The Pricing tab is where all prices for this particular stock code are set or displayed.

The stock pricing grid allows setting the selling price of stock for each price level and/or particular customer. This information will be taken across to the job stock grid as stock is added to jobs.

On the Pricing tab you will see in the far right a field called Prices for. Here you can select the different unit measures and the prices in the grid will change to show pricing for each unit measure when multiple unit measures are in use.

As well as this, the stock pricing grid will carry over nominated price breaks if required, so that larger quantities of stock sold to specific price levels (or particular customers that are nominated) will attract calculated price breaks.

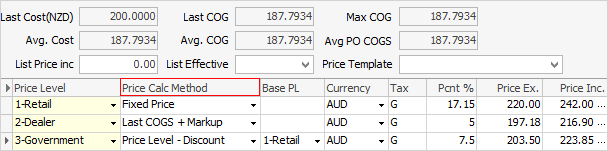

The default price calculation methods have probably already been set up in the Stock Pricing options. View and/or change the price calculation method from within this grid.

Price calculation method refers to the method of calculating the selling price for a stock code for a particular price level. There are numerous price calculation methods that Jim2 can use. If applicable, GST is added after the price calculation has been completed.

|

The price calculation method of List-Percent cannot be used when the price is greater than the list price and Pcnt % equals 0. To use List-Percent, either enter a – in the Pcnt % field (ie. -10), which will increase the list price by the percentage entered here. |

You can add any price in the Price Ex column and the Pcnt % will be based on the Price Calc Method. This is by design to show the % you are selling at compared to the buy price, to make sure you aren't selling for less than you have purchased.

Example

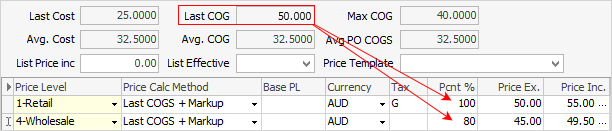

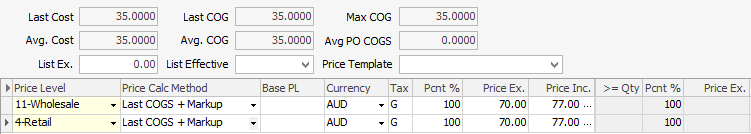

Stock code ABC has 2 price levels. These are Retail and Wholesale. The method of price calculation for this stock code for the Retail price level is Last COGS (what it cost to buy the stock) + Markup (the percentage to add to the cost). In this example, the last COGS is $50 and the Markup is 100%. The Retail price level selling price would be $100 ($50 + ($50*100%)), plus GST.

In this example the Wholesale price level will calculate at Last COGS + Markup, where the markup is 80%. As such, the selling price is $90 ($50 + ($50*80%)), plus GST.

See Stock Pricing for further information.

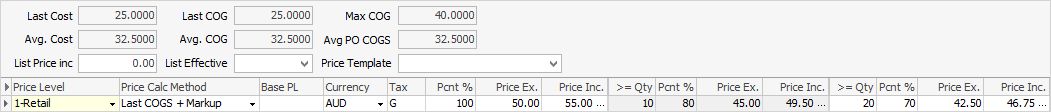

If customers are rewarded with better prices if they buy more of the stock, volume price breaks allow Jim2 to recalculate a selling price based on the quantity to be sold.

Example Stock code ABC, has a Retail price level, calculated as Last COGS + 100% Markup, for selling 1 to 9 units. If the customer would like to buy 10 units, the selling price can recalculate to Last COGS + 80% Markup. This same price would be calculated for 10-19 units, then 20 units or more can force Jim2 to recalculate to Last COGS + 70% Markup. This recalculated price would then apply to all units of ABC sold in that job.

|

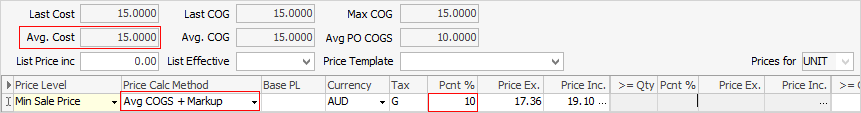

Minimum sale price level allows using any of the Jim2 pricing calculation methods to set the minimum sale price, instead of just a nominated price. For example, set it to Average Cost + 10%, thereby ensuring that nobody sells for less than cost plus 10%.

