posting their balances to the Balance Sheet. |

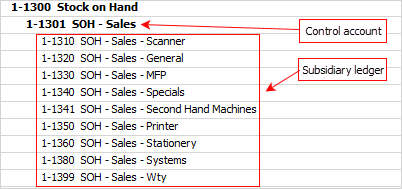

Control Account |

A general ledger header account containing the correct total amount without containing the details. The actual details are found in the subsidiary ledger. For example, the Stock On Hand control account would merely update with a few amounts, such as total collections for the day, etc. The details on each customer and transaction would not be recorded in this account. Rather, these details will be in the Stock On Hand subsidiary ledger.

|

Cost of Goods Sold (COGS) |

The COGS are the true cost of goods plus any other direct expenses incurred in preparing the goods for sale. |

Credit |

An accounting entry that either increases a liability or equity account, or decreases an asset or expense account. |

Creditors |

A list of suppliers (vendors) to whom the business owes money. |

Debit |

An accounting entry that either increases an asset or expense account, or decreases a liability or equity account. |

Debtors |

A list of customers who owe money to the business. |

Depreciation |

The value of assets usually decreases as time goes by. The amount or percentage that it decreases by is called depreciation. It is shown in both the Profit & Loss account and Balance Sheet of a business. |

Double entry book-keeping |

A system which accounts for every aspect of a transaction – where it came from and where it went to. This from and to aspect of a transaction is called crediting and debiting, which is what the term double entry means. |

Entry |

Part of a transaction recorded in a journal or posted to a ledger. |

Expenses |

Goods or services purchased directly for the running of the business, ie. stationery. This does not include goods bought for resale, or any goods of a capital nature. |

First In First Out (FIFO) |

A method of valuing stock, ie. the oldest inventory stock is recorded as sold first, however this does not necessarily mean that the exact oldest physical stock has been tracked and sold. In other words, the cost associated with the inventory that was purchased first is the cost expensed first. |

Fixed Assets |

These consist of anything that a business owns or buys for use within the business that still retains a value at year end. They usually consist of major items such as land, buildings, equipment and vehicles, however they can include smaller items such as tools. |

Fiscal Year |

The term used for a business accounting year (or financial) year. The period is usually twelve months, which can begin during any month of the calendar year. |

GL Accounts |

A set of accounts held in the general ledger. |

General Ledger |

A ledger within accounting software that holds all the general ledger accounts of a business. |

Fixtures & Fittings |

This is a class of fixed asset which includes office furniture, filing cabinets, display cases, warehouse shelving, etc. |

Income |

Money received by a business from its commercial activities. |

Intangible Assets |

Assets of a non-physical or financial nature, ie. a loan or an endowment policy. |

Inventory |

A subsidiary ledger which is usually used to record the details of individual stock. Inventories can also be used to hold the details of other assets of a business. |

Invoice |

A term describing an original document, either issued by a business for the sale of goods on credit (a sales invoice) or received by the business for goods bought (a purchase invoice). |

Journal(s) |

The place where transactions are first entered. |

Journal Entries |

A term used to describe the transactions recorded in a journal. |

Ledger |

The place where entries posted from the journals are reorganised into accounts. |

Margin |

Margin is sale price minus the cost of goods sold. For example, if a product sells for $100 and costs $70 to manufacture, its margin is $30. Or, stated as a percentage, the margin percentage is 30% (calculated as the margin divided by sales). |

Markup |

Markup is the amount by which the cost of a product is increased in order to derive the selling price. For example, a markup of $30 from $70 yields a selling price of $100. Or, stated as a percentage, the markup percentage is 42.9% (calculated as the markup amount divided by the product cost). |

Moving Average Total (MAT) |

The total value of a variable, such as sales figures for a product, over the course of the previous 12 months. This is a rolling yearly sum, so it will change at the end of each month with data from the new month added to the total, and data from the first month of the period taken away. |

Petty Cash |

A small amount of cash held in reserve – normally used to purchase items of small value where a cheque or other form of payment is not suitable, eg. coffee for the office, etc. |

Point of Sale (POS) |

The place where a sale of goods takes place, eg. a shop counter with a till. |

Posting |

|

Profit Margin |

The percentage difference between the cost of a product and the price it is sold for. For example, if a product costs $10 to buy and is sold for $20, then there is a 100% profit margin. |

Reconciling |

The procedure of checking entries made in a company's books with those on a statement sent by a third person (eg. checking a bank statement against the company's records). |

RAI-US / RAI-NR |

Return as is means the stock being returned is not repairable, or cannot reasonably be repaired. The differentiation here is between service that is stopped for whatever reason, not repairable (RAI-NR), or not completed because the product is unserviceable (RAI-US). |

RFC |

Return from customer is the process of a customer returning previously purchased stock from the business and receiving a refund or exchange. |

RTV |

Return to vendor is the process of the company returning purchased stock from the vendor and receiving a refund or exchange. |

Stock |

Goods manufactured or bought for resale by a business. |

Stock Taking (Stocktake) |

Stocktaking or inventory checking is the physical verification of the quantities and condition of stock held in an inventory or warehouse. This may be performed to provide an audit of existing stock. It is also the source of stock discrepancy information. |

Tangible Assets |

Assets of a physical nature. Examples include buildings, motor vehicles, plant and equipment, fixtures and fittings. |

Withholding Tax |

There are two forms of withholding tax: 1.If you pay interest, dividends, royalties or managed investment trust income to foreign residents, you may have to withhold tax. 2.An organisation supplying goods or services to the company should quote its ABN. Most quote their ABN on their invoice, and this invoice must be kept as part of the business records. They can also quote their ABN on another document, as long as it relates to the supply they are making. If they don't quote their ABN, an amount must be withheld from the payment made to them and this amount is to be paid to the ATO. Check the ATO website for information on how much. Do not withhold if any of the following applies: ▪The total payment to the supplier is $75 or less, excluding any GST. ▪The supplier is an individual under 18 years old, is not an employee, and the payments made to that person do not exceed $350 per week. ▪The supply is wholly input taxed under GST. ▪The supply is made in the supplier’s private capacity or as their hobby. ▪The payment is exempt income for the supplier – for example, the supplier is an endorsed charity. ▪The payment is to a non-resident who is not carrying on an enterprise in Australia or through an agent in Australia. ▪The supplier is not an enterprise because they have no reasonable expectation of profit or gain.

If withholding tax is to be paid, a PAYG payment summary – withholding where ABN not quoted must be filled in to send to the Australian Taxation Office. See https://www.ato.gov.au/Business/PAYG-withholding/Payments-you-need-to-withhold-from/Withholding-from-suppliers/Withholding-if-ABN-not-provided/ for further information. |

Further information