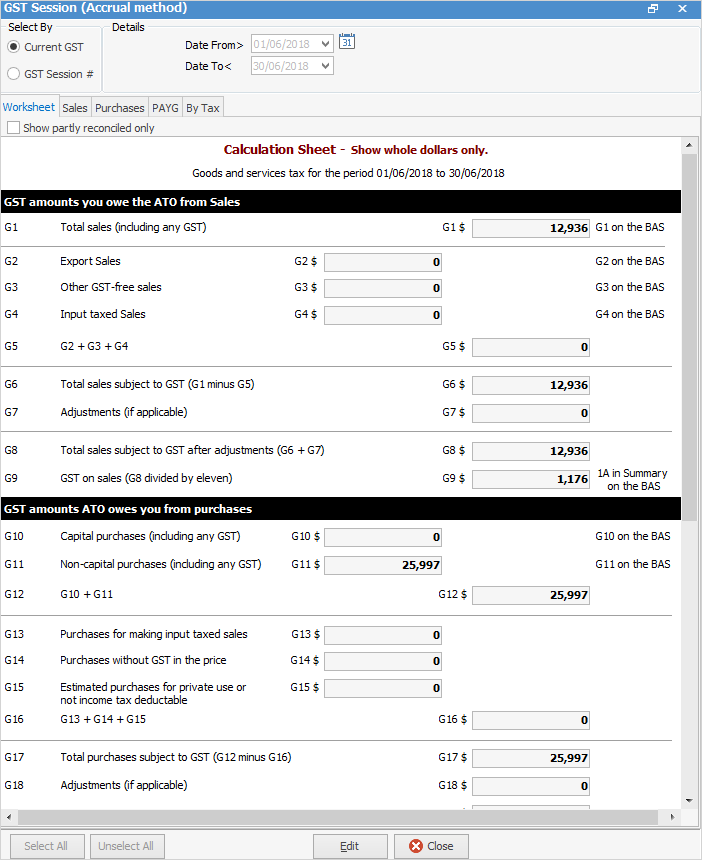

The Worksheet tab includes a range of fields that form the GST calculation sheet. Each field is labelled with codes equivalent to those that appear on the Australian Taxation Office issued BAS statement, as displayed below. Most of the Worksheet tab values are calculated from the transactions to be included in a GST session, and are based on the tax codes allocated in every transaction in Jim2. Therefore, all tax code allocations must be performed with careful consideration.

For more information on the tax codes used in Jim2, see Setup > Tax Codes.

|

Always take a few minutes to review the figures in the worksheet before completing the BAS. Do they look correct? Are there any values in fields where there should not be values, such as G2 when there are no export sales?

Once you have selected the transactions and saved the current GST Session you should then work from the By Tax tab.

The transactions are grouped into two main sections, the first being those that are In Session Reconciled, ie. selected in the saved session.

The transactions are then grouped by Type and Tax Code, ie. they display the details of the results in the Worksheet.The sub-groups are: ▪PAYG (wages) ▪Purchases ▪Sales

Lower down are those transactions Not In Session, which fall after the selected date range, so can be ignored for this purpose.

Under Purchases, they appear in this order: ▪Transactions where Tax Code X was used – a quick look down that section should identify any entries where X is incorrect. You can right click to view the transaction. ▪Transactions where Tax Code C was used – Capital Acquisitions. ▪Transactions where Tax Code N was used – reportable expenses but no GST. ▪Transactions where Tax Code G was used – reportable expenses with GST. ▪Transactions where Tax Code Y was used, if you import goods.

So, you are checking according to the Tax Code used rather than the transaction type. It is designed this way so the By Tax tab correlates with the results on the Worksheet. |

From the Worksheet tab, a hard copy of the GST Calculation Worksheet report can be printed for transferring the figures to the BAS.

Jim2 can calculate GST on a monthly or quarterly basis using either the cash or accrual method. For more information on how to configure the GST calculation basis, see the section on GST Sessions and the BAS. The calculation basis is normally provided by the ATO.

Either the company or company accountant will have registered the business with the ATO, advising them of the business activity. There will be the option of lodging the BAS as a written document or as an electronic form. The BAS layout will differ depending on which taxes are applicable to the registration, and when they are actually payable.

For businesses that lodge a monthly Instalment Activity Statement (IAS) for PAYG withholding on wages, please see the section on IAS Monthly PAYG Lodgement.

The amounts for G1, G2, G3, G4, G5, G6 and G8 are automatically calculated in the Worksheet tab of the GST session. The details of these values can be viewed in the Sales tab and By Tax tab of the GST session. |

The amounts for G10, G11, G12, G13, G14, G15, G16, G17 and G19 are automatically calculated in the Worksheet tab of the GST session. The details of these values can be viewed in the Purchases tab and By Tax tab of the GST Session. |

|

Note: The figure in G1 includes GST and will not match the income figure in the P&L for the same period as the P&L does not include GST. |

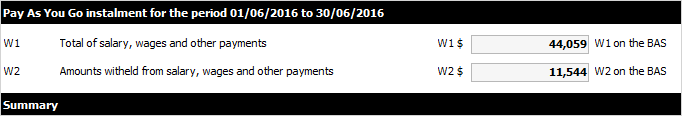

The amounts for W1 and W2 are automatically calculated in the Worksheet tab of the GST session. The details of these values can be viewed in the PAYG tab and By Tax tab of the GST session.

|

The following instructions are for accrual reporting only.

There are several options for paying the PAYG income tax instalment. Either pay an instalment amount (written at T7 on the BAS) issued by the ATO or calculate the PAYG instalment using income times rate (written at T1/T2/T11).

Calculate this amount manually, based on the income for the period which is reported on the Profit & Loss report x % rate advised by the ATO. ▪The T1 value is derived from the total reportable income eligible for instalment tax. ▪T2 is an ATO issued rate expressed as a percentage (can be varied). ▪T11 is the calculated instalment (income x % rate).

Jim2 is able to calculate specific taxes, depending on the activity the business is involved in. The BAS frequency, tax types and tax codes selected in Options and Setups are used to create the totals to be entered in specific fields on the BAS form. Simplified BAS summary reports and detailed BAS support documents are available in Jim2 but are only suited to the Accrual method.

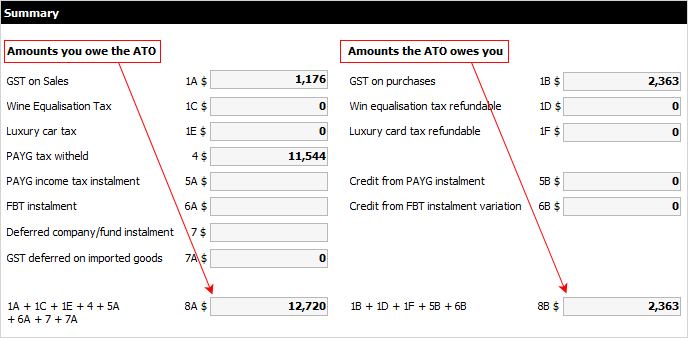

The following fields in the Summary section of the Worksheet tab are editable, allowing entry of manually calculated liabilities so they are included in the calculated totals in 8A and 8B: ▪Field 5A – PAYG income tax instalment ▪Field 6A – FBT instalment ▪Field 7 – Deferred company/fund instalment

The GST session worksheet Summary is effectively showing two things: amounts owed to the ATO, and amounts the ATO owes.

|

|

|

If the amount at 8A is more than 8B, then this amount is payable to the ATO.

If the amount at 8A is less than 8B, then this amount is refundable (or offset against other tax debt).

If there are any further questions or clarification required regarding the GST and the BAS report please contact the company's accountant or the ATO.

|

The GST reports found under Management > Reports pre-date the introduction of GST sessions and were designed for the Accrual method only. All transactions are automatically included to calculate liability, and these reports do not reconcile transactions. These legacy GST reports have been renamed as GST [reportname] (old) and should not be used. Happen advises using GST sessions to calculate GST liability. |

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports