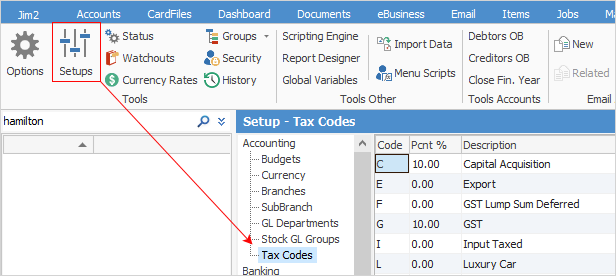

On the ribbon, go to Tools > Setups > Accounting and select Tax Codes.

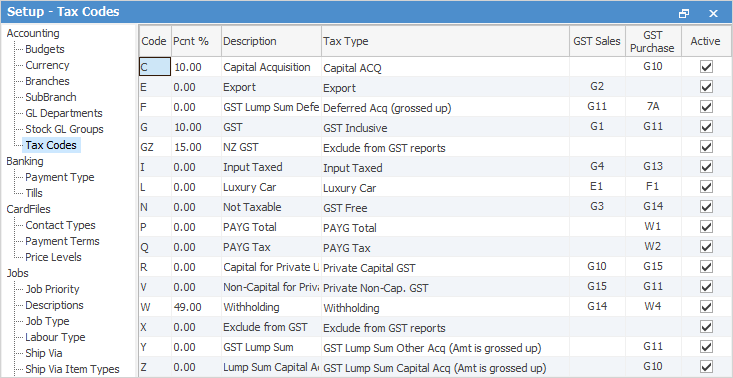

There are already standard tax codes set up in Jim2.

|

It is advisable to not make any changes here without discussing with your accountant and contacting support@happen.biz for more information. |

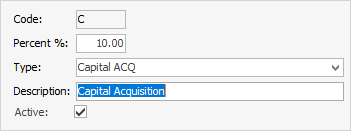

Code allows allocation of an alpha value to the various tax codes that apply to stock. When adding stock, add the appropriate tax code and the tax paid stock prices will automatically be calculated from the tax free prices.

In the setup grid, there are five fields that need to be filled out for each tax value. They are:

Field |

Explanation |

|---|---|

Code |

A unique alpha code for each tax type. |

Percent % |

The percentage value of the tax. |

Type |

Choose a tax type from the drop down list – these relate to BAS fields for GST. |

Description |

A description of the tax (up to 30 characters). |

GST Sales and GST Purchase |

Indicates where in the GST worksheet these values will be entered (auto-filled by Jim2). |

Active (checkbox) |

Whether the tax code is active and available for use. |

|

Once a tax code is used, it cannot be altered or deleted – untick Active to make it inactive. By making a tax code inactive, it is no longer available for use from that point onwards. If that code has been used previously, it still applies within historical records, and it can be re-enabled at any time. |

GST – BAS and Jim2

This is a table showing the tax types, and where they fit in the BAS. The tax types that are set up and used in Jim2 are vital to the formation of the BAS Report, and should not be changed.

Code |

Type |

BAS Field |

|---|---|---|

C |

Capital Acquisition |

G10 |

E |

Export Sales |

G2 |

F |

GST Lump Sum Deferred |

7A/G11 |

G |

GST Inclusive |

G1/G11 |

I |

Input Taxes |

G4/G13 |

L |

Luxury Car Tax |

E1/F1 |

N |

GST Free |

G3/G14 |

P |

PAYG Total |

W1 |

Q |

PAYG Tax Amount |

W2 |

R |

Capital for Private Use |

G15 |

V |

Non-Capital for Private Use |

G15 |

W |

Withholding |

G14/W4 |

X |

Exclude from GST Reports |

N/A. This is the code to be used when making payments to the ATO. |

Y |

GST Lump Sum |

G11 |

Z |

Lump Sum Capital Acquisitions |

G10 |

See the GST Sessions and the BAS section for more information.

Further information