Multi-level manufacturing is available via the use of fixed costs within the manufacture process.

The fixed cost on a manufacturing job can be edited any time until you click the Manufacture button on the job. This figure is derived from: 1.A user has entered an amount in that field. 2.The Manufacture Cost field in the Details tab of the manufactured stock code. 3.Information stored within the Manufacturing Item.

Whatever the value is at the time of clicking the Manufacture icon is the value that Jim2 will use to value each unit of the manufactured stock. |

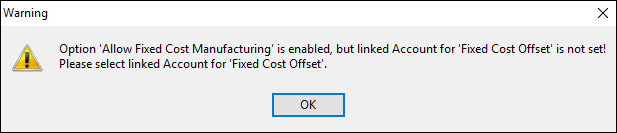

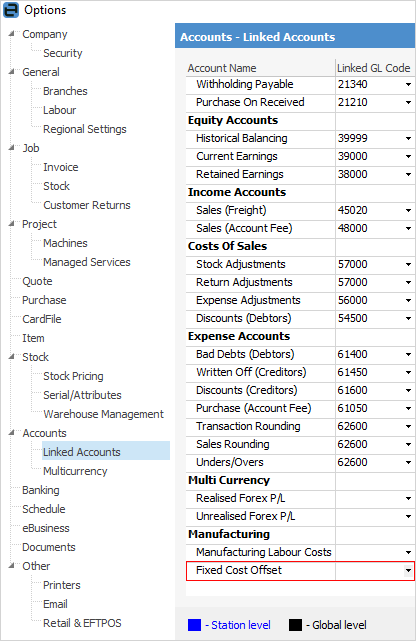

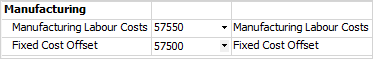

For fixed cost manufacturing, a linked general ledger account is required. On the ribbon, go to Tools > Options > Accounts > Linked Accounts.

It is highly recommended that this account be in the Cost of Goods area, as should a linked Manufacturing Labour Costs account. Using an account in the Cost of Goods area ensures that any offsets are accounted for within the current Profit and Loss period. If manufacturing over more than one accounting period, it is suggested that an Inventory general ledger account should be used (asset), but needs to be regularly reviewed and journalled out.

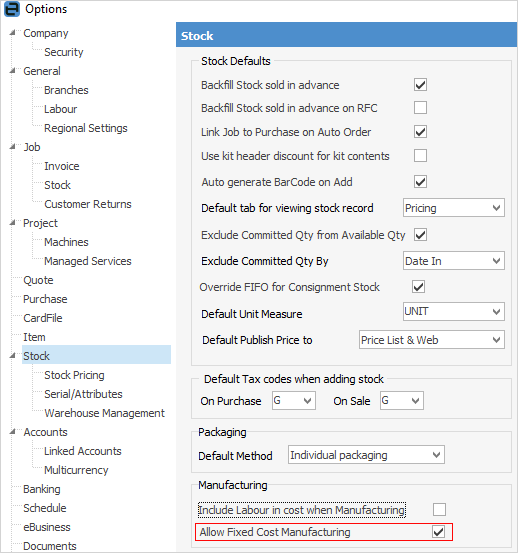

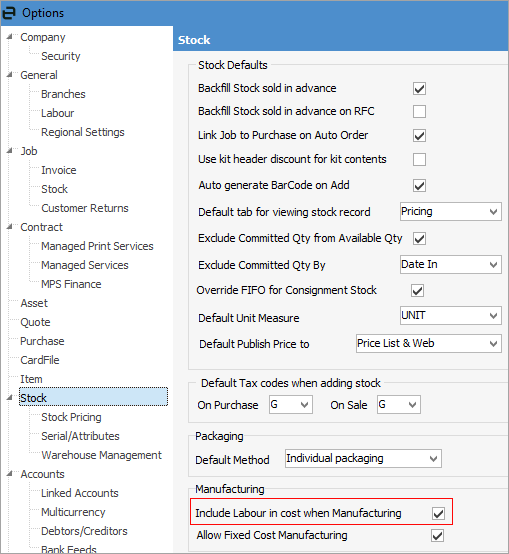

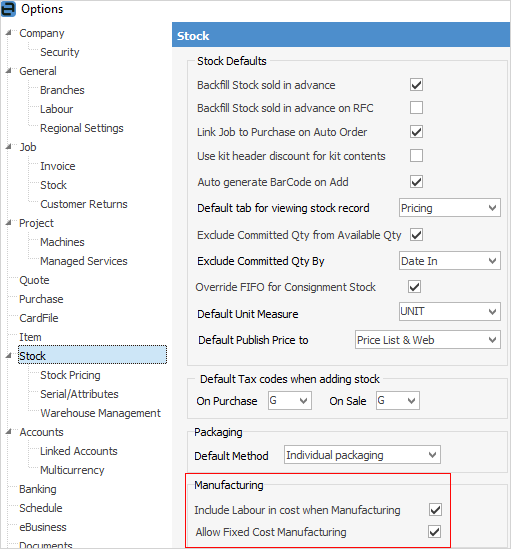

Next, on the ribbon, go to Tools > Options > Stock to enable Include Labour in cost when Manufacturing:

|

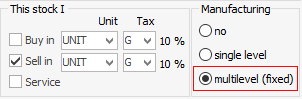

To enable multilevel manufacturing, add or edit an existing stock and tick multilevel (fixed).

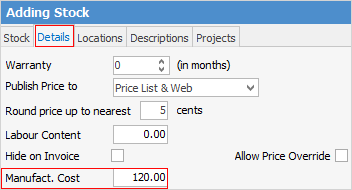

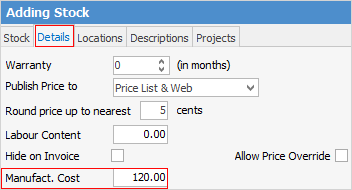

A default manufacturing cost can be set in the Details tab of the Stock screen if desired, which will be the default cost used on a Manufacturing job when manufacturing this stock.

The remainder of the setup is as for normal manufacturing, eg. a linked Manufacturing Item will be created where the specific stock codes are added that will be used in the manufacture process. This is where the Bill of Materials is located. |

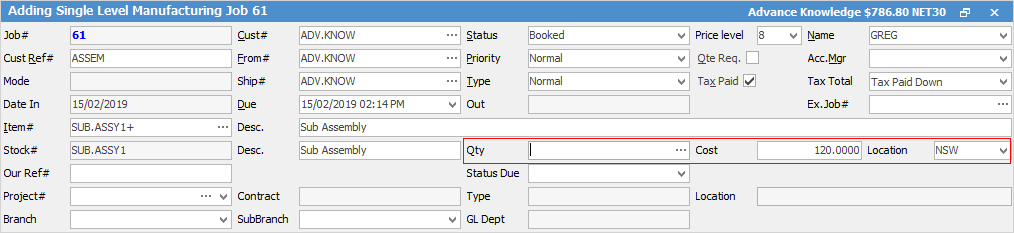

Once stock is set up for multilevel manufacturing, add a job and select the related Manufacturing Item. If the stock code is, for instance, SUB.ASSY1, the linked Manufacturing Item would be SUB.ASSY1+.

The only difference from a standard (single level) manufacturing job is an additional Cost field.

It will be populated with the default cost specified in the manufacturing stock code (Details tab), and it will show the default cost of 1 unit. The cost can be changed at any time up until the point of selecting the Manufacture icon.

Regardless of how many products are being manufactured, the cost figure is the cost to manufacture one unit.

The totals displayed on the Cost tab of the Manufacturing job have been updated to display the total fixed cost, the estimated actual cost, and the difference. It is expected this difference to be posted to the linked Fixed Cost Offset GL Account when selecting the Manufacture icon. |

When completing a Manufacturing job by moving to Finish status and selecting the Manufacture icon on the ribbon, the Fixed Cost Offset account will be used for the difference between the fixed cost set on the job and the actual cost of the stock codes used. For example, if all stock codes used in manufacturing are from purchase orders on Received, the full cost will be offset.

When these purchase orders are set to Finish, Jim2 will reduce the offset account by the cost of the stock, as example 2 below.

An important difference, compared to single level manufacturing is, once the fixed cost stock is manufactured, its cost will not be affected by expense orders, thus enabling the stock codes to be used as parts in another manufacturing job.

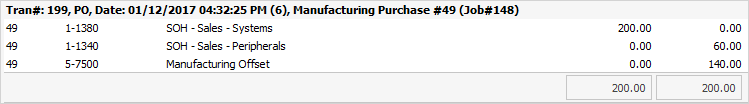

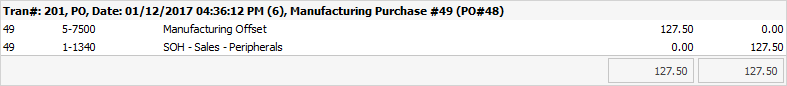

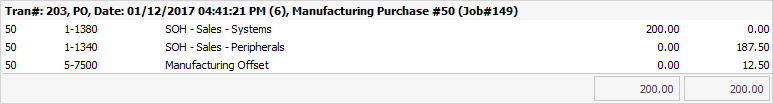

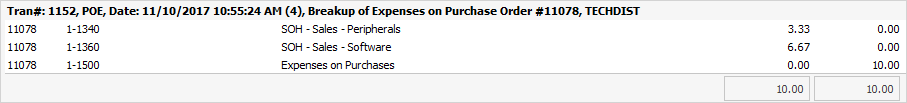

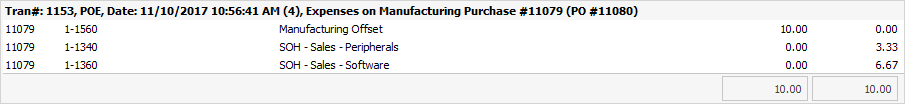

Examples of transaction journals 1.Stock was manufactured, and some of the purchase orders for the stock codes used in the manufacturing job are on Received status. In this case, the stock on hand account for Systems goes up by the cost determined by the manufacturing job (which creates a manufacturing purchase order). The amount of $200 was set as the fixed cost on the manufacturing job, with $60 of the stock on Finished purchase orders, and $140 of the stock on Received purchase orders.  2.When the Received purchase order is moved to Finish status, any difference in cost will remain in offset, so the difference between fixed and actual cost in this example is $140 – $127.50, leaving $12.50 as a credit in the offset account, reflecting the lower actual cost:  3.In the manufacturing purchase order below, all of the stock codes used in the manufacturing job were on purchase orders on Finish status. Using the same stock as in the previous example, see the flow.  4.In this example, an expense order (eg. linked freight expense) was applied to the stock codes used in manufacturing:  and again, the manufacturing account was debited by the linked expense amount:  |

Both single and multilevel manufacturing optionally allow the cost of labour to be included as part the total cost within the manufacturing process.

To allow labour to be considered as a cost of manufacture, in Tools > Options > Stock, Include Labour in cost when Manufacturing must be ticked and the Linked offset account set up (see above).

On the Details tab of the stock code, the cost of Labour is included in Manufact. Cost, along with the cost of any stock.

Any labour stock code that will be included in the manufacture will also need to have a Manufact. Cost, which represents the cost of providing one unit (normally an hour) of labour. This can be overridden on the job itself.

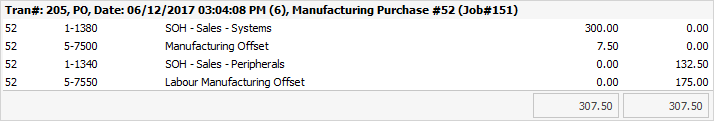

In the example below, a Labour stock code (with a Manufact. Cost of $175.00) has been included in the manufacturing job. The value of the Manufactured stock code increases by the value set on Manufact Job, and the Labour Offset accounts and Inventory accounts are credited.

Here is the journal flow:

The Labour offset will reduce the overall P&L expense for actual labour cost, as this portion of wage expense is being transferred to inventory value. |

Further information

Add Stock to a Manufacturing Item

Add Single Level Manufacturing Stock

Auto Create Manufacturing Jobs and POs