This will occur in the normal course of Jim2 transactions as shown below: ▪Cheque/deposit from a home currency bank account to a foreign currency bank account. ▪Cheque/deposit from a foreign currency bank account to a home currency bank account. ▪Pay a foreign currency creditor from a home currency bank account. ▪Refund a foreign currency creditor to a home currency bank account. ▪Creditors/debtors adjustment down to home currency, then creditors/debtors adjustment up to foreign currency. ▪Creditors/debtors adjustment up to home currency, then creditors/debtors adjustment down to foreign currency.

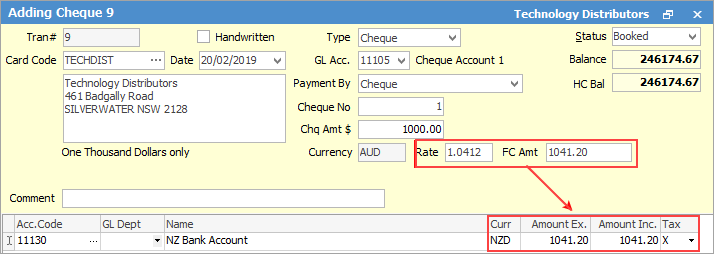

When entering a foreign currency bank account transaction (cheque or deposit) against a home currency bank account (or vice versa), Jim2 will calculate the equivalent in value in the home currency, based on the current default exchange rate.

This example shows a physical cheque for AUD1,000.00 written from the main operating account being deposited in the NZD account at a conversion rate of 1.765 (USD1765.00)

|

Further information

Multi-Currency Creditor/Debtor Lists

Multi-Currency Adjustments Up/Down

Multi-Currency Entering Cheques/Deposits