If extra columns are not hidden in the pricing grid in the Stock Pricing setup screen the Price Calc. Method field will be shown, otherwise click the solid arrow symbol

Using the Fixed Price method, the prices will not be updated by any purchase prices. Using either Last Cost or Avg Cost to calculate the price, these will be constantly updated in relation to any purchase orders for that stock. Using the Price Level – Discount, there is an ellipsis [...] within the Base PL field. This is used for recalculating the list price pricing levels if the list price value is changed.

|

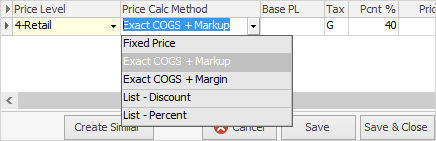

The available price calculation methods are detailed below. Click  to reveal the drop down list.

to reveal the drop down list.

|

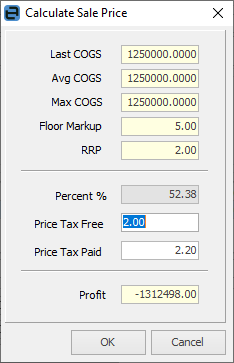

Note: If there is no stock on hand, both Max and Avg COGS will not work. Jim2 will use Last COGS instead. |

Area |

Field |

Explanation |

|||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Price Options (top grey area) |

Last Cost |

This is the last cost price recorded on a finished PO for this stock code. Last cost looks at 3 things: Vendor tab last updated (this needs to be manually updated), Received PO and any stock adjustments and takes the latest date from these 3 and updates Last Cost. |

|||||||||||||||||||||||||||||||||||

Last COG |

This is the last cost price and on-cost/landed cost recorded on a finished purchase order and expense order for this stock. |

||||||||||||||||||||||||||||||||||||

Max COG |

This is the maximum cost price paid for remaining quantities (stock on hand) of this stock code, including on-costs/landed costs. |

||||||||||||||||||||||||||||||||||||

Avg. Cost |

This is the average cost price of remaining quantities (stock on hand). |

||||||||||||||||||||||||||||||||||||

Avg. COG |

This is the average cost price of remaining quantities (stock on hand) of this stock code, including on-costs/landed costs. If there is no quantity on hand, it will pick up the estimated cost from the Vendor tab. |

||||||||||||||||||||||||||||||||||||

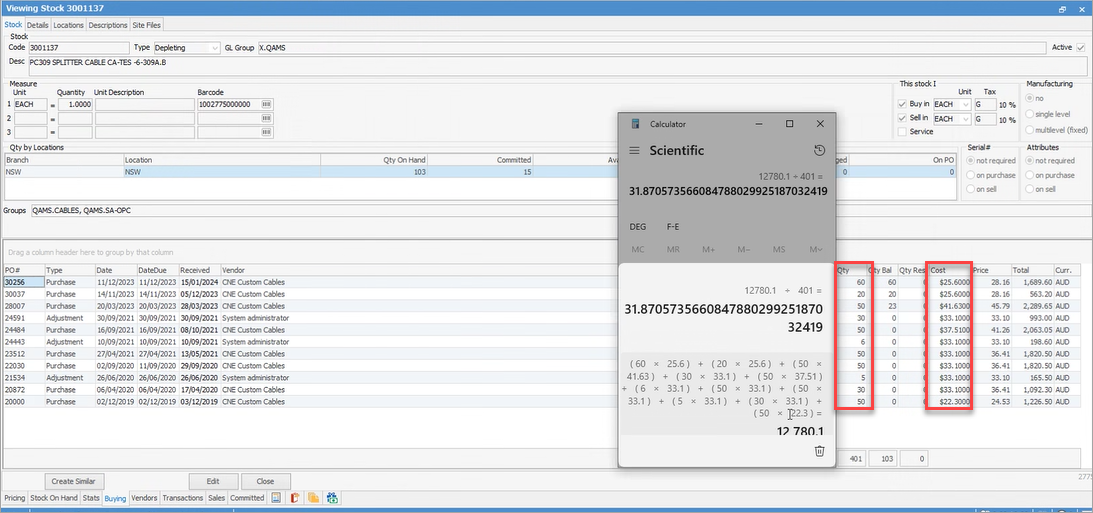

Avg PO COGS |

This is strictly the average cost price paid for this stock, including on-costs/landed costs. Jim2 will recalculate this figure each time a purchase order is finished. Vendor price feeds will not affect this pricing.

The Avg PO COGS field will show the average for all purchase orders.

How it relates to the Buying Tab This is calculated by multiplying each (Qty x Cost) for each Purchase Order, totalling the amount, then dividing it by the total Qty.

|

||||||||||||||||||||||||||||||||||||

List Ex. (or Inc.) |

This is a field which can be used to enter a recommended selling price, including or excluding GST. The GST option is dictated by the preferred Calc Tax Total From field in Tools > Options > Stock Pricing. |

||||||||||||||||||||||||||||||||||||

This field has no actual function. However, when stock is imported and there is a change to the List price ex, the date will populate/change to reflect the date it changed. |

|||||||||||||||||||||||||||||||||||||

Price Template |

Here, choose from a predefined list of price levels and calculation methods for this stock group. For example, set up a price template for stock which is grouped as paper products, and another one for toner, etc. Price templates can be set up in Tools > Setups > Stock > Price Templates. |

||||||||||||||||||||||||||||||||||||

Prices for |

This displays the unit measure that the pricing fields are based on, ie. the prices are applicable to selling this stock as a UNIT, BOX, DOZ, etc. |

||||||||||||||||||||||||||||||||||||

Pricing Grid |

Price Level |

Sets a price level for this price level line, eg. Wholesale, Dealer, Retail, etc.

|

|||||||||||||||||||||||||||||||||||

Price Calc Method |

The method of setting the prices for this price level, eg. Fixed, Discount, Avg. COGS + Margin, etc.

* Avg COGS is the original price method based on an average cost price of what is in stock, ie. 2 in stock at $100, plus 2 in stock at $80 – Jim2 will work out the average cost to be $90. Avg COGS is affected if you have stock feeds enabled. This means you might buy 3 of a part for $100 each, so the Avg COGS is $100. Then you get a new price feed from a supplier and their price is $150 per unit. The Avg COGS price is adjusted to that new price. |

||||||||||||||||||||||||||||||||||||

Base PL |

Choose to use a different price level to base a discount amount on, for instance. |

||||||||||||||||||||||||||||||||||||

Tax |

The tax rate, eg. G (for GST). This is determine by the tax code entered in the stock header. |

||||||||||||||||||||||||||||||||||||

Pcnt % |

Est Cost + Markup

|

||||||||||||||||||||||||||||||||||||

Price Ex. |

Est Cost + Margin |

||||||||||||||||||||||||||||||||||||

Price Inc. |

Avg PO COGS + Markup |

||||||||||||||||||||||||||||||||||||

Discount Prices in the Grid. Only one group is explained here, but a total of four can be set up, with different discount levels (%) |

>=Qty |

Avg PO COGS + Margin |

|||||||||||||||||||||||||||||||||||

Pcnt % |

Price Level – Discount |

||||||||||||||||||||||||||||||||||||

Price Ex. |

Price Level – Percent |

||||||||||||||||||||||||||||||||||||

Price Inc. |

The price including tax for this discounted quantity of stock. |

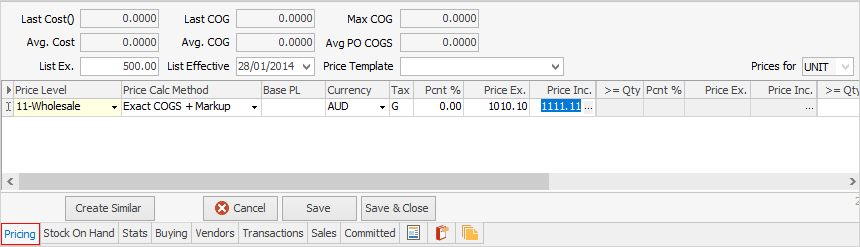

Special Stock covers stock where costs from the supplier will fluctuate. Special stock is also uniquely purchased for a specific job. The cost of goods will be taken across to the job when the stock is added, hence it uses the Exact COGS rather than the Last COGS.

For Special stock, also use Exact Cost + as per below. Once the special stock is selected on a job, the price will be the exact cost of the stock plus the percentage as set up here.

|

Within the price grid, some fields are not editable and are shown in a light grey colour. These are calculated fields and are dependent on other field values to calculate their values.

|

In the Stock tab of the Options screen the default calculate tax on Actual Selling Price would have been chosen. This selection will affect how prices are calculated.

Add each price level code to the grid, and the Cust# of anyone to provide special pricing to.

|

If a Cust# is nominated in the price level grid, each job for that customer with that stock will attract the special price and price breaks automatically. To signal that special prices apply, the job stock grid line on jobs for that customer will be coloured green.

|

The pricing entered is based upon the base unit measure. By default, when viewing the Transactions tab in a stock record, it will show the pricing based on the Sell unit. Use the drop down list at the top of the pricing grid to switch between the different unit measures (if applicable), to view the selling price of those.

|

Within this grid right click to Show Customer Price Rows and Show Stock Cost. The Show Customer Price Rows relates to custom pricing for certain card codes, and whether it is to be displayed in view mode or not. The Show Stock Cost relates to the cost fields above the pricing grid. |

Within the stock grid objects in Jim2 there is a solid arrowhead  in the top left corner. Clicking this arrow will expand/collapse columns within the stock grid.

in the top left corner. Clicking this arrow will expand/collapse columns within the stock grid.

Not all columns are showing in this image

To enter prices, click the ellipsis [...] within the Price Inc. field (or Price Ex., depending on how stock pricing has been set up), to access the Calculate Sale Price screen. This can only be performed in Edit mode.

Expanded pricing grid fields explained

Field |

Purpose |

|---|---|

Price Level |

Select the price level code: Retail, Wholesale, etc. Select the required code, or enter the price level number. |

Price Calc Method |

The method used for price calculation. Make a choice from the drop down list. |

Base PL |

Choose to use a different price level to base a discount amount on, for instance. |

Tax |

The tax type, eg. G for GST. |

Pcnt % |

Percentage of markup. |

Price Ex. |

Add the tax free selling price of each unit measure. |

Price Inc. |

Calculated tax paid selling price of each unit measure. |

>= Qty |

Add the quantity of the first price break (eg. 10 or greater). |

Pcnt % |

Percentage of markup. |

Price Ex. |

Add the tax free selling price of each unit in the first price break. |

Price inc. |

Calculated tax paid selling price of each unit in the first price break. |

>= Qty |

Add the quantity of the second price break (eg. 20 or greater). |

Pcnt % |

Percentage of Markup. |

Price Ex. |

Add the Tax Free selling price of each unit in the second price break. |

Price Inc. |

Calculated Tax Paid selling price of each unit in the second price break. |

>= Qty |

Add the quantity of the third price break (eg. 30 or greater). |

Pcnt % |

Percentage of markup. |

Price Ex. |

Add the tax free selling price of each unit in the third price break. |

Price inc. |

Calculated tax paid selling price of each unit in the third price break. |

>= Qty |

Add the quantity of the fourth price break (eg. 40 or greater). |

Pcnt % |

Percentage of markup. |

Price Ex. |

Add the tax free selling price of each unit in the fourth price break. |

Price inc. |

Calculated tax paid selling price of each unit in the fourth price break. |

|

Jim2 pre-calculates and stores all pricing in real time, as pricing changes. This allows immediate and easy updating of websites, price lists and bulk price updates, to name just a few. |

Price Background Colours

White |

Price level pricing. |

Pink |

Contract price level pricing. |

Green |

Customer specific pricing. |

Yellow |

Manually entered pricing. |

Further information