|

Prior to explaining change from cash to accrual, it is important to note that Jim2 does not support moving from Cash to Accrual GST reporting without some manual calculations – advice from the company's accountant may be required. For instance, how to determine which invoices have already been reported to the Australian Taxation Office on an accrual basis that will be paid in the future (and potentially reported again on a cash basis).

Please consult the accountant before proceeding. |

In this example, the date 30 June has been used, however it can be any date.

Transactions dated up to 30 June that were processed using the cash method will need to be treated as accrual now, and reported to the Australian Taxation Office for the first GST Period of the new financial year.

Assuming regular GST sessions (cash method) have been run to flag reported transactions, it is recommended the following steps be followed to ensure that no transactions remain in limbo.

|

The general ledger balance for GST Collected and GST Paid report on an accrual basis, so users will have a good checkpoint to balance to. |

1.In the live database, do a real cash GST session for the date prior to 30 June. Print the report, mark it A, and use these figures to lodge the June BAS.

2.Back up the database to create a copy to work on, then restore this as a new database named GST Changeover, or similar.

3.On the copy database (ie. the training database), any unpaid or part paid documents need to be dealt with prior to 1 July. Pay all debtors and creditors where invoice or purchase order date is prior to 1 July. Now, do another cash GST session for the date prior to 30 June. Print the report and mark it B – these figures will be included in the first BAS in the new financial year.

4.Back in the live database, change Tools > Options > Accounting > GST Calc Method to Accrual.

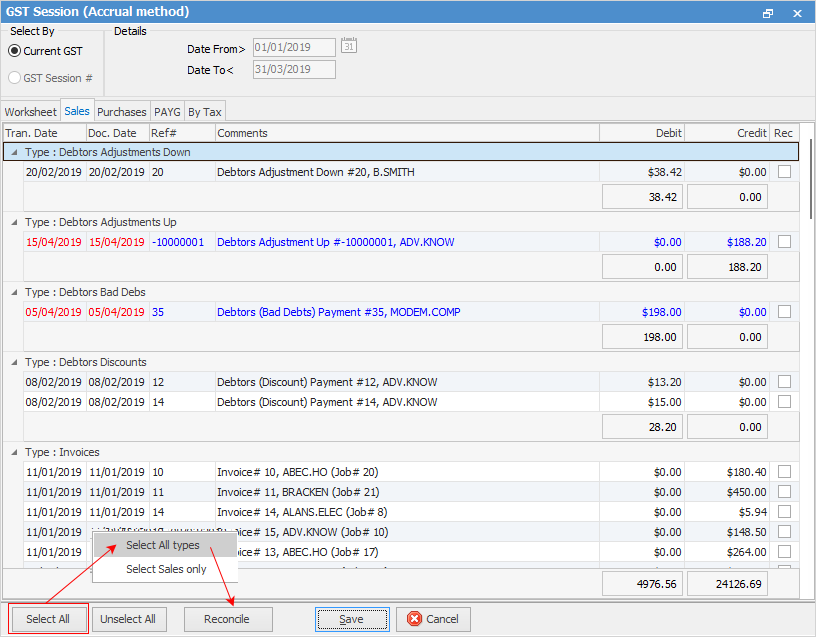

5.Run an Accrual GST session for the date prior to 30 June, then click Select All, Select All Types and Reconcile to clear all old transactions.

|

This is not reportable in your BAS, as these transactions would have been reported on a cash basis. |

|

There may be a large number of transactions to clear, as all transactions since commencing with Jim2 will be included. Ignore the result. |

Jim2 will calculate all transactions on an accrual basis for GST from 1 July.

The combined results of reports B and the next GST session will equal what needs to be reported on the next BAS. The general ledger balance for GST Collected and GST Paid should be very close to this total, give or take rounding from previous payments entered.

|

Once the GST calculation option has been changed in the live Jim2 database to Accrual, those reports relating to cash sessions will still be correct and accessible. |

In summary:

1.When changing the setting in Options, all accrual-based transactions from prior periods will appear in GST sessions, as they have never been included in a previous accrual GST Session. Run a dummy GST session up to the changeover date to clear them out of the real GST session.

2.In the first accrual-based GST session the GST will be significantly higher because of all the GST on unpaid invoices in Debtors and Creditors as at the changeover date.

Further information

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports