A GST session can be deleted if something is incorrect, however it is strongly advised not to delete a GST session once the BAS has been lodged as you will lose the record of what was lodge. Any changes can be included in the next GST session.

If the BAS has already been lodged, add a general journal to make any correction and this will automatically be included in the next GST session.

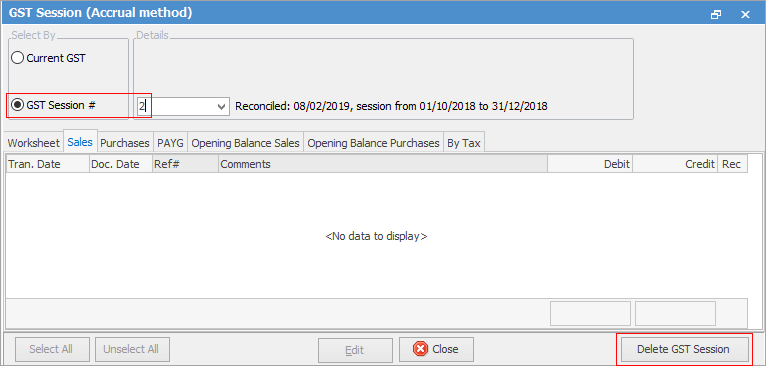

Open the reconciled GST Session and click on the Delete GST Session button on the bottom right.

All the transactions will revert back into Current GST, ready for you to start again and rework the GST session.

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database