Fuel tax credits provide businesses with a credit for the fuel tax (excise or customs duty) that's included in the price of fuel used in:

▪machinery

▪plant

▪equipment

▪heavy vehicles

▪light vehicles travelling off public roads or on private roads.

The amount depends on when you acquire the fuel, what fuel you use and the activity you use it in. Fuel tax credits rates also change regularly so it's important to check the rates each time you do your business activity statement (BAS).

Some fuels and activities are not eligible, including fuel you use in light vehicles of 4.5 tonnes gross vehicle mass (GVM) or less, travelling on public roads.

The fuel tax levy should match to 7D on your ATO form. The ATO has a fuel tax calculator available on their website.

If you claim the fuel tax credit refund from the ATO, this can be entered into Jim2 as a deposit.

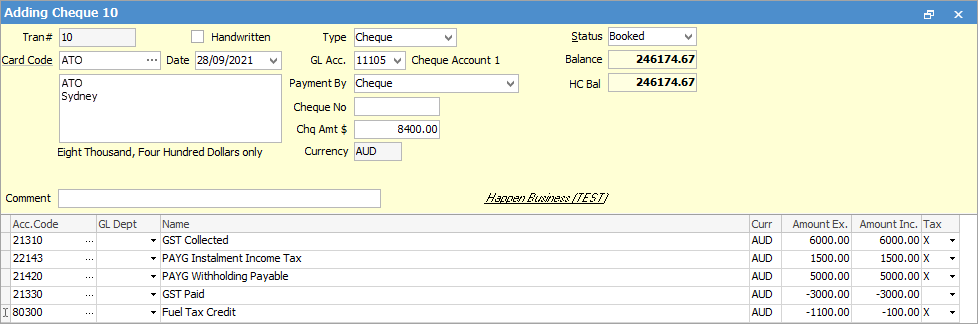

If the fuel tax credit refund is a negative amount, you can record this as a cheque payment. Enter the amount as a negative value against the Fuel Tax Credit general ledger account (which will need to be set up first).

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports