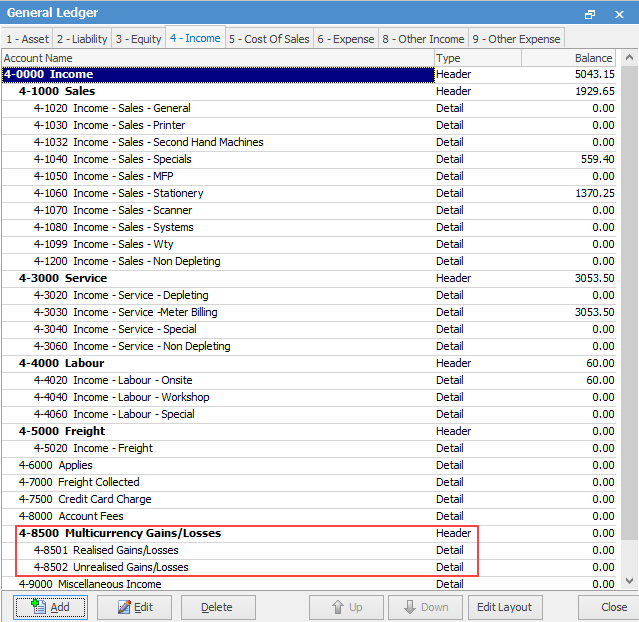

Add two new general ledger accounts to accommodate journals for unrealised gains/losses and realised gains/losses.

Typically, these new general ledger accounts would be set up as Income accounts, for example:

The Default Tax Code should typically be X, as transactions to these accounts are performed behind the scenes within Jim2.

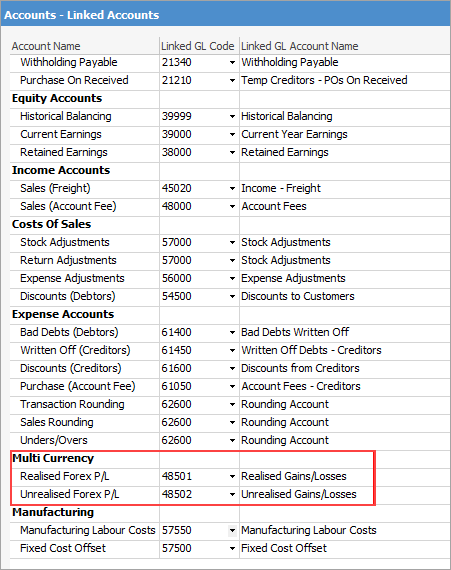

Tools > Options > Accounts > Linked Accounts

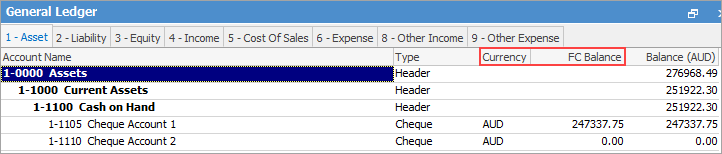

Once these accounts are set up and Multi-Currency has been turned on in Options, the view of the general ledger includes two additional columns: ▪Currency ▪FC Balance

These are for showing the nominated currency and calculated foreign currency balance of detailed cheque and credit card accounts. The Account Balance column will always show its current balance in the general ledger in AUD.

The AUD value of these accounts can be revalued using the Multi-Currency Revaluation Session.

|

Further information