The GST Cash method combines the total value of sales, purchases and PAYG transactions in a selected period. In Jim2, Cash GST is calculated from payments that are applied to debtor and creditor invoices in a selected period, plus cheque book entries, general journals and reports, according to the tax codes used on those transactions.

For Cash GST reporting, before commencing a GST session, ensure that bank account and credit card account reconciliations are up to date to ensure transactions are included in the relevant GST Period, and that all debtor and creditor payments and credits are applied to the relevant invoices. Refer to Apply a (Creditor) Credit Prepayment and Apply a (Debtor) Credit Prepayment for more information on applying credits. You will also need to check unallocated debtors and creditors, and fix these where necessary, before running the GST Session

|

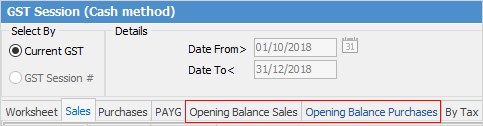

When on Cash GST reporting, the GST on opening balance debtors and creditors invoices and credits that were brought across into Jim2 must be calculated manually and added to the figures generated from the GST session, as Jim2 has no way of calculating the GST on these opening balance entries. Payments applied to opening balance invoices will be listed on the Opening Balance Sales and Opening Balance Purchases tabs in the GST session. |

1.To begin a GST session, on the ribbon, go to Accounts > GST Sessions.

Remember to select the GST period and calculation method via Tools > Options > Accounts, and ensure Cash GST Calculation is selected.

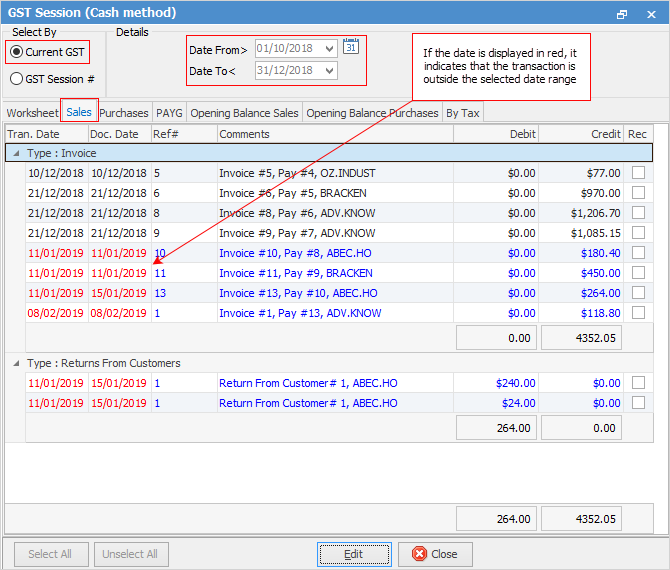

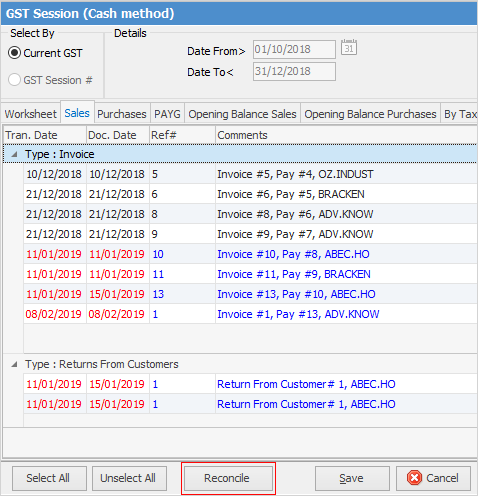

2.The GST session opens at Current GST on the Sales tab, displaying all transactions that have not been included in a previously reconciled GST Session. Transactions coloured black fall within the selected date range of the GST Session. Transactions coloured red fall outside the selected date range (either before or after the date range).

|

If a GST session is completed, selecting Current GST before the end of that period may present a blank screen. This will change once the next day after the Date To date has been reached, or dates entered are after the closed GST session.

When using GST sessions, the default BAS period set in Tools > Options > Accounts will default the current GST reporting dates to the next expected GST session. The default dates can be overridden, so to report GST quarterly and PAYG monthly, the BAS period default can match one or the other, and the session/report date range can be changed as required. |

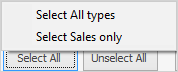

3.To commence a GST session, click Edit and select the transactions. To make the selection process as easy as possible, there are two options:

▪select all types of transactions (sales, purchases and PAYG) found for the specified period by clicking Select All at the bottom left of any tab, or

▪select all sales, purchases and PAYG transactions found, that need to be reported for the selected date range, by either selecting the individual tabs and choosing Select Sales only (or Purchases, etc.), or choosing Select All at the bottom left.

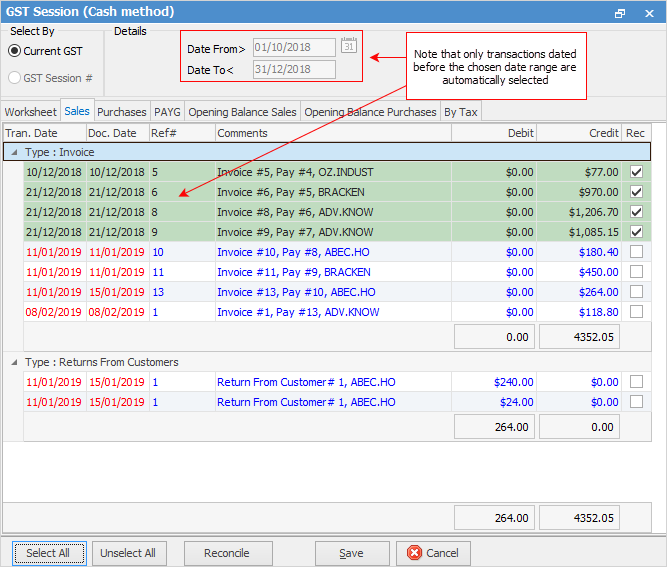

4.The GST session will now display all transactions that have been selected and there will now be a tick in the Rec checkbox. Note that transactions outside the selected date range are not selected when using the Select All types option.

|

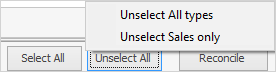

Specific sales, purchases or PAYG transactions can be excluded by unticking the Rec box at the right of the transaction. Unticked transactions will not be included in the worksheet calculations, and will move to the next GST session. Unselect All will remove the ticks from all. |

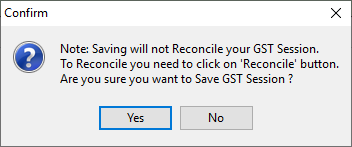

5.Once all transactions have been chosen to be included in the GST session, click Save to review the final figures on the worksheet, and via the By Tax tab before reconciling the GST session. A confirm message will appear reminding that saving will not reconcile the GST session – this is important as the GST session must be reconciled once the BAS has been lodged. Once a session has been saved, the selected transactions will recalculate the totals in the Worksheet calculation sheet, and should be checked prior to reconciling.

Once the GST session has been saved it can be returned to later, or it can be reconciled.

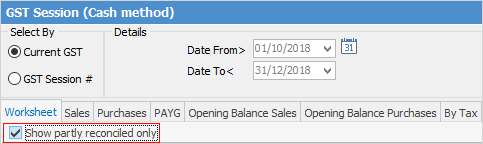

6.Once a GST session is saved, users can check the worksheet calculations. Go to the Worksheet tab and tick Show partly reconciled only, so that only the selected transactions will be included in the totals.

