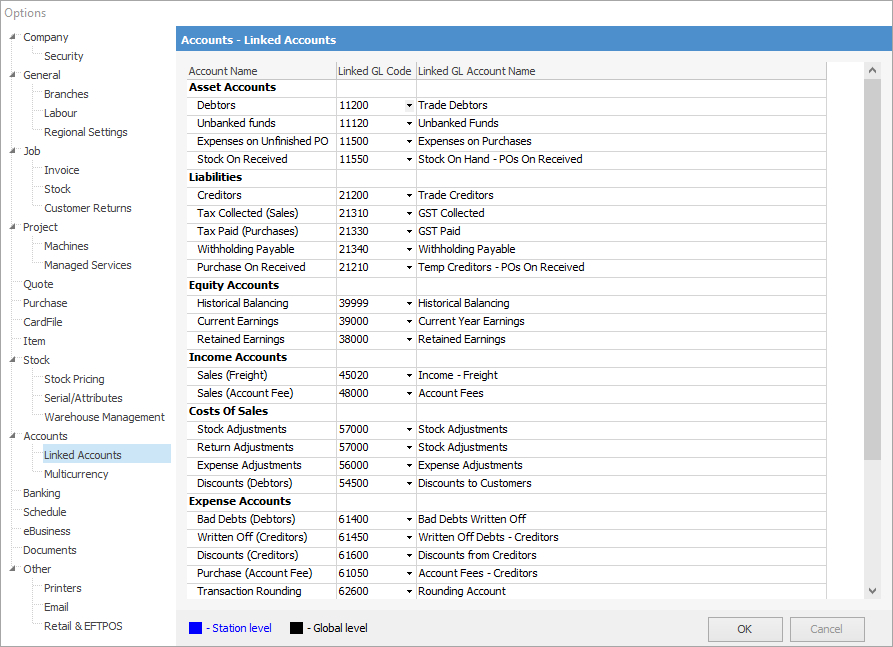

On the ribbon, go to Tools > Options > Accounts > Linked Accounts.

Linked accounts are used by Jim2 to work out where transactions will be placed in the general ledger when finishing forms within Jim2.

|

Options cannot be saved when any of these linked account fields are empty – Jim2 cannot function without this information. |

These are the accounts of importance (full list not shown in the above image). Each impacts globally on the function of Accounts, ie. every user accessing Accounts is affected by the options set here.

Account Name |

Detail Account Name |

Linked GL Account Name |

||

|---|---|---|---|---|

Assets |

The linked Debtors account is used for all debtor-related transactions, including invoicing, debtor payments and returns. |

|||

The Unbanked Funds account is used for all debtor payments that have not been included in a banking session, and therefore not moved to a bank account. For example, payments made in cash and entered into the Till would go into the Unbanked Funds account. |

||||

Expenses on Unfinished purchase orders |

The Expenses on Purchases account is used when a linked expense order (usually for freight) is finished, however the purchase order it is linked to is still on Booked, Ordered or Received. When a purchase order is finished, the amount is reversed out of the Expenses on Purchases account, as it updates the COGS on the purchase order. |

|||

Stock on Received (on purchase orders) |

The Stock on Received account is used when the status of a purchase order is changed to Received. The value of the stock nominated on the purchase order will appear in this account, and will be included in the stock on hand (SOH) figure. When the purchase orders are finished, the amount is reversed and will be included in the correct SOH or COGS account. |

|||

Liabilities |

The Creditors account is used for all creditor-related transactions, including creditor invoices (purchase orders and expense orders), creditor payments and returns. |

|||

Tax Collected (Sales) |

The Tax Collected account is used for all GST on sales. |

|||

Tax Paid (Purchases) |

The Tax Paid account is used for all GST on purchases. |

|||

Withholding Payable |

The Withholding Payable account is rarely used. For example, it is used for purchases from a supplier who does not quote an ABN number. Check with the Australian Taxation Office about current rates. See Withholding Tax for more information. |

|||

Purchases on Received (Creditors) |

The Purchases on Received account is a temporary creditors account. It reflects the amount owed to a creditor according to the value of purchase orders on a status of Received. When the purchase orders are finished, the amount is reversed from this temporary creditors account and included in . |

|||

Equity |

Historical Balancing |

The Historical Balancing account is used as an internal check to identify if the debits and credits entered into Jim2 are in balance. If they are in balance, the account balance will be zero. If there is a balance in this account, this will need to be investigated and resolved before closing a financial year. |

||

Current Year Earnings |

The Current Year Earnings account is used to calculate the result of the profit and loss transactions. This will include the result for a combination of two financial years if there are two financial years open. Once a financial year is closed, the balance in Current Year Earnings will be for the current financial year only. |

|||

Retained Earnings |

The Retained Earnings account is used to show the result of the previous financial year's trading. When closing a financial year, the current year earnings for the year being closed will roll over into the Retained Earnings (for previous year) account. |

|||

Income |

Sales Freight |

The Sales Freight account is used for all freight charges entered into the Freight field on the Invoice Details tab of jobs. |

||

Sales Account Fee |

The Sales Account Fee account is used for all account fees charged where the account fees are included in the setup of payment terms. |

|||

Cost of Sales |

The Stock Adjustments account is used for all stock adjustments entered into Jim2. |

|||

Return Adjustments |

The Return Adjustments account is used when stock is returned at a lower price than purchased for. The price difference is a return adjustment which goes to the Stock Adjustments account. |

|||

Expense Adjustments |

The Expense Adjustments account is used when a return to vendor is added against a purchase order with an expense order. The value of the expense order is not included in the RTV but goes to the Expense Adjustments account. |

|||

Discounts (Debtors) |

The Discounts (Debtors) account is used when entering a discount amount on a debtor account at the time of entering a payment. The net amount excluding GST is posted to this account and the GST component is posted to the Tax Collected account. |

|||

Expenses |

Bad Debts (Debtors) |

The Bad Debts (Debtors) account is used when selecting the Bad Debts payment method to clear an invoice from the debtor account. The net amount excluding GST is posted to this account and the GST component goes to the Tax Collected account.

|

||

Written Off (Creditors) |

The Written Off (Creditors) account is used when the Bad Debts payment method is selected to clear an invoice from the creditor account. The net amount excluding GST is posted to this account and the GST component goes to the Tax Paid account.

|

|||

Discounts (Creditors) |

The Discounts (Creditors) account is used when entering a discount amount on a creditor account at the time of entering a payment. The net amount excluding GST is posted to this account and the GST component to the Tax Paid account. |

|||

Purchase (Account Fee) |

The Purchase (Account Fee) account is used for all account fees entered onto a purchase order, and where the account fees are included in the setup of payment terms. |

|||

Transaction Rounding (on Purchase Orders) |

The Transaction Rounding account is used to handle any rounding errors that may occur when posting to the general ledger. |

|||

Sales Rounding |

The Sales Rounding account is used to track the odd cents when a customer is paying by cash. For example, the invoice total is $19.99 and the customer pays $20.00. The one cent difference is posted to this account. It is recommended that this account be flagged as a Control Account. |

|||

Unders/Overs |

The Unders/Overs account is used to record any differences between the real and actual amounts counted when doing a Till reconciliation. |

|||

|

(if Multi-Currency is enabled in the Jim2 licence key) |

Realised Foreign Exchange Gain/Loss |

The Realised Foreign Exchange Gain/Loss account is used to record realised profit and/or loss transactions in foreign currency. |

||

Unrealised Foreign Exchange Gain/Loss |

The Unrealised Foreign Exchange Gain/Loss account is used to track unrealised profit and/or loss transactions in foreign currency. |

|||

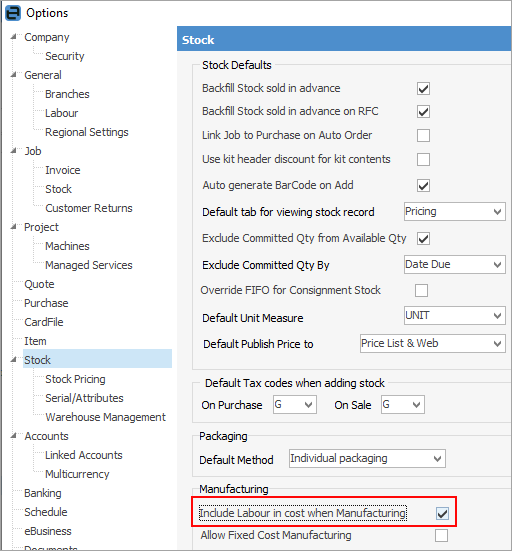

Manufacturing |

Manufacturing Labour Costs |

The Manufacturing Labour Costs account allows the cost on Labour and Applies stock involved in the manufacturing process to be included in the manufactured product's COGS. This account is used to offset any labour included in the manufacturing cost. This would typically be an Asset account (1-xxxx). To use this feature, the Include Labour cost when Manufacturing option under Tools > Options > Stock must be enabled. Once enabled, all future manufacturing jobs will include the labour cost in the manufactured goods cost (COGS).

|

||

Fixed Cost Offset |

The cost difference between the fixed cost and actual costs of parts (and labour, if configured by Labour Options) are offset to the Fixed Cost Offset account. Any additional costs related to parts/stock used (from purchase order finish or expense order, etc.) are offset to the Fixed Cost Offset account. |

|

By default, the Sales Rounding and Unders/Overs accounts are to the existing (transaction) Rounding account. It is recommended that new general ledger accounts be created for/to the Sales Rounding and Unders/Overs accounts if required. |

Further information