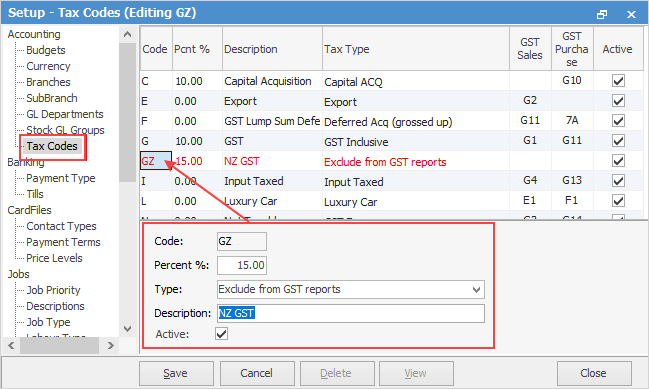

1.Add GST Code GZ via Tools > Setups > Tax Codes. Type – Exclude from GST Reports, so it reports like tax code X in GST Sessions. Enter 15 in the Percent % field.

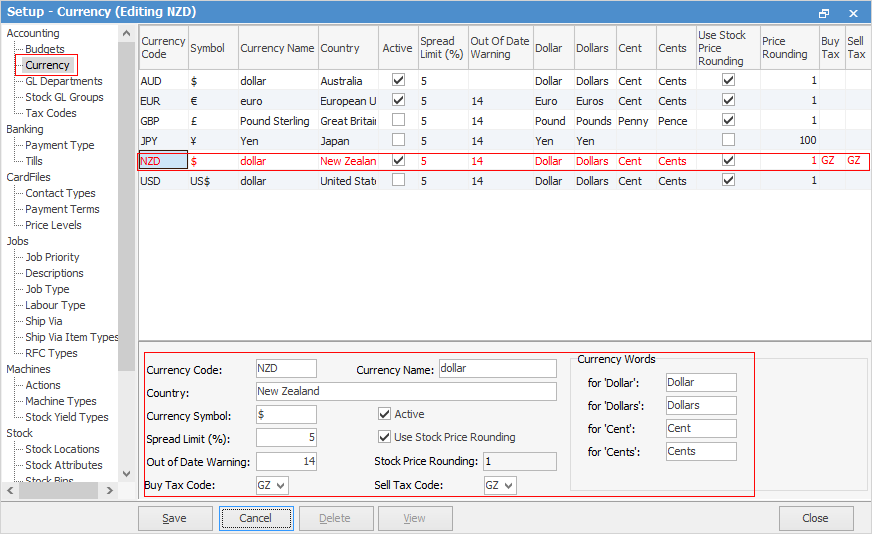

1.Ensure GZ code is set against the currency in Currency setup. On the ribbon, go to Tools > Setups > Currency.

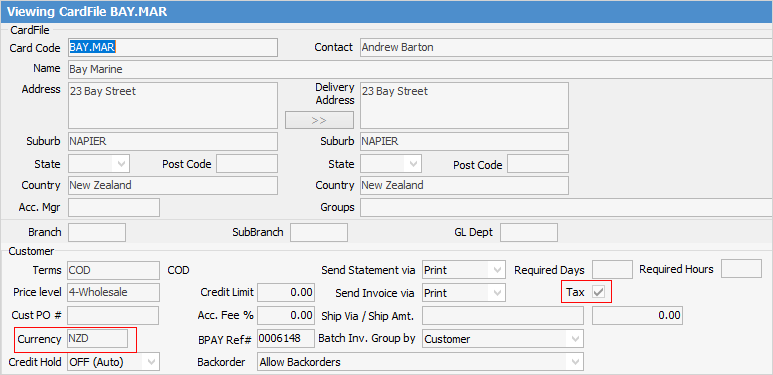

2.Set customer cardfile default currency to NZ and tick Tax.

