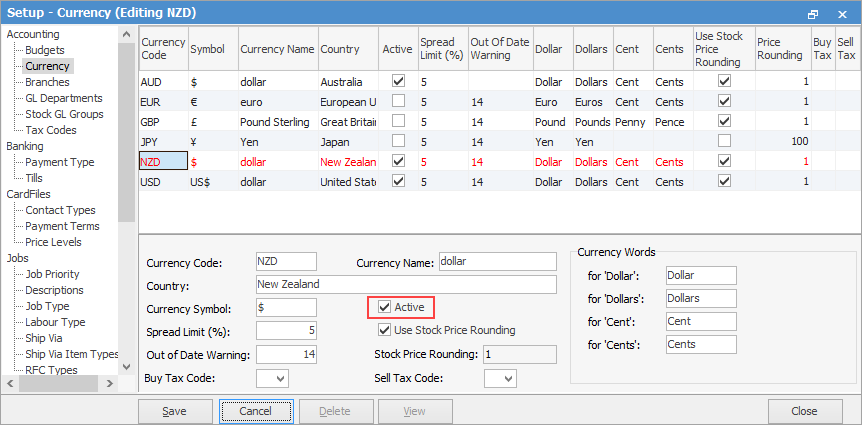

Foreign currencies need to be set up before they can be used.

The Jim2 database is supplied with common currencies that can be made active if required. To make any of the pre-supplied currencies active:

▪On the ribbon, go to Tools > Setups > Accounts > Currency and select the currency.

▪Click Edit.

▪Tick Active.

▪Adjust the Spread Limit % to a numerical value representing the percentage of rate swing for this currency.

▪Adjust the Out of Date Warning value to reflect the number of days the currency rate on this currency is valid for.

▪Click Save.

To add additional currency:

▪Click Add.

▪Enter a three digit Currency Code abbreviation for this currency.

▪Enter the full Currency Name.

▪Enter the name of the Country this currency is used in.

▪Enter the correct currency symbol (most symbols are available from the Windows Alt Character set, or search the internet for the appropriate symbol) into the field Currency Symbol. The symbol is used on various reports.

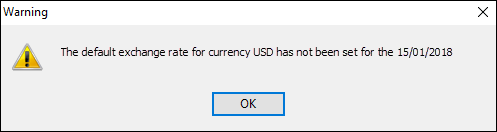

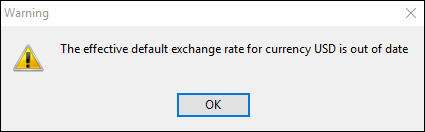

▪In the Spread Limit (%) field, enter an acceptable swing for this currency. This function acts as an early warning system when users attempt to finish a transaction when there has been a change in the currency rate, ie. finishing a purchase order. If Jim2 calculates that the existing exchange rate recorded on the document differs from the current default rate by more than the allowed %, it will send a warning to screen.

▪In the Out of Date Warning field, enter the number of days the rate on this currency is valid for. Jim2 will send a warning to screen if the currency rate has not been changed (reviewed) in that number of days.

▪Enter the Currency Words for each denomination – noting the tense for plurals. These words are used on Jim2 cheques, eg. one hundred Euros and sixty six cents.

In the example above, the expectation is that in any particular month accommodate a five percent swing in Euro currency exchange rate, and review that rate fortnightly. The exchange rate is set at a specific value at the beginning of each month via the Currency Rate chart.

Further information