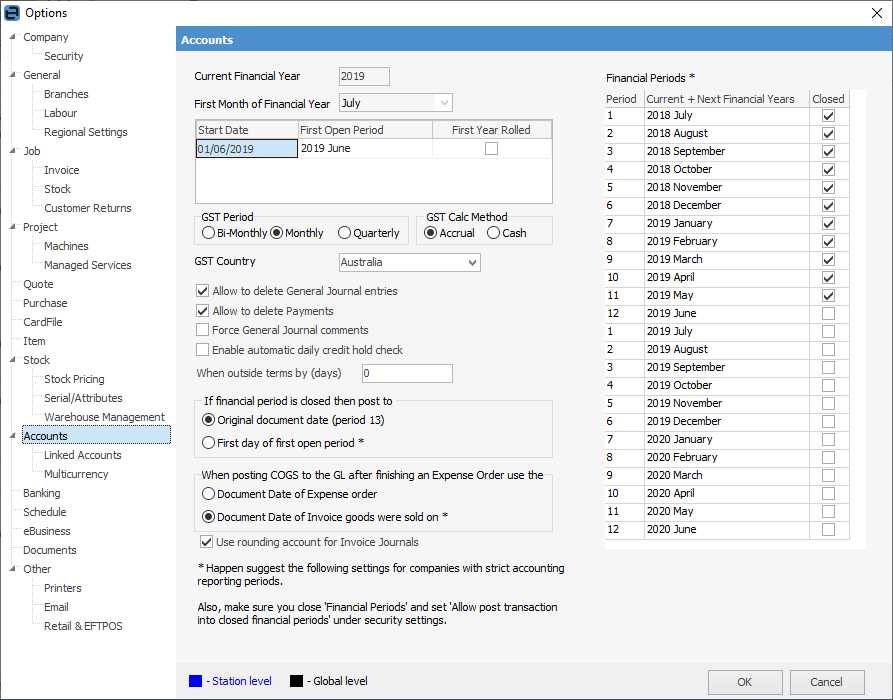

On the ribbon, go to Tools > Options > Accounts.

There are several important and specific accounting defaults which are set here. The Accounts options are extremely important in regard to the way Jim2 works . This area specifies how general ledger accounts are used when Jim2 needs to create transactions in the general ledger. Some of these options are also related to business structure and methodology.

This is also where to close periods/months, locking those periods from further entries.

|

These defaults should be considered carefully as they have a major impact on how Jim2 works and how the business is run. |

From this screen the following options can be set, all of which will have a global impact, meaning that every user accessing Accounts is affected by what is set up here. The purpose of each field is described below.

Field |

Explanation |

||

|---|---|---|---|

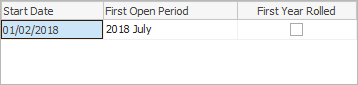

Current Financial Year |

The financial year information will be entered when Jim2 is first set up (via the Jim2 Startup Wizard). These fields will show the information relating to the current financial year, first month of financial year, starting month using Jim2 – this is used for locking and reporting purposes, and these values cannot be changed. When a financial year is rolled over, the current financial year will automatically update. The fields below show when the actual start date of the company was, along with the first open period and a checkbox indicating whether the first financial year has been rolled or not. This is not an editable area. Jim2 will automatically tick the box when the year has been rolled.

|

||

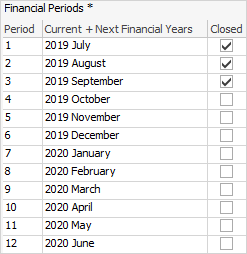

Financial Periods |

As the financial year continues and each month is finalised, the period should be closed so that no transactions can be posted, and no existing transactions can be changed for those periods. To do this, tick the box next to the period to be closed. A period can be unlocked at any time, as long as the following periods are not locked. For example, the August period cannot be unlocked unless the September and October periods are unlocked first.

|

||

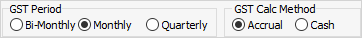

GST Period |

Specify how often to complete a GST/BAS return. This is used when printing the report at default dates, and when editing documents.

|

||

GST Calc Method |

Select either Accrual (default) or Cash GST reporting methods, depending on the company's GST reporting requirements. This option is in the Jim2 Startup Wizard (used when setting up Jim2 for the first time). See |

||

GST Country |

The default country for GST. Choices are: Australia, New Zealand or South Africa. |

|

It is important that the GST calculation method is selected prior to finishing the first GST session. However, if the GST calculation method is changed at a later time, it is easy to identify the method that was used for each session.

Jim2 does not support moving from Accrual to Cash GST reporting without some manual calculations – advice from your company accountant may be required.

For instance, howtwould you determine which invoices have already been reported to the ATO on an accrual basis that will be paid in the future, and potentially reported again on a cash basis? |

Field |

Explanation |

|---|---|

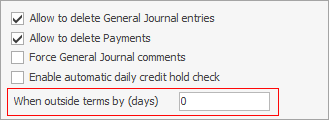

Allow to delete General Journal entries |

This and the following two options are more business methodology related, ie. should users be able to delete general journal entries? There is a further security setting on this option. |

Allow to delete Payments |

This allows users to be able to delete debtor and creditor payments. There is a further security setting on this option. |

Force General Journal comments |

This will ensure when users add and post general journal entries, they always enter a comment in the Comment field of the general journal. |

Enable automatic daily credit hold check |

Tick this box to automatically put customers (debtors) on credit hold if they have invoices that are overdue by a predetermined number of days. Enter that number into the When outside terms by (days) field. The default is 0 (zero) days.

|

If Financial Period is closed then post to |

You can elect to post to either Original Document Date (Period 13) or First Day of First Open Period* (see |

When Posting COGS to the general ledger after finishing an Expense Order |

Here, you can choose to use either the document date of the expense order or the document date of the invoice the goods were sold on* (see |

Use rounding account for Invoice Journals |

If ticked, when a job is invoiced and there is rounding, instead of putting the rounding into the first income account, Jim2 will use the rounding account instead. This is a 6-XXXX expense account. |

|

It is suggested to use the settings indicated by * for companies with strict account reporting periods. Also, make sure to close financial periods and untick Allow post transaction into closed financial periods, under Security settings. |

Further information

below). The 13th period isn't an actual period of time. It is a place-holder that contains year-end adjustments. Transactions dated in the 13th period are performed with the view that the transaction doesn't affect any of the twelve actual reporting periods.

below). The 13th period isn't an actual period of time. It is a place-holder that contains year-end adjustments. Transactions dated in the 13th period are performed with the view that the transaction doesn't affect any of the twelve actual reporting periods.