Following are resources in Jim2 that can be used to reconcile/check/balance a GST Session.

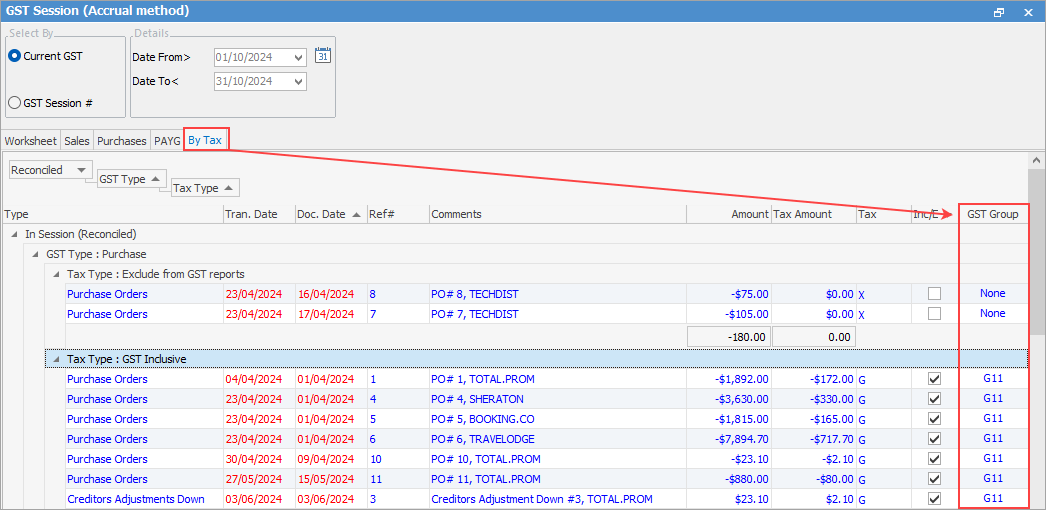

| The By Tax Tab within a GST session |

The By Tax tab will show you the transactions that make up the totals in the GST worksheet.

The GST Group column will show which GST worksheet field the transaction appears in.

You can also right click in the grid and select Export Data, to save as a spreadsheet.

|

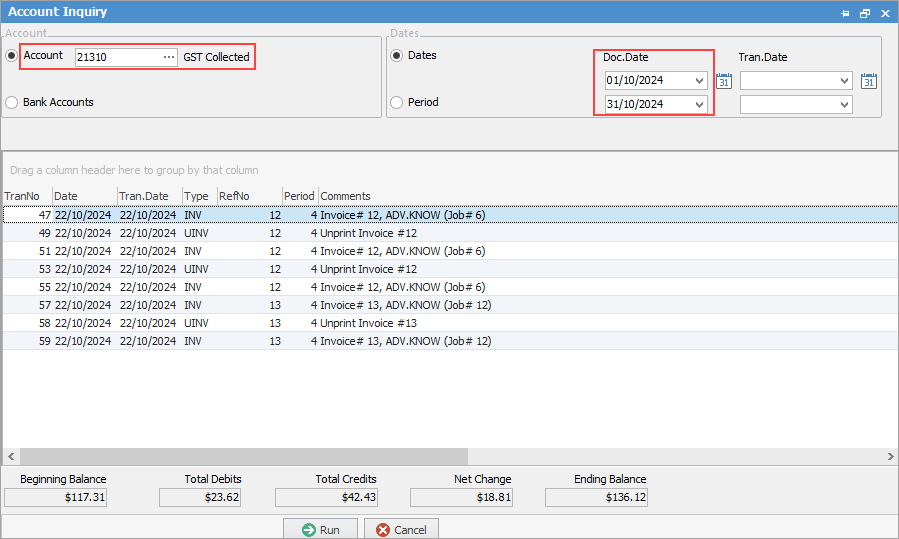

You can complete an account inquiry for the GST Collected and the GST Paid GL Accounts for the selected period via Accounts > Account Inquiry. These totals should mirror the totals in the GST Session (minus the payment entered for previous period's BAS).

|

You can create a sales register list for the selected period and compare this to the Sales figures in the GST Session. |

You can complete a purchase order list for the selected period and compare this to the Purchase figures in the GST Session. |

These figures may not be exact, particularly if there is a lot of unprinting and backdating in the system.

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports

Record Your BAS Payment/Refund to ATO