When a customer wants to use their own stock, there are a number of scenarios to consider.

▪In a larger company, where there is a person who specifically orders stock (not expenses), to order stock, they should raise a normal stock purchase order, then sell it on a job to themselves.

▪For a smaller organisation that controls all aspects of purchasing, an expense order can be used.

▪There may also be the situation where the stock is to be display stock, and eventually may be sold.

There are a few different methods to move the inventory into expenses if an expense order isn't used:

Method #1

A running sales job can be created where staff can add stock that is used in-house. This job will then be invoiced and the invoice total moved to the Expense ledger:

▪Add the stock to a job where Cust# is the company cardfile.

▪Adjust the sell price to equal the current COGS for the stock in question.

▪Change the default tax code on sell from G to X (exclude from overall sales reported in BAS).

▪Invoice.

Now the company becomes a debtor to itself. To move the stock COGS to the Expense ledger:

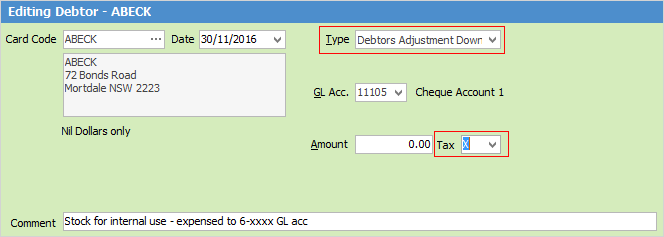

▪Open the company debtor record.

▪Record a debtors adjustment down against the appropriate expense code (typically 6-XXXX).

▪Make sure the tax code on adjustment is also X.

▪Save.

The adjustment down will create a credit that should now be applied to the original invoice. To apply the credit:

▪Edit the debtor record again.

▪Select Payment By: Credit.

▪Choose the credit just created.

▪Apply the amount in the Paid Now column of that credit to clear the invoice.

▪Save and close.

Method #2

Similar to the above option, however this method will expense the total COGS to a nominated expense account via an entry on the original invoice using journal stock.

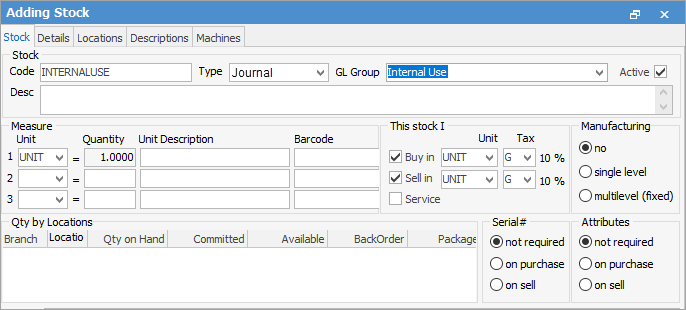

▪Set up a new Stock GL Group called INTERNALUSE and select the accounts the COGS are to be moved to when expensing this stock. Stock Type will be Journal.

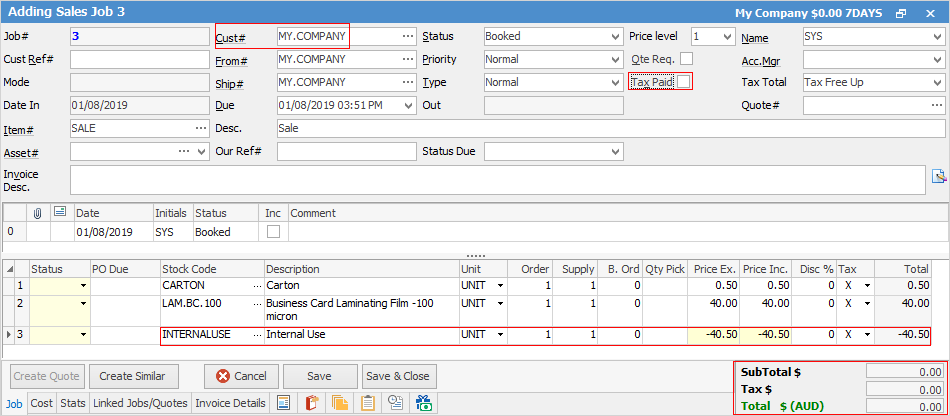

Create a running sales job, and add the stock that has been used in-house:

▪Adjust the sell price to equal the current COGS for the stock in question.

▪Change default tax code on sell from G to X (exclude from overall sales reported in BAS).

▪Add a journal stock entry with a negative value that equals the total invoice. This will move the total COGS to the relevant expense account.

▪Invoice.

Method #3

Use the Stock Adjust Down function to remove the stock from the current stock on hand count, then use a general journal to move the total to Expenses.

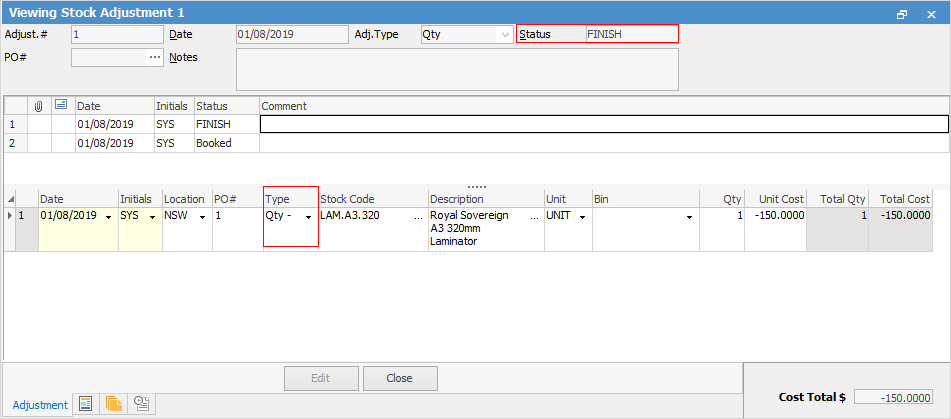

▪Add a stock adjustment.

▪Select QTY – and the correct stock code to reflect which product(s) used.

▪Change to Finish.

This stock adjustment down (debit) will move the stock COGS into the 5-XXXX Stock Adjustment account in the general ledger. It then needs to be journalled to the correct expense account(s):

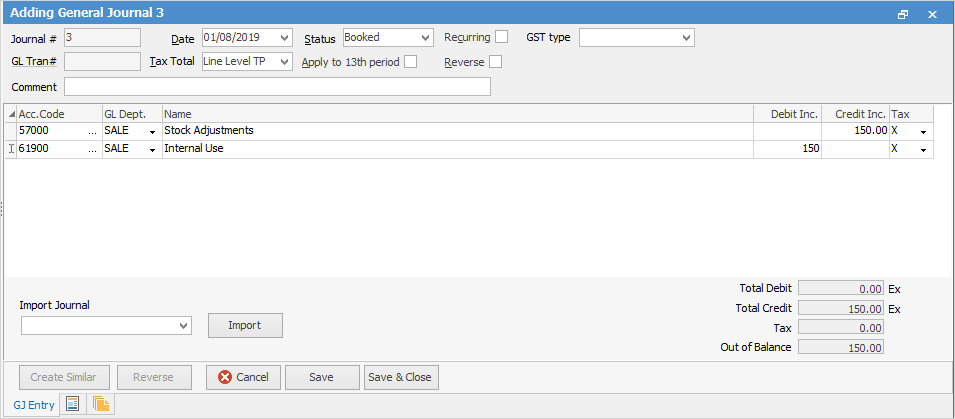

▪Add a general journal.

▪Select the 5-XXXX Stock Adjustment account.

▪Enter the total in the Credit column (credit back the stock adjustment account), tax code X.

▪Select the 6-XXXX Expense account.

▪Enter the $total in the Debit column (debit the expense account instead), tax code X.

▪Finish and Save.

|

Separate the expenses by apportioning the total across multiple (debit) entries if desired. |

The above options will report differently in Jim2, and should be checked with the company's accountant for the preferred option.