This setup ensures that the required information flows through to the standard Job List – Job Profit Report. To demonstrate this process, following is an example of a Managed Service device based billing contract.

Device Based Billing Stock Codes

These codes are used for billing stock defaults on the contract Default Stock tab.

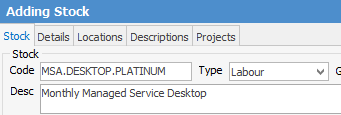

Create a new Device Billing Code set with:

Type – Labour

GL Group – Managed Service Labour, Labour, or something similar.

|

Whilst this could be set up as a non depleting code, it will not provide the ability to estimate the labour content unless Labour type is chosen. Not being able to include the labour content on the report does not mean the report cannot be used, it just makes the report more informative on labour. |

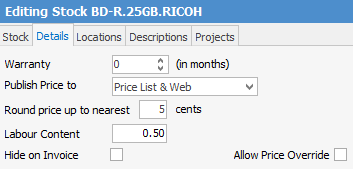

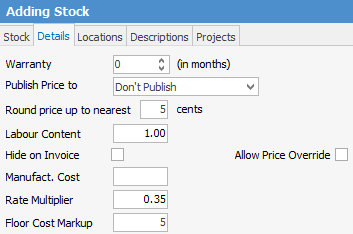

Once the stock code(s) is created go to the Details tab of the newly created stock code. Go to the Labour Content field.

Enter the amount of labour estimated will be spent on the device in a particular month. With desktop contracts, general practice suggests that a 'swings and roundabouts' approach is used. In this example, the selection is 50 minutes per desktop, knowing that it is likely that more time will be spent on some and less on others. Note that this is just a budget for the contract.

Repeat this process to create device-based billing stock codes for the other stock on contracts, ie. physical servers, virtual servers, printers, etc.

User Cost Recovery Estimate Amount

Each user has a rate which represents the company's cost to provide this user with one hour of work. These rates are used to cost the actual labour time spent on a job.

It should be noted that the $ amount is captured at the time the labour entry is made. This means the following may need to be performed:

▪go back to active jobs and manually update the rate, or

▪wait until a new set of entries have been logged to confirm that they are picking up the new cost rate entered against each user (on their cardfile).

Estimating Hourly Cost of Labour

The suggested method for estimating the hourly cost of labour is as follows:

1.Determine the annual expenses of running the service element of the business by reviewing a recent Profit & Loss report. These examples should include:

▪Rent and electricity for the service space.

▪Wages of technicians and service admins.

▪Superannuation and insurance costs for technicians and service admins.

▪Tools of trade, ie. an RMM product.

▪Vehicle costs associated with providing service.

▪All other service department related expenses.

|

The above should not include any stock related costs. |

2.Determine the number of hours available for service. This number should be calculated by considering:

▪How many techs are available to provide service (eg. 5).

▪How many weeks per annum they are available to provide service (eg. 46).

▪How many productive hours they are likely to provide per week (eg. 28).

▪Multiply a. x b. x c. This provides the number of productive hours that are available to customers per year. In this example, the productive hours are 6,440.

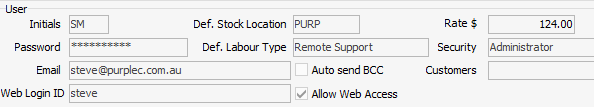

3.Divide the total expenses (point 1) by the number of hours (point 2). So, 800,000 ÷ 6,440 = $124.00 (approximately).

Update the Rate $ field in the User tab on the user's cardfile with the figure that has been calculated.

Using the Rate Multiplier to More Accurately Cost Service Jobs

Technicians will often provide service to customers after hours, or in hazardous environments, and will cost a higher rate per hour for the work performed.

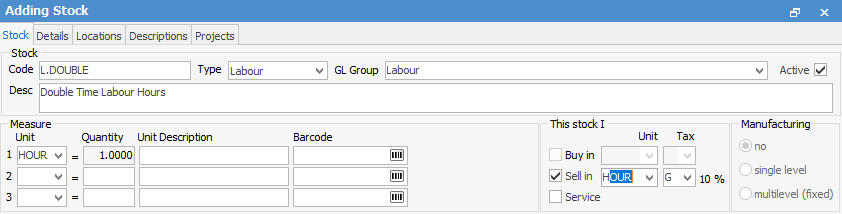

When tracking actual labour, likely codes used would be Onsite, Remote, Non-Billable, etc. Add an additional code called Double Time.

The reality of Double Time is not that the cost is doubled. Rather, the cost probably increases by approximately 35%. Jim2 can provide job cost reports with this loaded rate whenever the Double Time Labour Type is used in jobs or time sheets.

Setup is as follows:

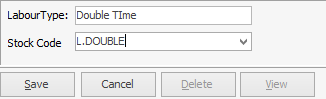

1.Add a new stock code (labour type) with a code of L.DOUBLE. It is possible that this code will never be needed for actually billing a customer, but it is required to record a Stock GL Group and a unit of measure of HOUR.

2.In the Details tab of L.DOUBLE stock, update the Labour Content to 1, and the Rate Multiplier field to 1.35 (35%). This is where the loading factor is stored.

Once the stock code has been added, create or update the Double Time Labour code to use the multiplier using these steps:

1.On the ribbon, go to Tools > Setups > Job > Labour Type > Add.

2.Update the Double Time code to include the new Multiplier stock code.

From now on, when an actual labour entry is made using the Double Time Labour Type, the user's standard rate will be multiplied by 1.35, providing a more accurate underlying cost.

Device Based Project Creation

Now that the underlying setups have been performed, ensure the contract correctly reflects the newly created stock billing codes.

|

If Projects has not been set up within Jim2, refer to Project Setup to ensure it has been correctly configured to handle Managed Service contracts. |

Price level codes are used when setting the sell prices at stock level, and flow through to the contract's pricing for a customer/device/contract combination. If pricing levels have not been set up, it is possible to continue and enter the contract pricing manually.

See Creating Billing Templates for how to set up the correct billing templates for the device based contract.

Monthly Job Management Process

During the month, jobs will be created for work to be performed on a contract. It is important to ensure the following criteria are met in order to gain an accurate contract/job profit assessment. To create this:

1.Ensure the job is correctly linked to the appropriate customer contract ID.

2.Staff must accurately log actual labour on the jobs.

3.Staff are to choose the correct labour type when entering their actual labour.

4.Jobs are triaged and set to Ready in preparation for the EOM billing.

Now the month is coming to a close, create the billing job for the contract, and (assuming it is set to do so) the job will be created and set to Ready automatically.

Job Profit Report

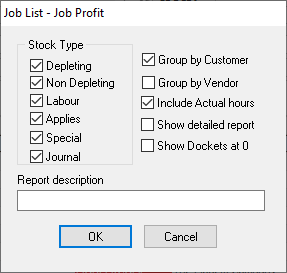

To view the Job Profit Report:

1.Create a list of Ready jobs for the contract.

1.From the Reports menu select Job List – Job Profit, and click Preview.

2.Leave the default options selected.

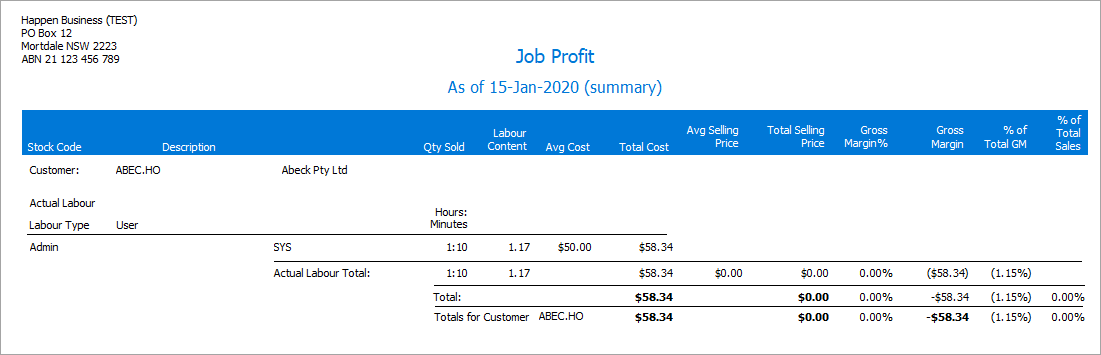

3.This will display the Job Profit report similar to this:

Refer the report to find:

Total labour estimated for this contract |

4 hours |

Total dollar value of the contract being invoiced |

$462.73 |

Total actual labour entered as per summary |

2:10 hours |

Total cost of actual labour estimate |

$126.00 |

Estimated Gross Margin% for the contract |

72.77% |

Estimated Gross Margin# for the contract |

$336.73 |

How to

Add Recurring Managed Service Jobs