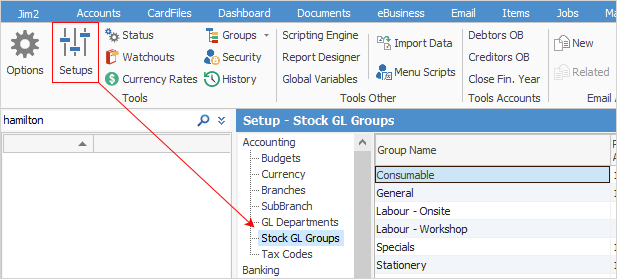

On the ribbon, go to Tools > Setups > Accounting and select Stock GL Groups.

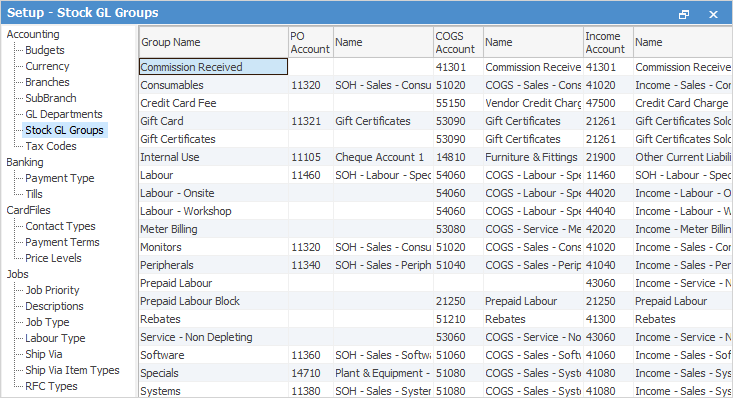

Every stock record in the Jim2 database is assigned to a Stock GL Group. Stock GL Groups are the mechanism that Jim2 uses to record all transactions relating to every piece of stock.

When purchasing stock, once the status of the purchase order is set to Finish, the value of the stock on that purchase order will automatically flow to the SOH (stock on hand) asset account assigned to the Stock GL Group the stock belongs to. Similarly, when selling that stock, the SOH account will reduce by the amount of the stock sold, the COGS (cost of goods sold) account will increase by that amount, and the income account will record income received for that stock.

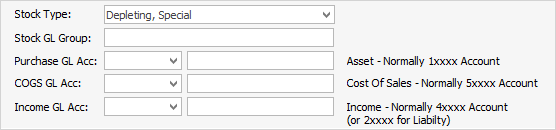

There are three main types of Stock GL Groups: 1.Depleting, Special. 2.Non Depleting, Journal 3.Labour, Applies.

These directly relate to the types of stock that can use a particular Stock GL Group.

Depleting and Special Stock GL Groups can be used for all stock types, however the Non Depleting, Journal, Labour and Applies Stock GL Groups can only be used for those types of stock (not for depleting or special). This prevents a user from setting up a Stock GL Group for non depleting stock with no purchase account, then attaching it to a depleting and/or special stock. It also removes the need to set up twice for depleting and non depleting stock types. Depleting/Special Stock GL Groups can be set up and attached to depleting, special, non depleting, labour and/or applies types of stock.

Special Stock covers stock where costs from the supplier will fluctuate. Special stock is also uniquely purchased for a specific job. The cost of goods will be taken across to the job when the stock is added, hence it uses the Exact COGS rather than the Last COGS. |

1.Depleting and Special Stock GL Groups

2.Non Depleting, Labour and Applies Stock GL Groups

|

||||||||||||||||||||||||||||||||||||||||

|

A Stock GL Group cannot be edited or changed once it is used by stock which has any transactions. Nor can it be deleted once it is attached to a stock record. The exception is the group name itself, which can be changed. |

When adding a new Stock GL Group, it is not possible to select a COGS account that has been set up as an expense order account. A COGS account that is either a Control account or a Detail account must be selected. A new COGS GL account can be added if a suitable one is not available to choose from.

Further information