Whilst the Australian Taxation Office has simplified GST reporting, they have not changed the law, so the requirement for properly recording GST remains the same.

The BAS form only needs a few numbers recorded (1A,1B and W2), however it still expects those values to be provable in the case of a tax audit. The Jim2 worksheet calculates the values needed for this simpler BAS reporting, so it already supports this reporting regime. In other words, the process remains the same.

The display of GST sessions is specific to the home currency, as set up when first installing Jim2. For example, if the home currency is NZD, the GST session's worksheet will be formatted as per New Zealand's GST reporting requirements.

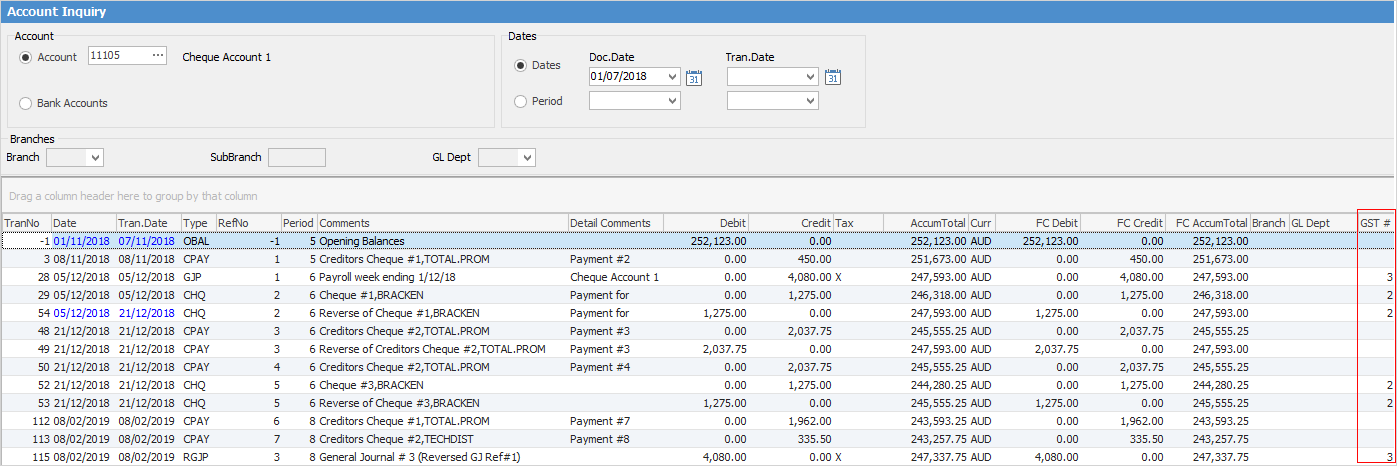

GST sessions are the means of selecting the transactions to report on the BAS, and all transactions entered into Jim2 appear in GST sessions. How and if they are to be reported in the BAS depends on the tax codes used in the transactions (refer to Tools > Setups > Tax Codes for more information). Once completed, each GST session is reconciled and the transactions are flagged with the GST session number that they were included in, via the Account inquiry screen.

|

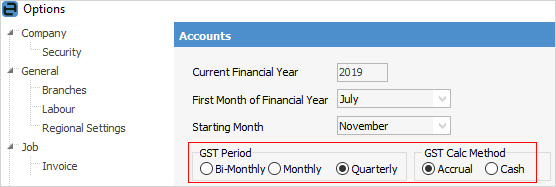

Jim2 is an accrual accounting system, however it allows GST reporting on either cash or accrual basis. For more information on cash or accrual GST reporting, please visit the Taxation Office website of the desired country. |

The GST reporting basis must be configured in Tools > Options > Accounts > GST Period and choosing the GST Calc Method.

To access GST sessions, on the ribbon, go to Accounts > GST Sessions.

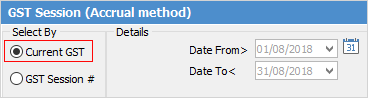

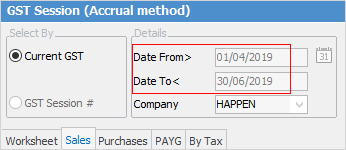

The default view when accessing GST sessions is Current GST, and the date range will reflect the current GST period.

The date range can be manually selected as required. The previous GST session must be reconciled before commencing a new one.

|

If a GST session has been completed, and Current GST is selected before the end of that period, a blank screen may be presented. This will change once the date reaches the next day after the Date To date, or simply enter dates after the closed GST session.

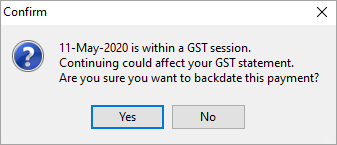

The following warning may appear when trying to enter transactions:

This means there are either saved entries for the dates shown or a GST Session has been completed which includes these dates in the date range. |

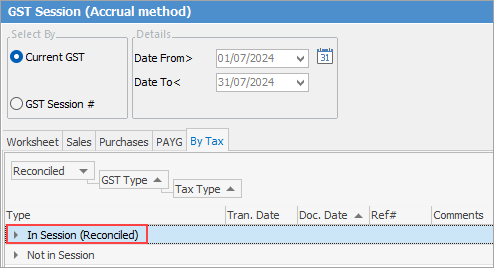

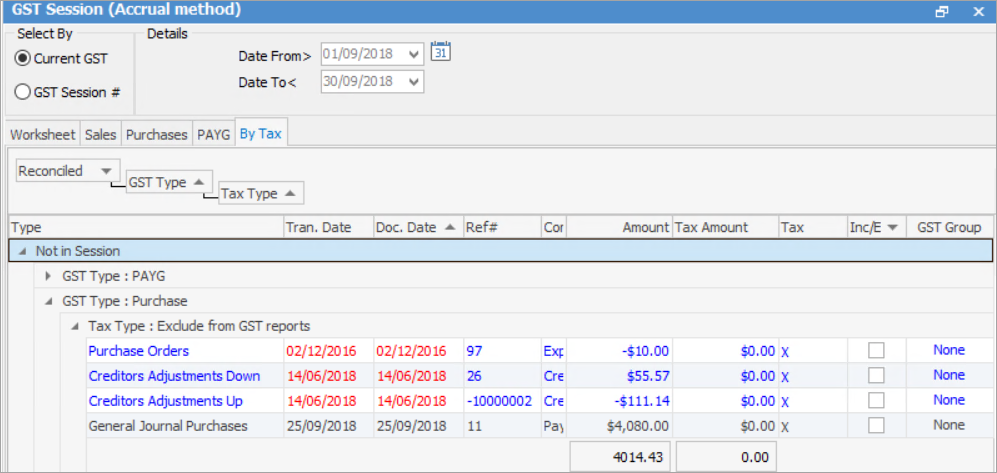

To look at only the transactions for the dates selected, go to the By Tax tab and expand the In Session section.

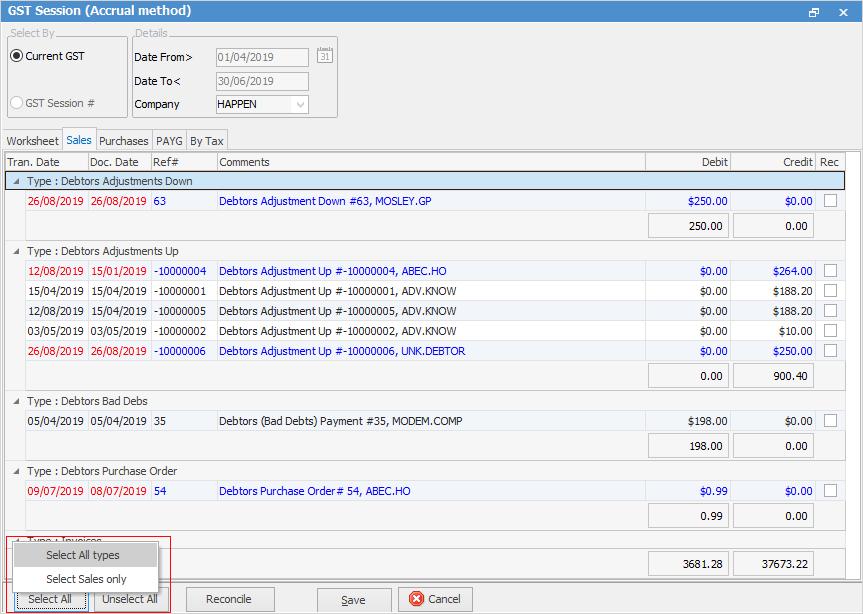

To look at a future GST session and see running totals, click Edit, Select all, Select all Types, then Save. When finished, unselect all.

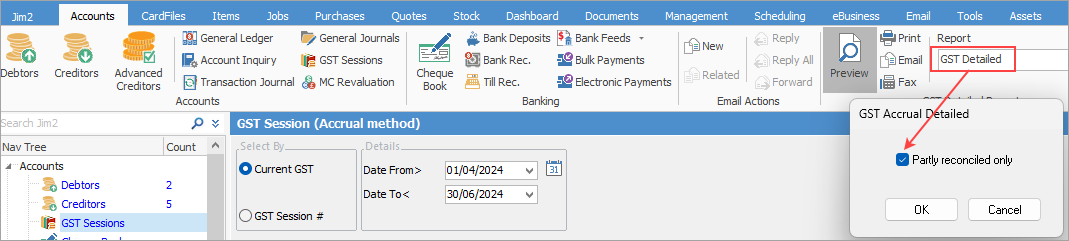

If you wish to run the GST Detailed report for only those transactions within the GST session, click Edit and Select All types, then save it. If you then preview the GST Detailed report within the ribbon, ticking Partly reconciled only and this will show only those within the dates selected for the GST session.

|

Note: Entries coloured red and blue indicate that the transaction is dated outside the selected date range, whilst black transactions are within that range. |

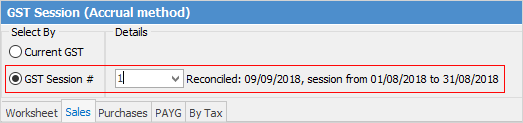

Choosing GST Session# in the Select By area allows for opening previously reconciled GST sessions:

To commence a GST session, ensure the required date range has been chosen, then click Edit.

|

Note: Before commencing a GST Session, you must ensure that the previous GST Session has been reconciled. If you leave a session as saved and do not reconcile it, those transactions will automatically be included in the next GST Session. |

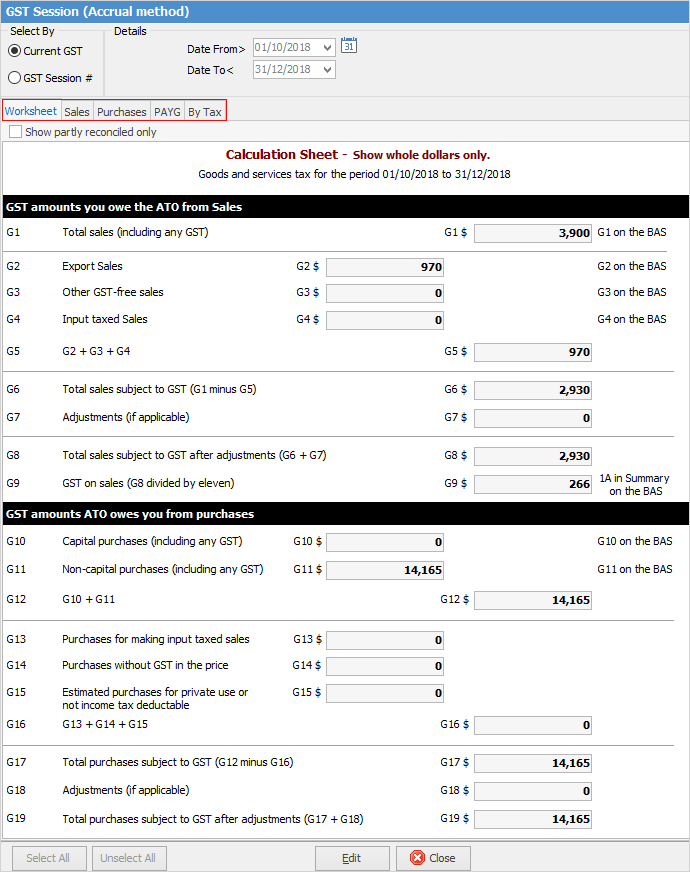

The Accrual GST session contains five tab headings: Worksheet, Sales, Purchases, PAYG and By Tax (the Cash GST session contains seven tab headings as there are two additional tabs for Opening Balance Sales and Opening Balance Purchases – refer to the section on Completing a GST Session: Cash Method for further information).

The GST period nominated in Options determines the dates displayed in the GST session. These dates can be changed manually by the user. For example, if reporting GST on a quarterly basis and PAYG Withholding on a monthly basis, date range in the GST session can be narrowed down to suit.

The purpose of the GST session is to tick off all transactions associated with a certain GST period. These ticked transactions are reconciled, then form a unique GST session (with a sequentially allocated session number) from where all included transactions can be viewed by selecting a particular session number.

For example, if the Go-Live date for Jim2 was 1/07/2019 and GST is reported on a quarterly basis, GST session # 1 will contain all transactions relating to 1/7/2019 – 30/09/2019. Reconciled transactions will no longer appear in the current GST session.

Any backdated transactions that are entered after the GST session for the relevant period has been completed will automatically be included in the next GST session.

|

Each GST session must be reconciled on completion and lodgement of the BAS, or the saved transactions will automatically be included in the next GST session. |

GST Session colours

Entries coloured red and blue indicate that the transaction is dated outside the selected date range, whilst black transactions are within that range.

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports