Some businesses are required to lodge a monthly Instalment Activity Statement (IAS) for PAYG Withholding (from wages and salaries), while still reporting GST/BAS on a quarterly basis.

If this is the case, a monthly GST session will need to be completed, selecting and reconciling only those transactions that appear in the PAYG tab, relating to payroll entries. It may also be a requirement to report amounts at W4 (amount withheld where no ABN is quoted) and W3 (other amounts withheld excluding any amounts shown at W2 and W4).

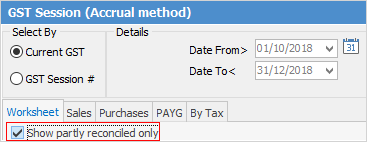

Once PAYG entries have been selected for the nominated period, this is effectively doing a partial GST session reconciliation. To print out a GST session summary displaying a total of the selected PAYG transactions only, ensure that the Show partly reconciled only box is ticked in the Summary tab.

When printed, the GST Calculation Report will display the W1 and W2 totals only.

To complete the GST session, use the same selection method but against PAYG transactions only, as described in GST Session Accrual Method or GST Session Cash Method.

|

When entering payment to the Australian Taxation Office, ensure that tax code X is used when allocating the amount remitted for PAYG withheld. Tax code Q is only for use in the Payroll general journal to ensure that the PAYG tax appears in the correct area in GST sessions. If tax code Q is used on the Australian Taxation Office payment entry, it will incorrectly appear in the PAYG tab of the GST session. |

Further information

Change GST from Cash to Accrual

Complete a GST Session: Accrual Method

Complete a GST Session: Cash Method

Handle NZ GST in Australian Database

Record Deferred GST on Imports