When changing to Jim2 there may be some unpresented cheques and outstanding deposits that need to be reconciled at a later date.

To enter these into Jim2, follow these steps:

Bank Balance as per bank statement (excluding unpresented amounts) |

Bank balance as at 18/4/19 |

$12,000.00 |

Unpresented cheques |

Dated 1/4/19 |

$6,000.00 |

Dated 7/4/19 |

$1,000.00 |

|

Outstanding deposit |

Dated 29/3/19 |

$3,000.00 |

Previous system account balance |

Figure obtained after final bank reconciliation in previous system |

$8,000.00 |

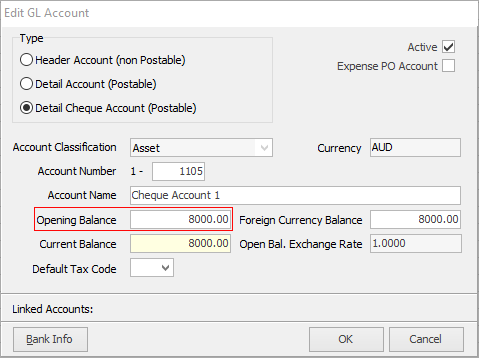

1.Enter opening balance in cheque account ($8,000).

2.Using the the company card code, add two cheques (1 x $6000 and 1 x $1000) from and to the same cheque account, using tax code X, and set status to Finish. This will create two transactions which have equal debits and credits for the same cheque account, and therefore will not change the balance.

3.Using the company card code, add one deposit (1 x $3000) from and to the the same cheque account, using tax code X, and set status to Finish. This will create a transaction which will have equal debits and credits for this same cheque account, and therefore will not change the balance.

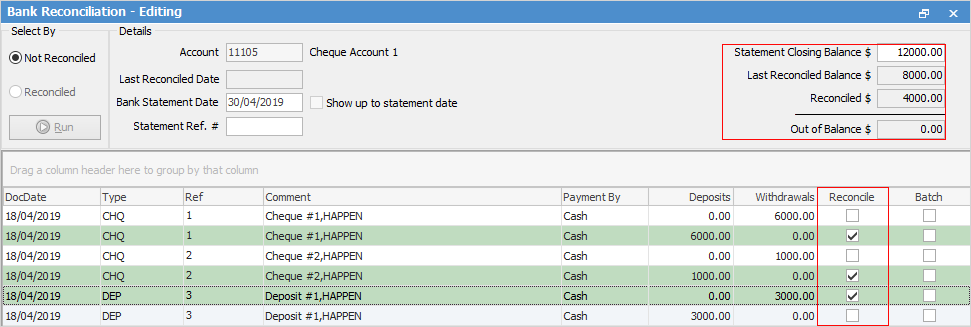

4.Open Bank Reconciliation:

▪select the cheque account

▪enter the bank statement date at the first day of the conversion month

▪enter the statement closing balance as at the last bank statement – 30 April balance ($12000.00)

▪tick Reconcile for the deposit side of each unpresented cheque

▪tick Reconcile for the withdrawal side of each outstanding deposit only. The bank reconciliation will now show:

–statement closing balance = $12000.00

–last reconciled balance = $8,000.00 (the amount entered as an opening balance)

–reconciled = $4000.00 (the entries that have just been ticked)

–out of balance = $0.00

5.Click Reconcile.

How to

Locate a Previous Bank Reconciliation

Make Entries Through Bank Reconciliation