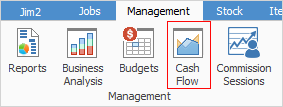

Cash Flow Analysis is accessed from the Cash Flow icon in the Management tab on the ribbon, or from the Nav Tree under Management (right click and select Cash Flow).

It allows you to forecast your cash requirements up to 180 days in advance, allowing you to prepare and plan your cash requirements.

Cash Flow Analysis takes into account the following sources:

▪Cash in the bank as of today.

▪Outstanding debtors invoices dated as they are due.

▪Outstanding creditors invoices (purchases) dated as they are due.

▪Manually added one-off deposits and withdrawals.

▪Manually added recurring deposits and withdrawals.

▪Recurring deposits/withdrawals based on previous transactions for a given GL account.

Examples of other cash flow inputs include wages, rent, phone, lease payments, etc. In other words, anything that will have a major impact on your cash requirements.

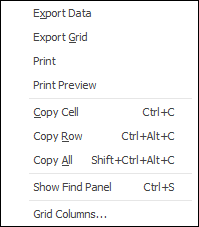

If your security allows it, you can right click within the list grid, select Export Data and save the list information as an XLSX file.

As you can see from the above image, you have a number of other useful right-click options, all self explanatory.

Further information: