Transferring Funds from One Currency to Another

This will occur in the normal course of Jim2 transactions as shown below:

▪Cheque/deposit from a home currency bank account to a foreign currency bank account.

▪Cheque/deposit from a foreign currency bank account to a home currency bank account.

▪Pay a foreign currency creditor from a home currency bank account.

▪Refund a foreign currency creditor to a home currency bank account.

▪Creditors/debtors adjustment down to home currency, then creditors/debtors adjustment up to foreign currency.

▪Creditors/debtors adjustment up to home currency, then creditors/debtors adjustment down to foreign currency.

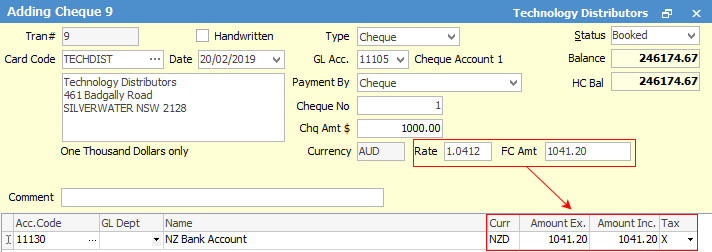

When entering a foreign currency bank account transaction (cheque or deposit) against a home currency bank account (or vice versa), Jim2 will calculate the equivalent in value in the home currency, based on the current default exchange rate.

|

Funds cannot be transferred from one foreign currency account directly to another foreign currency account because the transaction must go via the home currency account in order to calculate the profit/loss on foreign exchange. The transaction order must be from foreign account to home account, then to another foreign account. |

|

The calculated home currency amount can be changed if needed. Jim2 will recalculate the exchange rate (based on the entry and the current exchange rate). The default spot rate can be overridden by entering a different rate. Jim2 will recalculate the home currency amount to match that rate. |

This example shows a physical cheque for AUD1,000.00 written from the main operating account being deposited in the NZD account at a conversion rate of 1.765 (USD1765.00)

|

Some letters in the field names within the header are underlined, eg. Status. Using Alt+ the underlined letter will jump to the field beside that heading. |

|

If the business regularly transfers funds from one foreign currency account to another, it would be helpful to set up another home currency account that acts exclusively as the transfer account. Call this account Foreign Exchange Transfer or something similar. This account is not associated with any physical bank account – it is a transfer account so that transfers from one foreign currency to another can be facilitated away from the normal operating accounts. |

Further information