Jim2 allows for handling multiple currencies with ease. Multi-Currency works in a real-time environment, not from an as at date point of view.

Exchange rates and exchange rate fluctuations have a major influence on both the operation and profit results of businesses dealing in foreign currencies.

Multi-Currency is a core component of Jim2, ensuring that every process involving a foreign currency is fully integrated. From raising a quotation through every process in the business cycle, Jim2 enables transactions in foreign currency, making it easy to manage both unrealised gains and losses (potential changes in the value of overseas transactions) and realised gains and losses (the actual changes in the value of assets, liabilities and equity that occur when foreign currency is exchanged for local currency) by providing accurate, live transaction reporting.

Jim2 Multi-Currency allows for an unlimited number of definable foreign currencies. Maintenance of exchange rates is easy using the Currency Rate table. Jim2 automates individual spread limit % (swing) and out of date warnings on each currency to ensure accuracy, and encourage vigilance when dealing with the volatility of foreign exchange.

|

The home currency can only be used in general journals, as the general ledger is only in home currency. |

Jim2 Multi-Currency removes any need for separate debtor/creditor identities to trade in multiple currencies. The suite of practical documents and professional business reports in Jim2 supports all Multi-Currency requirements.

The Jim2 Multi-Currency Revaluation Session is a tool for recording and reporting the foreign currency position. Fully integrated into the functionality of Jim2, this feature reports unrealised foreign exchange exposure at any point in time, automatically creates the journals required when currencies are revalued, and with automatic realisation journals created on full or part payment of invoices.

|

Once Multi-Currency has been enabled, it cannot be disabled. |

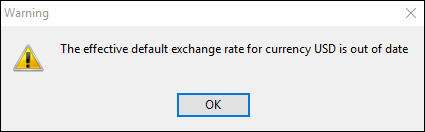

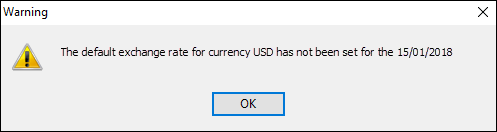

▪Commencement date for Multi-Currency is January 1. The exchange rate for USD is set at $0.80. ▪The default setup for USD remains at 5% spread limit with 14-day out of date warning.  ▪On January 1, purchasing and payments in USD transactions are going to be based on the $0.80 rate. ▪On January 15, users finishing a January USD purchase order will be warned that the out of date range has been reached.  ▪The currency rate for USD should now be reviewed and adjusted.

On February 1st, the USD exchange rate has taken a downward turn from $0.80 to $0.70. The currency rate for USD should now be reviewed and adjusted. Once adjusted, all new February purchasing and payments in USD transactions will be based on the $0.70 rate.

However, because the spread limit for USD (5%) has been exceeded against open January documents, users attempting to finish a purchase order created in January will receive a spread limit warning. They can choose to adjust the document rate to match current spot rate (of $0.70), or finish as is and let the next Revaluation Session correct the gain/loss.

On February 15, all new USD purchase orders entered or payments made will still be defaulted to the 0.70 rate, and users finishing January purchases will correctly receive a spread limit warning, which can be actioned as above. The USD Currency Rate should now be reviewed and adjusted, or users finishing purchasing and payments in USD will be warned that the Out of Date range has been reached.

On March 1st, the USD exchange rate is now $0.72. The USD Currency Rate should again be reviewed and adjusted. March purchasing and payments in USD transactions will be based on this $0.72 rate. Because this rate is within the allowed variation of 5%, there will be no spread limit warnings if a user finishes a February purchase order, however there will be a warning if they finish a January purchase order (where the rate was $0.80).

On March 15, the USD currency rate should again be reviewed and adjusted, or users finishing purchasing and payments in USD will be warned that the out of date range has been reached.

|

Stock pricing is calculated as set in the Pricing tab on a single piece of stock for that price level and currency. In the case that the stock doesn’t have a price level in that currency, the price will be calculated based on the home currency price converted to the currency rate on the job.

It is necessary to set up Multi-Currency in Jim2 before these features can be used. The following sections work through a logical progression of setup and application. |

As the general ledger is only in the home currency, cardfile credit limits will only show in home currency. When running a cardfile list with mixed currencies, any foreign currencies will not show the credit limit in the corresponding column. |

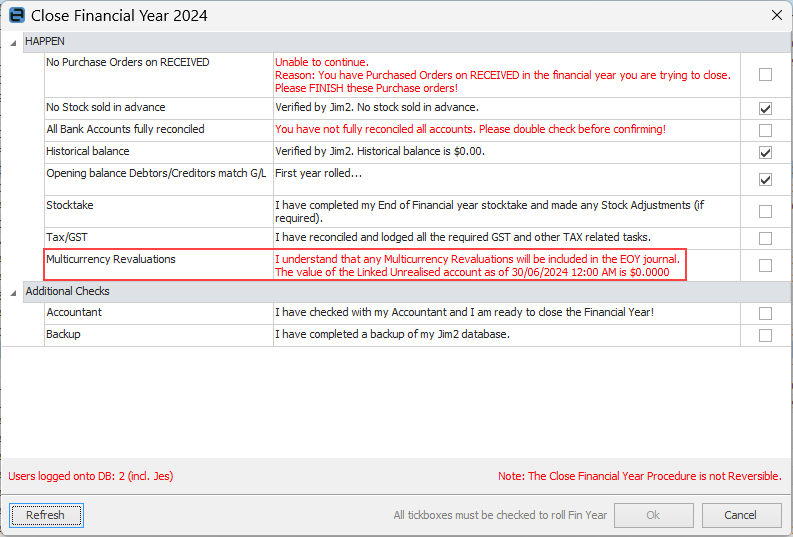

See here for information on closing the financial year. There is one exception within the Close Financial Year Wizard for multi-currency. You will see a section relating to Multicurrency Revaluations. If you are happy with what is stated in this area, you can tick the box to continue with closing the financial year.

|

Further information

Multi-Currency Business Analysis

Multi-Currency Transfer From Home Account to Overseas Account