If an asset is accidentally added (ie. a company vehicle) as depleting stock, the following will allows moving it to an asset.

▪First, move the stock on hand by doing a stock adjustment down.

▪View the stock adjustment general ledger account to obtain the value.

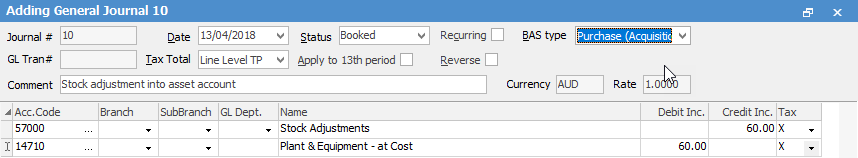

▪Journal this value out of COGS and into the asset account by:

–Crediting from the COGS stock adjustment.

–Debiting the Asset account.

Ensure:

▪the date is correct

▪the tax code is X

▪the BAS type is Purchase,

and record the reason in the Comment field.