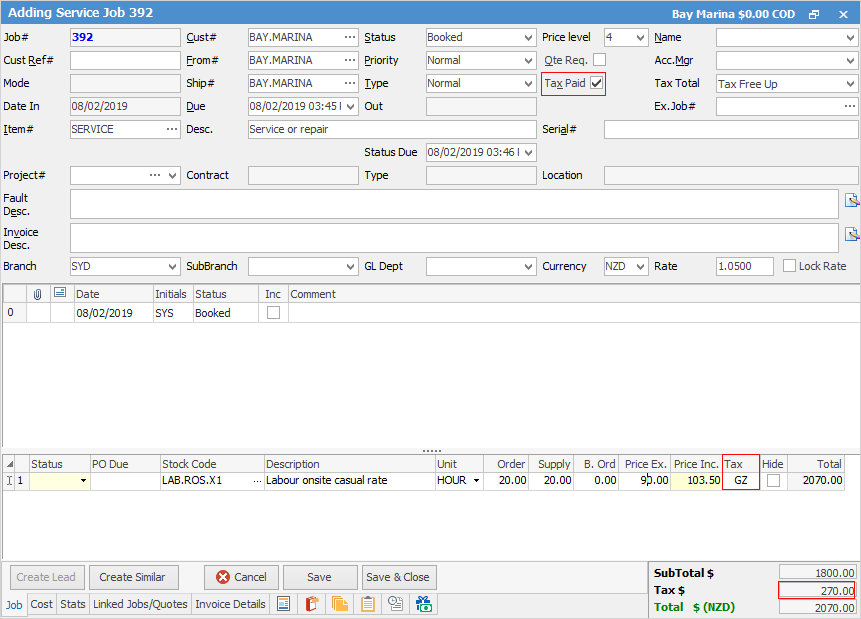

3.Raising a job will now calculate the 15% GST automatically.

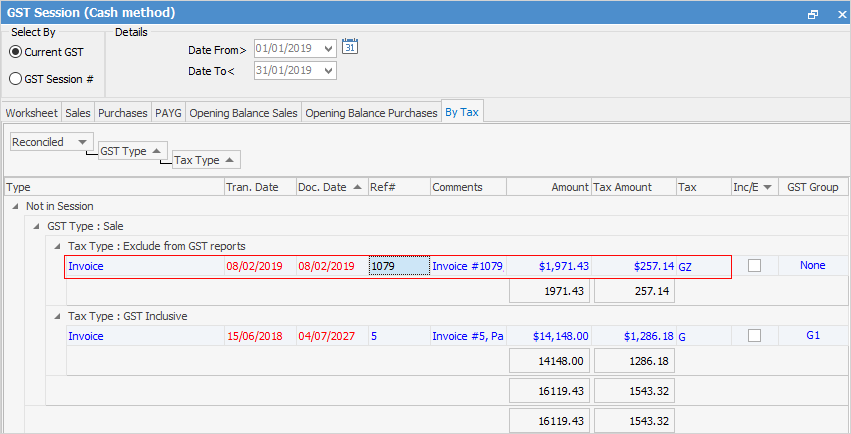

4.In GST sessions, transactions will behave like X non reportable, and will not impact worksheet figures for reporting GST in Australia. However, the By Tax tab will display the total value of transactions and GST for tax code GZ for the reporting period.

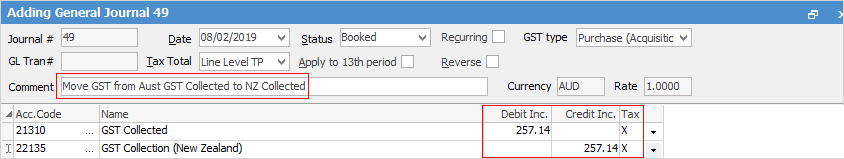

5.The GZ values will be included in the general ledger GST Collected Liability account. Users will need to use the By Tax tab in the GST session to establish the GZ values, then enter a journal to move these values from the GST Collected Liability account to a new GST Collection (New Zealand) liability account. This is performed each GST reporting period.

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Record Deferred GST on Imports