7.Check that no figures are showing in incorrect areas. For example, there should not be a a value in G2 Export Sales if no goods have been exported. If figures are showing in incorrect areas, review which transactions are reporting into these fields, and the tax codes used on these transactions using the By Tax tab. From there, drill down to the individual transactions to review and/or amend them.

|

Note: Any changes are not automatically up in the saved session. You need to edit the GST Session, click Unselect All and choose All Types, then Select All, All Types (to pick up any changes, then Save and review again.

|

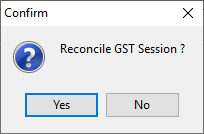

8.Once satisfied with the accuracy of the calculation sheet, click Edit, then Reconcile.

9.A confirmation will appear to reconcile the GST session. Click Yes.

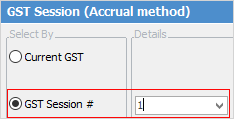

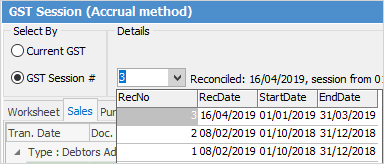

10.The reconciled GST session will be saved and allocated a GST Session number by selecting GST Session #. The session can be viewed at any time, and the relevant reports printed.

11.View the Opening Balance Sales and Opening Balance Purchases tabs to see if there are any entries included in the reconciled GST session. Remember that these figures are not included in the figures on the worksheet. These must be handled separately, and added to the figures on the worksheet report to lodge the BAS.

Jim2 will report the entire transaction amount. Check in the retired software how much of the transaction total attracted GST, and adjust the BAS report accordingly. Check the entries to see if they are all subject to GST, and, if so, divide the gross figure by 11 to calculate the GST component. Add the gross amount and the GST amount to the figures in the relevant fields on the GST Calculation Worksheet report to lodge the BAS.

12.Either the GST Calculation Worksheet report or the GST Summary report can be printed for use to complete the BAS. The information in both reports is identical, however the layout is slightly different.

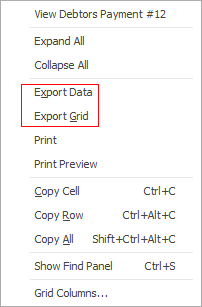

13.From the By Tax tab, right click, select Export Data and save the detailed transaction information as a spreadsheet file, which can be printed or emailed to the company's accountant.

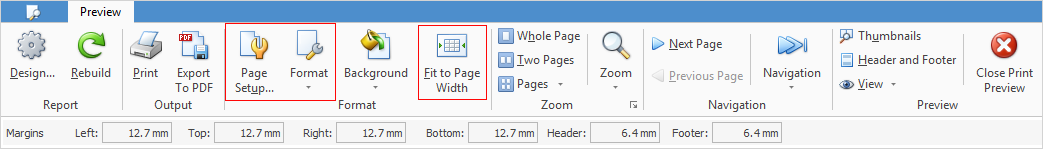

The detailed transaction information in a report can be printed by right clicking and choosing Print Preview and Fit to Page. This report shows all transactions that are included in the GST session grouped according to the field they report into on the Worksheet. Use the Page Setup and Format icons in the report editor to change the page orientation, print order, enter a title for the report and page numbering as required.

To view a previous GST session, change Select By to GST Session# and choose a session from the drop down list. When viewing a previous session, that session can be deleted using the Delete Session button. This will return all those transactions back to Current GST to re-do the session.

A GST session can be deleted if something is incorrect, however it is strongly advised not to delete a GST session once the BAS has been lodged. Any changes can be included in the next GST session.

The detailed reports found on the Sales and Purchases tabs list the transactions from each tab that have been included in the GST session, and do not report in a manner that directly corresponds to the fields on the worksheet. Refer to point 12 above for instructions on printing detailed reports.

|

The GST reports found under Management Reports pre-date the introduction of GST Sessions and were designed for accrual method only. All transactions are automatically used to calculate liability, and do not reconcile transactions. These legacy GST reports have been renamed as [reportname] (old). Happen advises to use GST Sessions to calculate GST liability and produce reports, and not these reports. |

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports