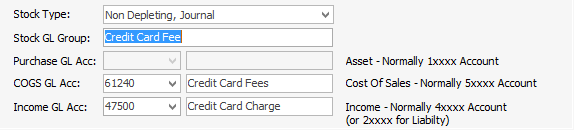

Add a Stock GL Group

Go to Tools > Setups > Accounting > Stock GL Groups and click Add.

▪Type – Non Depleting, Journal.

▪Name – Credit Card Fee.

▪GL Account – it could be:

–Income eg 4-7500 Credit Card Charge

–COGS eg 5-5100 Vendor Credit Charges or

–Expense eg 6-1240 Credit Card Fees.

|

It's wise to check with your accountant, as you may need to add a new GL account. |

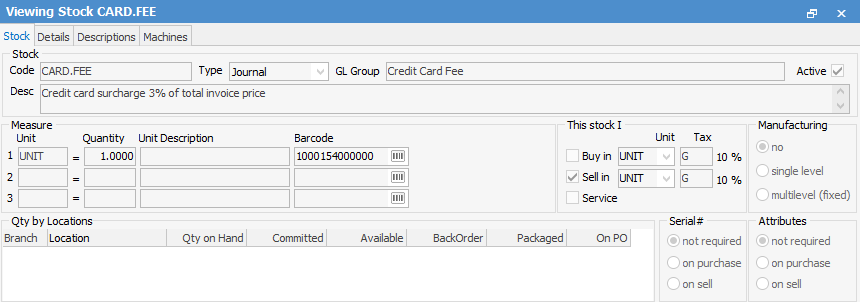

Add a Stock Record

▪Code – CARD.FEE

▪Type – Journal

▪GL Group – Credit Card Fee

▪Enter Description of your choice

▪Tick This Stock I Sell in and Tax – G

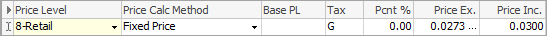

▪On the Pricing Tab:

–Add a price level

–Select Price Calc Method – Fixed Price

–Price Inc = 0.0300

|

This setup is for 3% of the total invoice price including GST. You will need to calculate the value for other % rates. There is a slight rounding issue that may become apparent on large invoices – there is no way around this except to override the Price Ex or Price Inc as appropriate. |

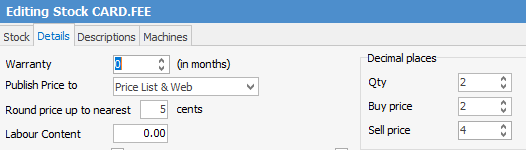

▪On the Details tab, change the decimal places to:

–Qty = 2

–Sell price = 4

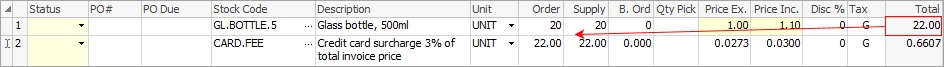

Add a Job and Complete the Sale

▪Check the Total sale value

▪Add the Stock CARD.FEE then change the Order Qty to equal the original job Total

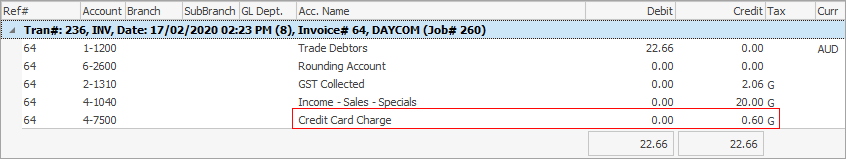

▪In this example, the total sale before adding the CARD.FEE was $22.00, therefore 66 cents ex GST is added to the total after adding an order quantity of 22 in the Order and Supply fields of the card fee stock line.

▪Invoice the job.

▪You can see that 60 cents net ex GST has gone to the appropriate card fee account and 6 cents has been added to the GST Collected account.

Further information: